Suez Canal & Red Sea Situation Update – Full RoRo Report

We are delighted to share a comprehensive analysis of the Red Sea crisis: Impact on Suez Canal traffic for the first 11 months of 2024.

Most RoRo carriers have opted for the longer Cape of Good Hope route for security reasons. However, not all have taken this path. The extended sailing time restricts the global fleet’s cargo-carrying ability by as much as +/-5%, equating to about 35 vessels being sidelined annually.

When the situation in the Red Sea stabilizes, we anticipate a significant impact on the supply/demand balance. Despite the complexities of this geopolitical issue and no immediate resolution in sight, the continued reliance on the Cape route has tangible negative effects on both commercial activities and CO2 emissions.

Executive summary

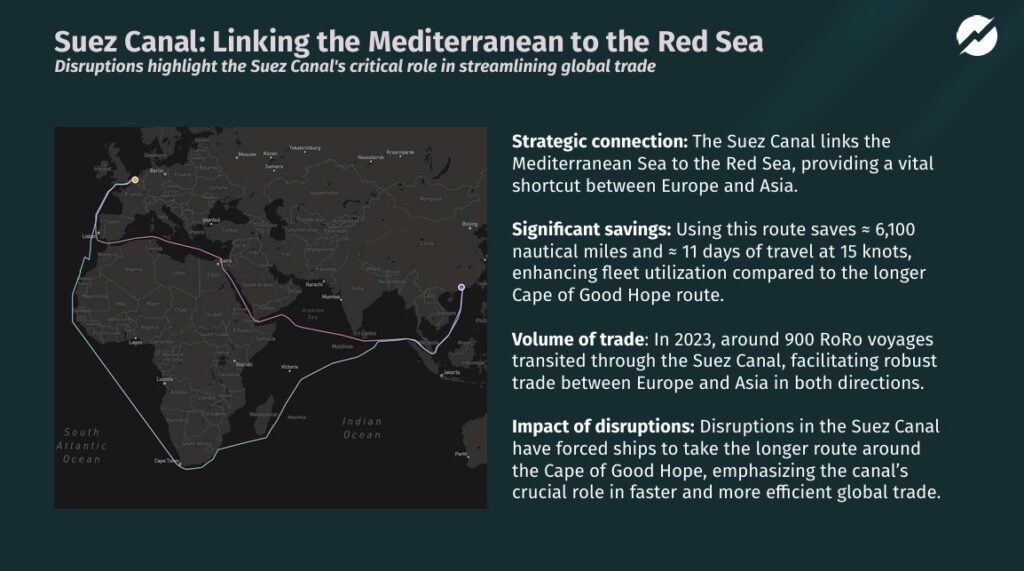

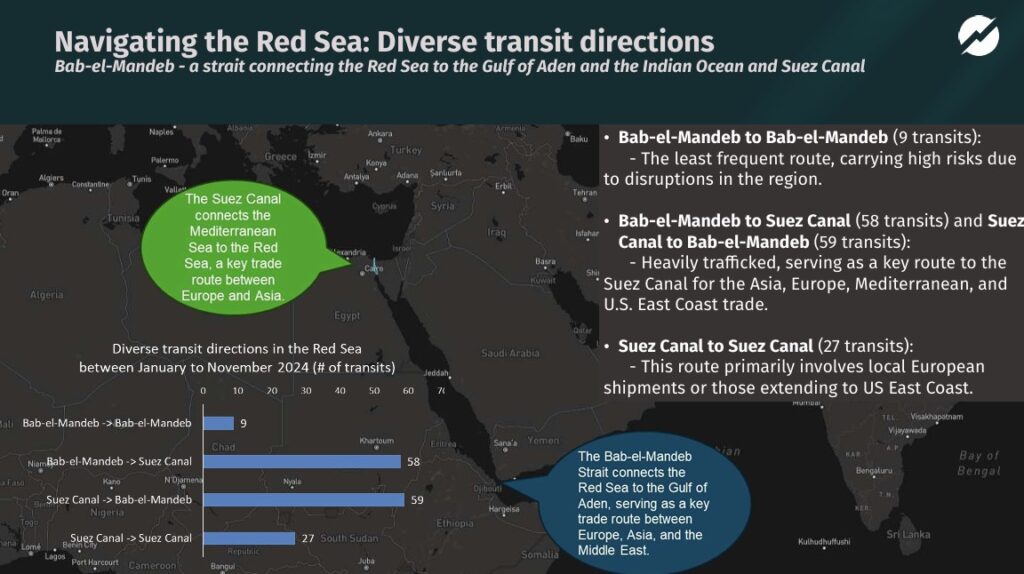

- The Red Sea as a vital maritime corridor: Linking the Mediterranean Sea to the Indian Ocean via the Suez Canal and the Bab-el-Mandeb Strait, it is essential for the efficient transport of goods between Europe, Asia, and the Middle East.

