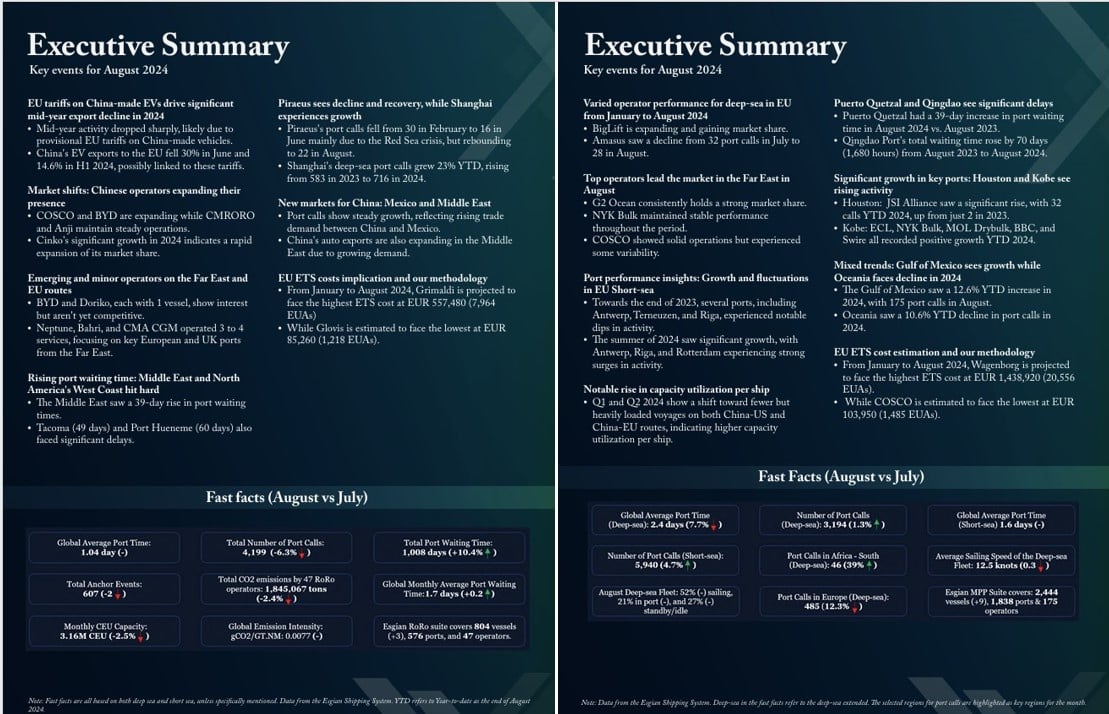

Esgian Shipping RoRo and MPP Market Reports for August 2024

We are pleased to share the key highlights from the executive summary of the RoRo and MPP report for August 2024.

(RoRo)

EU tariffs on China-made EVs drive significant mid-year export decline in 2024

- Mid-year activity dropped sharply, likely due to provisional EU tariffs on China-made vehicles.

- China’s EV exports to the EU fell 30% in June and 14.6% in H1 2024, possibly linked to these tariffs.

Market shifts: Chinese operators expanding their presence

- COSCO and BYD are expanding while CMRORO and Anji maintain steady operations.

- Cinko’s significant growth in 2024 indicates a rapid expansion of its market share.

Rising port waiting time: Middle East and North America’s West Coast hit hard

- The Middle East saw a 39-day rise in port waiting time.

- Tacoma (49 days) and Port Hueneme (60days) also faced significant delays.

(MPP)

Varied operator performance for deep-sea in EU from January to August 2024

- BigLift is expanding and gaining market share.

- Amasus saw a decline from 32 port calls in July to 28 in August.

Notable rise in capacity utilization per ship

- Q1 and Q2 2024 show a shift toward fewer but heavily loaded voyages on both China-US and China-EU routes, indicating higher capacity utilization per ship.

Mixed trends: Gulf of Mexico sees growth while Oceania faces deline in 2024

- The Gulf of Mexico saw a 12.6% YTD increase in 2024, with 175 port calls in August.

- Oceania saw a 10.6% YTD decline in port calls in 2024.

The full report is available exclusively to our clients. If you’d like more information, feel free to reach out at shipping@esgian.com.

Image left: Market Report for RoRo (August), Right: Market Report for MPP (August)