There has been a lot of talk lately about rigs leaving the North Sea due to a lack of opportunities in the region and accelerated demand elsewhere with the Middle East being the hotspot for jackup rigs and the Golden Triangle – the U.S. Gulf of Mexico, South America, and West Africa – for floaters.

In late January 2023, in light of the UK’s latest oil and gas licensing round, we looked into the status of rigs in the North Sea to gain insight into their availability in the region. Some rigs have already left and some are scheduled to leave the region in the near term. Moreover, the limited visibility of new drilling programmes in the North Sea for the upcoming period has resulted in an increasing number of units being marketed elsewhere.

While the international offshore drilling market has seen an increase in demand and day rates over the course of last year, the UK has been struggling to catch up and reach expected levels. The key factor impacting the UK drilling market and its recovery is the windfall tax, the increase of which brought the UK’s energy profits tax to levels that are among the highest in the world.

The International Association of Drilling Contractors (IADC) North Sea Chapter has recently raised concerns that reductions in the UK operators’ investment plans due to the windfall tax and the shrinking pipeline of work in the medium term may drive more rigs out of the North Sea, urging the UK government to create a long-term energy plan and ensure a balanced long-term approach to the energy transition. The association expressed concerns as the migration of rigs to other basins reduces the drilling capability in the North Sea, which is particularly important at a time when the security of hydrocarbon supply is a major concern, as well as decommissioning capability in the region.

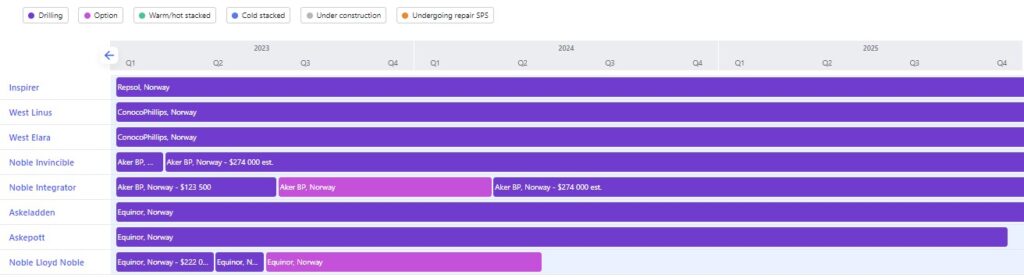

Over in Norway, there’s limited visibility of new drilling programmes in the next 12 months but market chatter points to the possibility of new rig commitments being made before the summer holidays, particularly by the state-owned Equinor.

