Ports in Motion: An overview of Europe MPP developments (2022–Q1 2025)

As part of our regional MPP port analysis, we’re highlighting key trends across Europe, with fresh insights into vessel activity, operator performance, time at berth, and port waiting times.

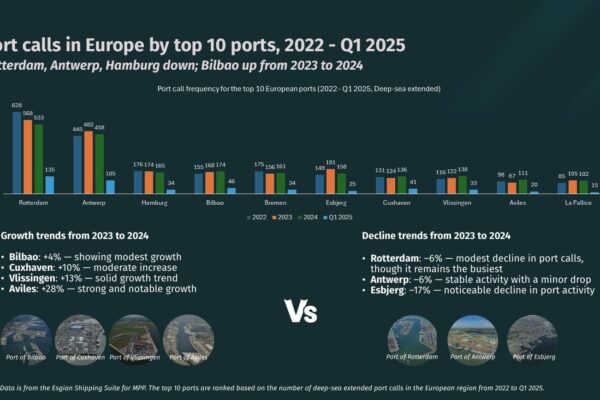

Overall Activity (2022-Q1 2025): From 2022 to 2024, Rotterdam, Europe’s busiest port, saw a modest decline in port calls, though it maintained its leading position throughout the period. In contrast, smaller ports such as Cuxhaven, Vlissingen, and Aviles experienced overall growth, with a notable rebound between 2023 and 2024. As new tariffs and trade policies take effect in 2025, their influence on major ports like Rotterdam and Antwerp could shape future shipment patterns, particularly in transatlantic trade.

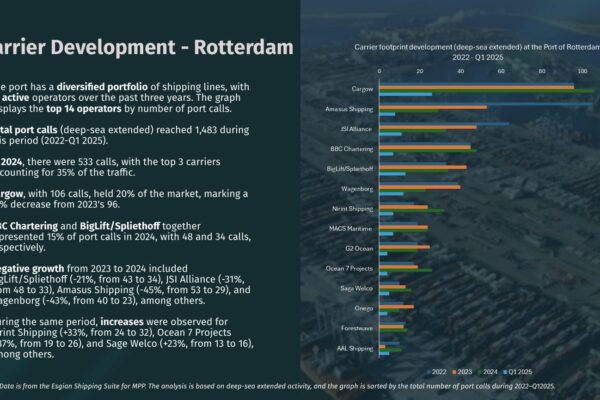

Carrier Performance (2022–Q1 2025): BBC Chartering remained the leading operator during the period, with over 2,420 port calls, followed by Wagenborg with 1,990 calls. Ocean 7 Projects and Cargow showed strong growth from 2023 to 2024, while Amasus Shipping and BBC Chartering experienced a decline in port activity during the same period. Looking ahead, new tariffs and evolving trade policies in 2025 may influence operator strategies and could lead to adjustments in regional port activity and supply chain flows later in the year.

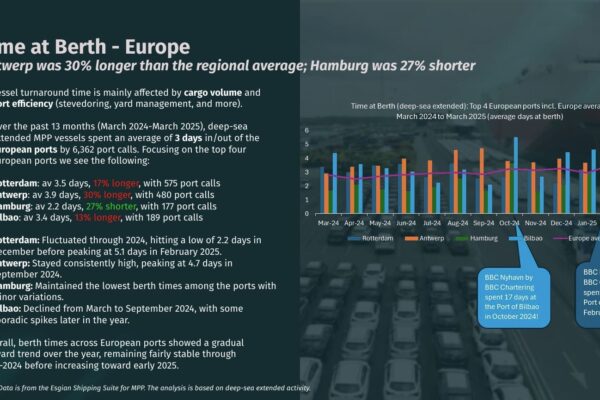

Time at Berth: In Europe, over the 13-month period from March 2024 to March 2025, deep-sea extended MPP vessels spent an average of 3 days at port per call across 6,362 port calls. During this same period, Rotterdam—the busiest port for the MPP segment in the analysis—recorded an average port time of 3.5 days, approximately 17% longer than the regional average, with a total of 575 port calls.

Port Waiting Time: We observed notable spikes at the Port of Rotterdam, where waiting times reached an extreme outlier of 203 hours on average. Antwerp also experienced significant surges in June, July, and September, with averages exceeding 100 hours. These delays can result not only from congestion but also from scheduling conflicts, clearance procedures, cargo readiness issues, or adverse weather conditions.

The full details and MPP market insights are available in our comprehensive report, exclusively for clients. For inquiries, please contact us at shipping@esgian.com. For more updates and insights, follow us on LinkedIn.