- Decline in Suez Canal traffic: Geopolitical tensions and security risks in the Red Sea have drastically reduced canal usage since November 2023.

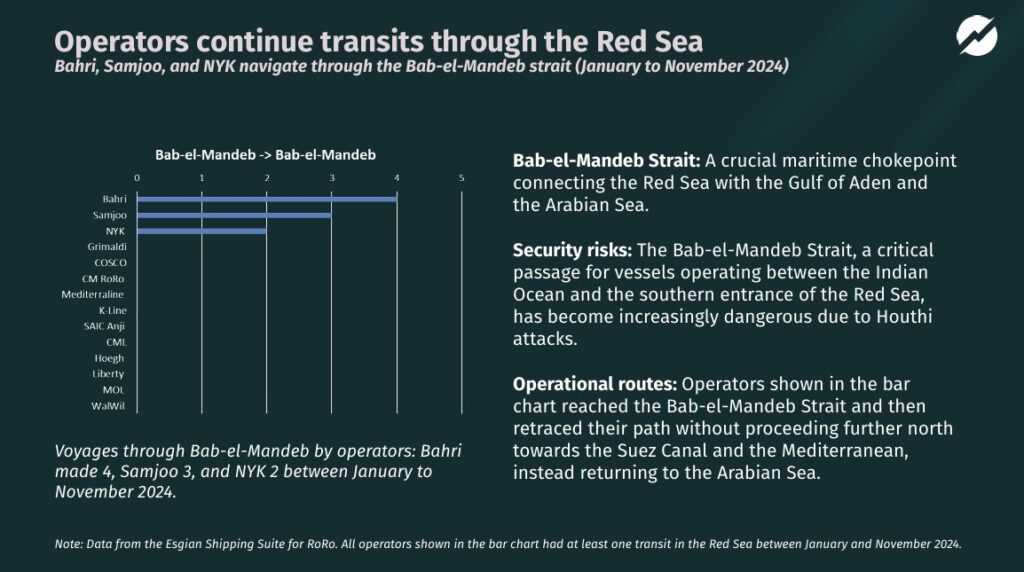

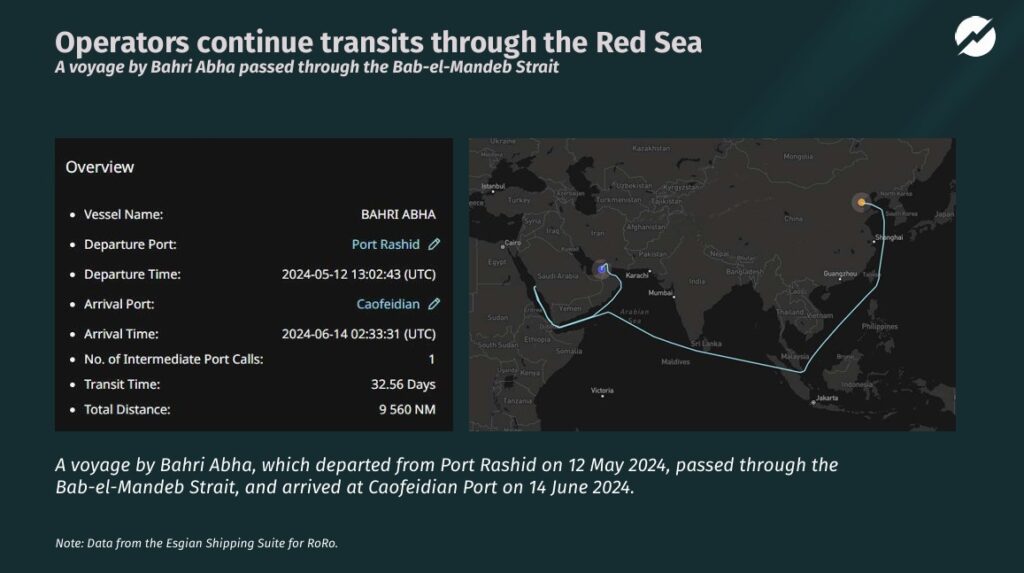

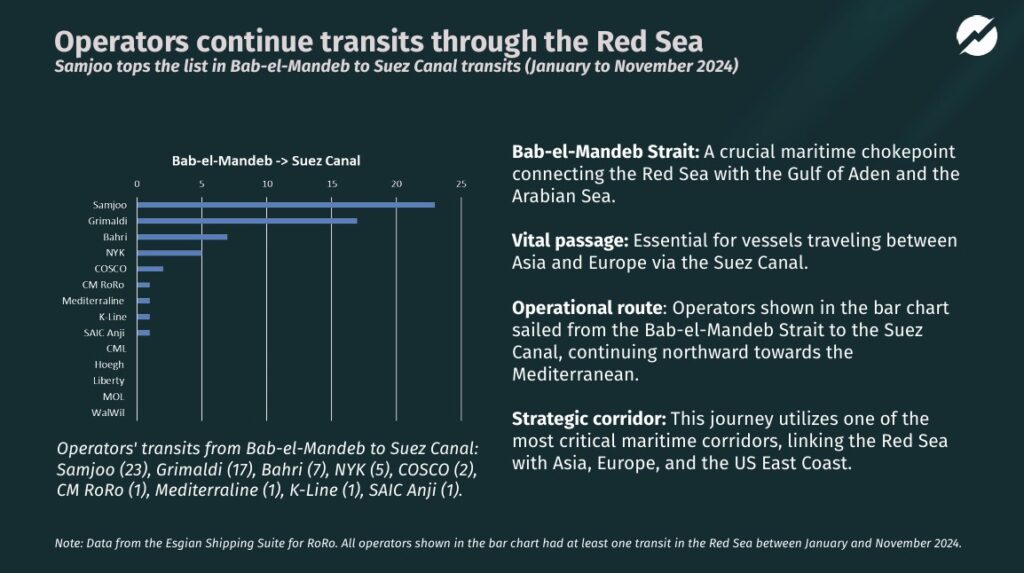

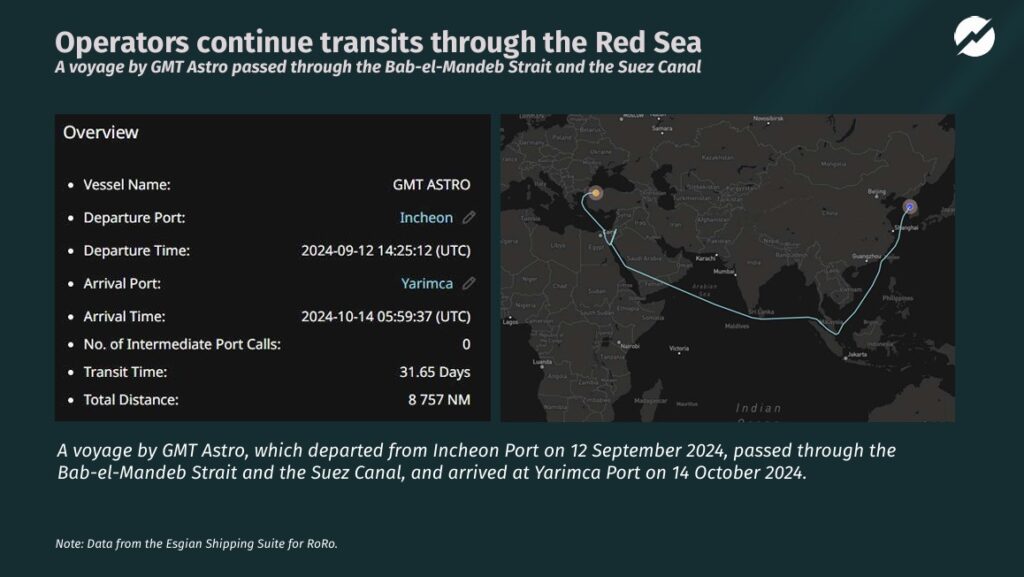