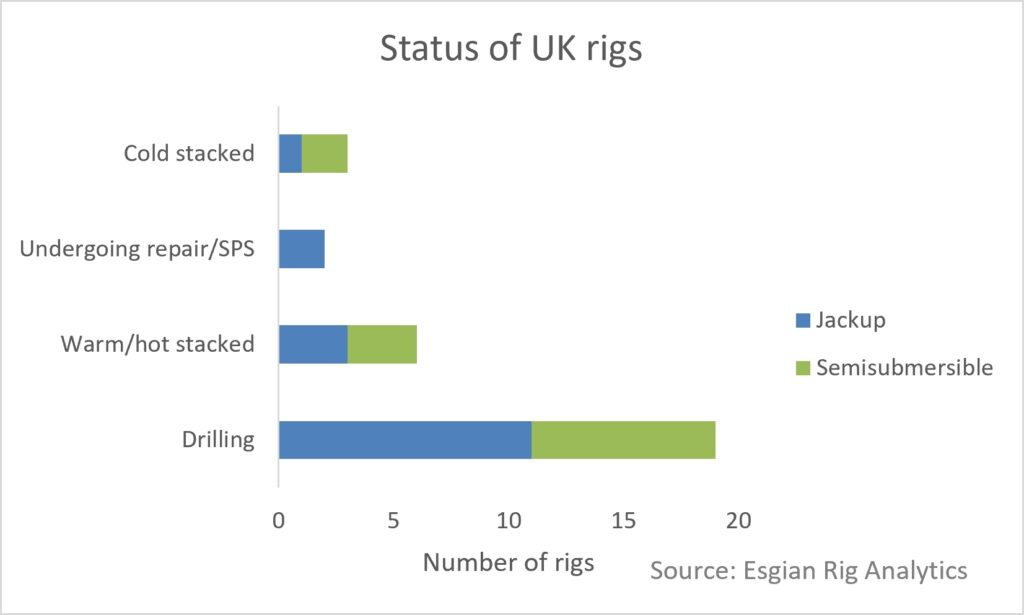

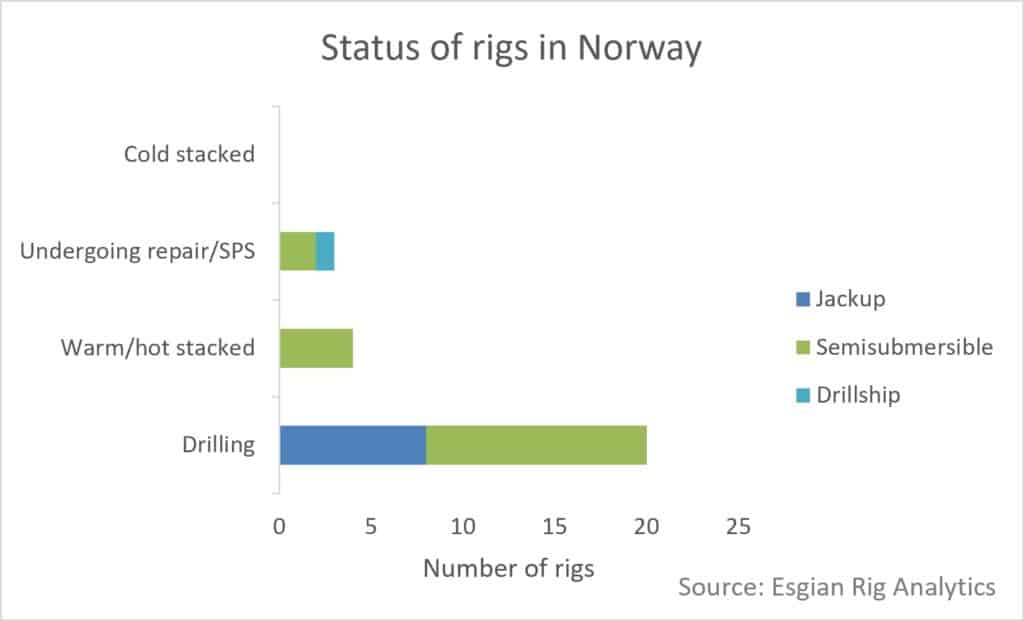

When it comes to current supply, Esgian Rig Analytics shows there are currently 70 rigs in the North Sea region, the majority of which are in the UK (30) and Norway (27) and the rest are spread across the Netherlands, Denmark, and the north of Russia. From the total of 57 in the UK and Norway, 10 are warm stacked and 3 are cold stacked.

Effects of UK’s windfall tax on rig demand

In the UK sector of the North Sea, there are currently 30 rigs of which 17 are jackups and 13 are semisubmersible rigs.

The outlook for the UK North Sea has softened following the increase in taxes, which prompted a number of operators to reduce their spending plans for the area. The energy profits levy (EPL) was first announced in May 2022 to alleviate the cost of living crisis and increased later that year. While it was initially due to expire in December 2025, it was later extended until March 2028. According to Offshore Energies UK (OEUK), over 90% of its operator members are looking to scale down investment in homegrown energy because of the EPL.

Due to a lack of opportunities, three jackups – one at Kishorn, one at Invergordon, and another one at Dundee – are available for new work. Additionally, there are seven jackups that are rolling off contracts during this year.

