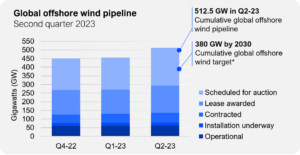

1.The offshore wind pipeline continues to grow at break-neck pace… The global offshore wind pipeline increased 13% over the previous quarter to reach a new high of 513 GW. That means the global pipeline now exceeds global targets.

1.The offshore wind pipeline continues to grow at break-neck pace… The global offshore wind pipeline increased 13% over the previous quarter to reach a new high of 513 GW. That means the global pipeline now exceeds global targets.

2.But lumpy contract flow means feast or famine for suppliers. In Q2 some suppliers flourished thanks to a wave of new contracts for foundations (16 new contracts), cables (26) and substations (13) . The notable exception was turbine suppliers, for whom there was only one new contract to be had.

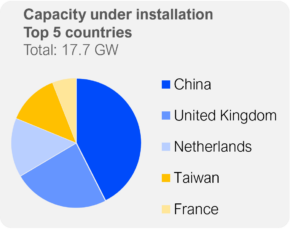

3.Five countries account for 99.4% of capacity currently under installation. In these five countries, the top five largest projects under installation contribute 6.7 GW of this capacity, with the UK and the Netherlands dominating the list: Dogger Bank A&B, United Kingdom, 2470 MW; Hollandse Kust Zuid I-IV, Netherlands, 1500 MW; Seagreen, United Kingdom, 1075MW; Greater Changhua 1-SE, Taiwan, 900 MW; Hollandse Kust Noord V, Netherlands, 759 MW.

4.And the vessel industry is racing to keep up with this demand. Installation vessel activity remained high in the quarter, with several projects completing installation work. Eleven vessels continued to be under construction in the second quarter, with two additional newbuilt orders announced and two vessels delivered or on sea trial.

4.And the vessel industry is racing to keep up with this demand. Installation vessel activity remained high in the quarter, with several projects completing installation work. Eleven vessels continued to be under construction in the second quarter, with two additional newbuilt orders announced and two vessels delivered or on sea trial.

5.Europe continues to lead in terms of number of offshore auctions, but the US and Asia are competing for volume. In Europe, Poland, Ireland and Denmark were at the center of Q2 activity, with allocations for six Polish sites concluding, the results for the first Irish ORESS subsidy round published and Denmark ending the open-door track. In the US, the release of the Final Sales Notice (FSN) for the Gulf of Mexico was delayed; BOEM is expected to announce auction dates for GOM sites soon. In Asia, Japan ended its second offshore wind auction round, for four sites offering fixed projects.