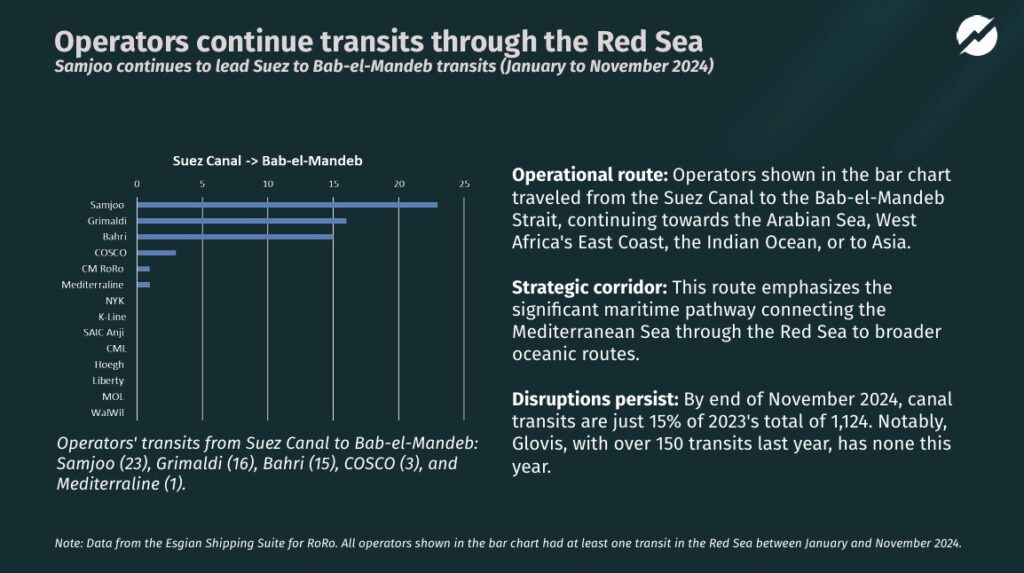

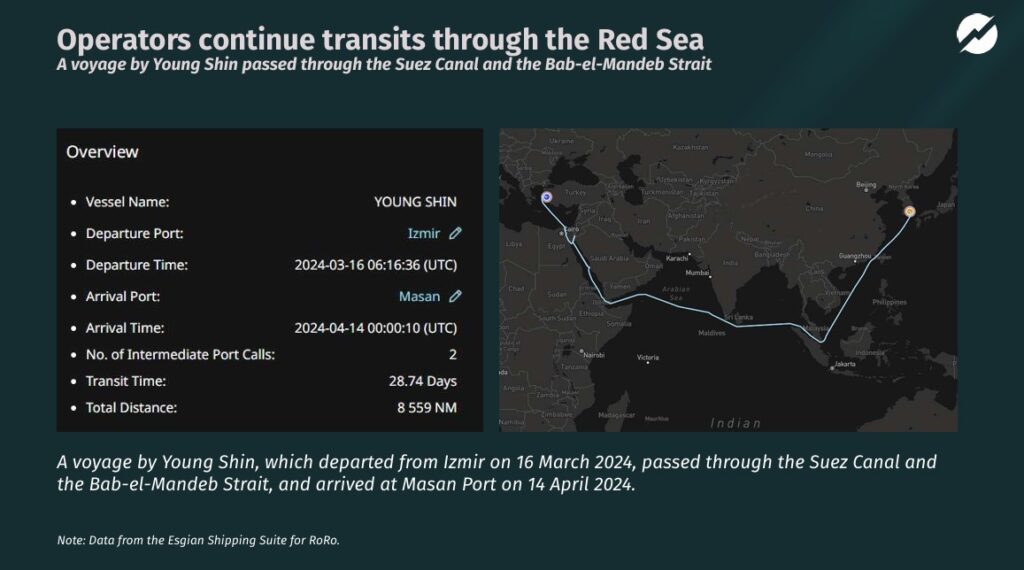

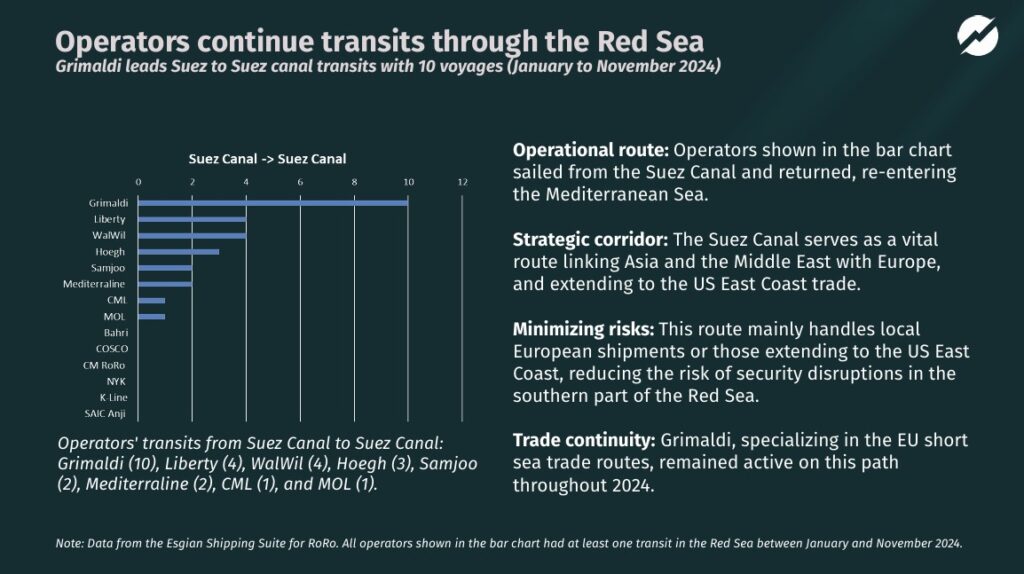

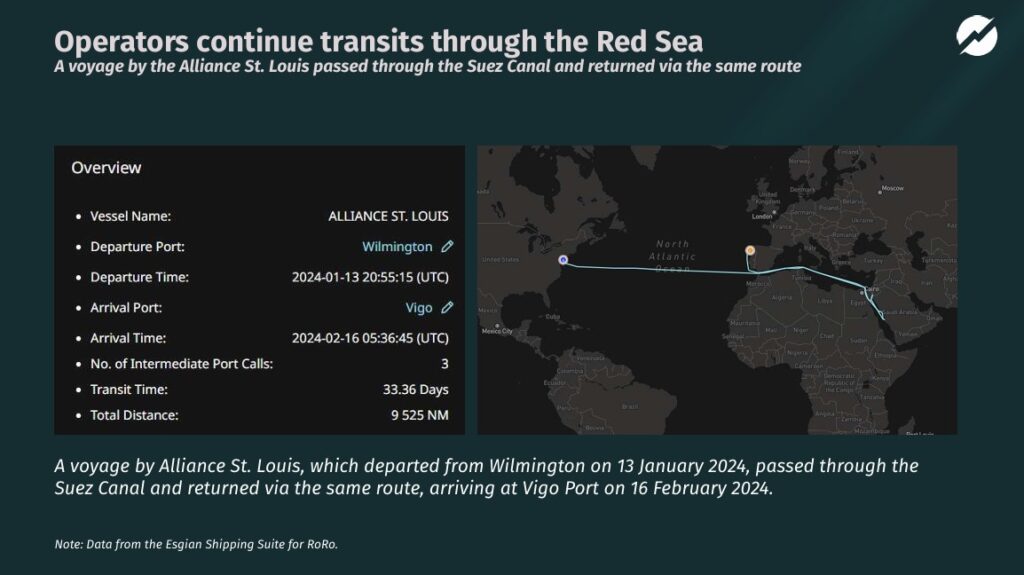

- Strategic rerouting, but not for all: Most RoRo operators have been bypassing the Suez Canal, opting for the Cape of Good Hope route; however, as this analysis shows, not all have made this change.

- Increased costs and transit times: This diversion adds ≈ 11 days to transit times and escalates fuel expenses, impacting fleet utilization and representing about 5% of the total deep-sea RoRo fleet capacity.

- Suez Canal importance: Despite security risks and disruptions, the Suez Canal continues to be important for handling a moderate amount of trade, especially from the Far East. Its consistent use underscores its role in global trade.

For more insights and updates, please follow us on LinkedIn and reach out to us at shipping@esgian.com!