Last year, two jackups that previously worked in the UK, Shelf Drilling’s Noble Houston Colbert (to be renamed Shelf Drilling Odyssey) and Borr Drilling’s Ran, left the North Sea region for contracts in Qatar and Mexico, respectively. Ran has also recently secured more work in Latin America, which could see it busy throughout 1Q 2024. There are indications that some rig owners are looking to place their assets in other markets but there are also exceptions. Noble is not actively trying to remove its idle rigs from the region despite headwinds caused by the energy profits levy in the UK and anaemic demand in Norway.

On the other hand, the UK’s jackup rig count has recently increased by two units after Valaris moved its unemployed KFELS N Class rigs, Valaris Stavanger and Valaris Viking, from Norway to Scotland. Valaris Stavanger is undergoing its special periodic survey (SPS) and is being marketed for projects in the North Sea as well as further afield. The Valaris Viking is expected to be idle for at least 12 months so it has been preservation stacked since its arrival in late January 2023. The Valaris Norway is also in the UK and is currently under contract, which means that all three Valaris-owned Keppel FELS N class rigs, which are capable of working in Norway, are now located in the UK but only one is partially contracted for the year ahead.

In addition, the Valaris 121 is also in Dundee where it arrived in late January 2023. The rig is supposed to undertake its SPS while in Dundee ahead of its contract in July. Meanwhile, the Valaris 247 has just recently left the port to start a new contract.

When it comes to semisubs, the most recent contract award in this segment was secured by the currently warm stacked Stena Spey for one exploration well in the UK with Ithaca, which will keep the rig busy into 3Q 2023. The rig is due for an SPS by the end of 1H 2023, which will most likely be carried out after the Ithaca contract. The other semisub from Stena Drilling, the Stena Don, has recently returned to Scapa Flow to prepare for its next campaign. The firm part of the contract with Shell is scheduled to end in 2Q 2024 with a one-year option attached.

Following yard stays, two semisubs from Diamond Offshore started working again during March. The Ocean Endeavor has been working in the UK for Shell over the last several years until December 2022 when it arrived at Hanøytangen for repairs, regulatory surveys, and steel renewal. Following the completion of these operations, the rig resumed its contract with Shell, which will continue into 2Q 2024.

The Ocean GreatWhite arrived in the UK from the Canary Islands in October 2022 to be reactivated and prepared for a contract with bp, which started this month. The rig is now working on the Ben Lawers location in the West of Shetland area. The firm part of the contract with bp is scheduled to end in early 2024 after which the operator has eight 60-day options. If all the options are exercised, the rig would be working into 2Q 2025.

Diamond’s Ocean Patriot was supposed to be busy with APA Corp’s subsidiary Apache for the better part of 2024 but APA has recently terminated the contract early, shortening it by about a year. Apache said that recent tax changes in the UK had made returns less attractive compared to other opportunities in its portfolio. Diamond also has one cold stacked rig, the Ocean Valiant, understood to be marketed for P&A work in the UK but with no firm reactivation plans.

APA wasn’t the only operator to reduce its spending plans as of late. Market sources indicate that a recent tender for a semisub unit for long-term work in the UK was delayed due to the windfall tax and it remains unclear if and when this work will be moving forward.

Harbour Energy has been very outspoken in its criticism of the UK’s tax changes but the company will continue using Transocean’s Paul B. Loyd, Jr. again next quarter. Following the sublet period with NEO Energy under the Harbour charter, the rig is expected to continue working for Harbour into 3Q 2024.

Another semisub rig has recently moved from Norway to the UK. After working in Norway from 2021 to late 2022, the Transocean Barents had been warm stacked in Ølen until early March when it started its contract with TotalEnergies in the UK. The rig is working on an exploration well on the Benriach prospect located West of Shetland after which it is targeting international as well as North Sea opportunities.

