Esgian Shipping RoRo and MPP Market Reports for November 2025

We are pleased to share the key insights from our November 2025 RoRo and MPP Market Reports. Discover the key trends and developments that shaped the RoRo and MPP segments in November 2025.

RoRo November 2025 highlights:

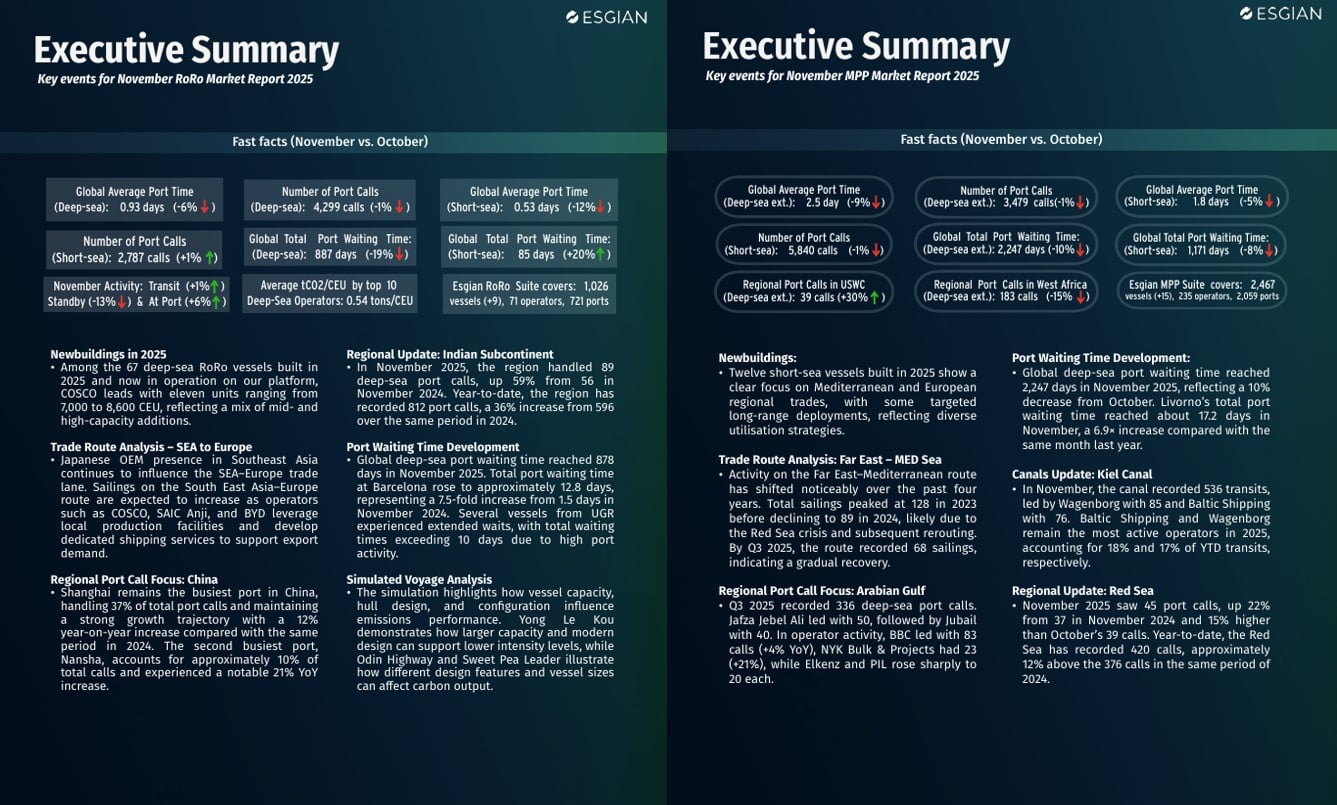

Newbuildings in 2025:Among the 67 deep-sea RoRo vessels built in 2025 and now in operation on our platform, COSCO leads with eleven units ranging from 7,000 to 8,600 CEU, reflecting a mix of mid- and high-capacity additions.

Trade route analysis – Southeast Asia to Europe: Japanese OEM presence in Southeast Asia continues to influence the SEA–Europe trade lane. Sailings on the South East Asia–Europe route are expected to increase as operators such as COSCO, SAIC Anji, and BYD leverage local production facilities and develop dedicated shipping services to support export demand.

Regional Port Call Focus – China: Shanghai remains the busiest port in China, handling 37% of total port calls and maintaining a strong growth trajectory with a 12% year-on-year increase compared with the same period in 2024. The second busiest port, Nansha, accounts for approximately 10% of total calls and experienced a notable 21% YoY increase.

Port Waiting Time Development:Global deep-sea port waiting time reached 878 days in November 2025. Total port waiting time at Barcelona rose to approximately 12.8 days, representing a 7.5-fold increase from 1.5 days in November 2024. Several vessels from UGR experienced extended waits, with total waiting times exceeding 10 days due to high port activity.

MPP November 2025 highlights:

Trade route analysis – Far East to Mediterranean Sea: Activity on the Far East–Mediterranean route has shifted noticeably over the past four years. Total sailings peaked at 128 in 2023

before declining to 89 in 2024, likely due to the Red Sea crisis and subsequent rerouting. By Q3 2025, the route recorded 68 sailings, indicating a gradual recovery.

Regional port call focus – Arabian Gulf: Q3 2025 recorded 336 deep-sea port calls. Jebel Ali led with 50, followed by Jubail with 40. In operator activity, BBC led with 83 calls (+4% YoY), NYK Bulk & Projects had 23 (+21%), while Elkenz and PIL rose sharply to 20 each.

Canals Update – Kiel Canal: In November, the canal recorded 536 transits, led by Wagenborg with 85 and Baltic Shipping with 76. Baltic Shipping and Wagenborg remain the most active operators in 2025, accounting for 18% and 17% of YTD transits, respectively.

Explore the full details and market insights in our comprehensive reports! Our reports are exclusively available to our clients. Please contact us with any inquiries at shipping@esgian.com. For more updates and insights, follow us on LinkedIn.