The 4th Generation semisub Transocean Leader has been cold stacked in the UK since late 2020. Due to a prolonged idle period, it is understood that the rig is not actively marketed. The reactivation of such a unit would require a significant investment, which could only be justified by a long-term deal currently not visible in the area. In addition, reactivations could take from 12 to 18 months due to capacity constraints in yards. In general, Transocean has been quite firm in its position that it would not reactivate a rig unless a customer pays for the entire reactivation plus an acceptable return over the initial contract.

Norway: anaemic demand in 2023 may lead to supply deficit in 2024

In Norway, there are currently 27 rigs of which 8 are jackups, 18 are semisubmersibles, and 1 is a drillship.

After the departure of Valaris Stavanger and Valaris Viking, all jackup rigs in Norway are under long-term contracts and working at least for the next several years. One of them, the Noble Invincible, is under a frame agreement with Aker BP with the duration into 4Q 2027. The rig had been on standby in Stavanger from January 2023 until last weekend when it started its transit to the North Sea to start operations on the Edvard Grieg field.

Following last year’s lull, indications are that the Norwegian market will continue to see weak demand this year with no significant opportunities expected to materialise at least until 2024. Noble recently shared its belief that late 2024 will bring back demand for its CJ70 fleet. At the same time, rumour has it that two other North Sea jackup owners are offering their available rigs in the Middle East.

The Norwegian semisub rig count has recently been reduced by two units due to the departures of the Transocean Barents and Ocean Endeavor, which was only visiting for repairs.

Two Dolphin Drilling-owned semisubs, Borgland Dolphin and Bideford Dolphin, are currently warm stacked and are being heavily marketed for the North Sea but also for international opportunities. The rig owner has recently said it has seen a lot of interest around the Borgland Dolphin and incoming interest around the Bideford Dolphin. In order to be mobilised and start working this year, the contract signing needs to take place this quarter or early next quarter at the latest, as Dolphin estimates it could have the rig ready to work in 80-120 days. Each rig has an estimated mobilisation cost in the range of $20 million to $25 million.

While it was previously rumoured that one semisub in the Far East would come to the North Sea region, it is understood these plans have changed due to contractual obligations in its current region.

Aside from the two Northern Ocean-owned 6th Gen harsh-environment (HE) semis, Deepsea Mira and Deepsea Bollsta, another semisub managed by Odfjell Drilling had already worked outside of the North Sea area and is contracted to do the same again this year. After returning from Canada to the Hanøytangen yard in Norway in late 2022, Hercules is now undergoing its SPS and contract preparations before it begins another round of exploration drilling in Canada in 2Q 2023. Working for ExxonMobil, the unit will stay there at least until September or into November 2023 should its one-well option be exercised. This will be the first time for Odfjell Drilling to operate in the harsh environment of Canada.

Despite being able to find work for its rigs outside of the North Sea, Northern Ocean has said it continues to participate in tenders for work on the Norwegian Continental Shelf (NCS) and is maintaining the optionality to return to the region when the timing is justified.

Meanwhile, one semisub, which is currently working in Norway, is rumoured to be the frontrunner for a long-term job in the UK sector while another HE semisub may leave Norway after completing its current contract early next year.

All four Transocean-owned Cat D rigs are located in Norway, but not all of them have long-term jobs. Namely, Transocean Equinox has been idle since October 2022 following Equinor’s early termination of the contract. In addition, Equinor’s long-term options for the Transocean Endurance lapsed and the rig’s firm contract is scheduled to end in mid-2023. This will leave Equinor with two Cat D rigs, Transocean Encourage and Transocean Enabler, under firm contracts.

Transocean has recently stated that it expects to see two or three units move out of Norway soon due to better margins, adding that the future trajectory of HE rigs should raise some eyebrows. As Petrobras is pushing forward with tenders in Brazil and the drillship supply is tightening, an opportunity is arising for semisub rigs, which could move out of the North Sea as a result. In addition to Brazil, Australia is another potential and suitable location for these semisubmersibles.

Should a North Sea rig move out of the region for a long-term job elsewhere, it might take years before it becomes available to come back if the Norwegian demand rebounds. If this happens, there’s a possibility that the Norwegian market will see a supply deficit in 2024.

Drillships are not common in the North Sea, but an occasional unit has been known to operate in the area. While it has never worked in Norway, the 7th Gen 12,000-ft rated Deep Value Driller has been stacked in the country for several years and is now being reactivated at Westcon Yards in Ølensvåg. It was formerly owned by Dolphin Drilling and known as Bolette Dolphin until it was bought in 2021 by Deep Value Driller AS. In February 2023, Saipem bareboat chartered this drillship and, after its reactivation is completed this summer, the unit will head out for a $400 million contract with Eni offshore Cote d’Ivoire.

Would tax changes be enough to shift market sentiment?

The global drillship market has tightened significantly over the last year, leading to increased global demand for semisubs. Should North Sea semisub demand remain low, rig owners are not ruling out the possibility of more units moving out as operators from other regions take advantage of idle units and hire them out.

Last year, the increasing demand for jackups in the Middle East drove dozens of rigs to the region and existing plans show that this will continue, albeit at a much slower pace, in 2023. UAE’s ADNOC Drilling already said it plans to make further rig acquisitions this year.

In addition to the previously mentioned Noble Houston Colbert and Ran, which are now in Qatar and Mexico, respectively, Borr Drilling’s Prospector 5 also left the North Sea region in late 2022 to work for Eni offshore Congo. Also, the Valaris 249, which had previously worked in the UK, started a new contract in New Zealand in early 2022 following a prolonged idle period in prior years. The contract is set to end this quarter and, after that, the rig will move on to Trinidad for a one-year contract starting late in 2Q or early in 3Q of 2023.

Driven by demand, it is not unusual to see rigs moving from one region to another. However, recent activity in the North Sea market and speculations that more rigs could move out of the region bring into question whether the current number of available rigs will be enough to handle the work once demand recovers.

Due to dozens of project sanctions in Norway over the last couple of years, the country’s floater market is expected to see a comeback in activity from mid-2024 and this may entice rigs to return to the market to meet the heightened demand, as the limited supply of HE units and barriers to entry make Norwegian dayrates some of the highest in the world.

Meanwhile, the likelihood of new floating rigs being built in the near future is low due to long lead times, high costs, and different payment schemes compared to previous years. However, this does not apply to jackup rigs for which we do expect to see new orders but most likely targeting the Middle East market.

Speaking of newbuilds, two former Awilco Drilling HE semisubs, Nordic Winter and Nordic Spring, are actively bidding for contracts in Norway for which the rigs were initially intended. However, they have also been offered for a long-term opportunity coming up in the UK in 2024. The rigs are under construction at a Keppel shipyard and have been managed by Dolphin Drilling since late 2021.

In the UK, concerns related to the windfall tax have dampened the operators’ mood. However, later this week, the government is expected to make a series of announcements related to energy policy, including possible changes to the windfall tax and a move on carbon capture and storage (CCS) projects.

It is also rumoured that the government is expected to make a decision on a licence for the Equinor-operated Rosebank field. Norway’s Equinor has recently doubled its stake in Rosebank as part of a strategy to optimise its portfolio in core countries. The project’s final investment decision (FID) is expected this year and the start date for drilling operations is slated for 2025.

While there have been instances of North Sea rigs moving out of the region, leaving regional operators with fewer options, there has also been a pickup in activity over 2022 following the 2020 downturn due to the Covid-19 pandemic.

The UK government’s announcement related to the windfall tax and a step forward in major decisions for Rosebank and Cambo developments may result in some changes to the overall market sentiment. Should this happen, it remains to be seen whether it will be enough for operators to change their plans for the region amid projections by OEUK that the cuts in investment mean that the UK’s potential oil and gas resources have immediately been downgraded, with 500 million barrels less likely to be produced, equivalent to a year of UK output.

Image credit: Diamond Offshore