Esgian Shipping RoRo and MPP Market Reports for October 2025

We are pleased to share the key insights from our October 2025 RoRo and MPP Market Reports. Discover the key trends and developments that shaped the RoRo and MPP segments in October 2025.

RoRo October 2025 highlights:

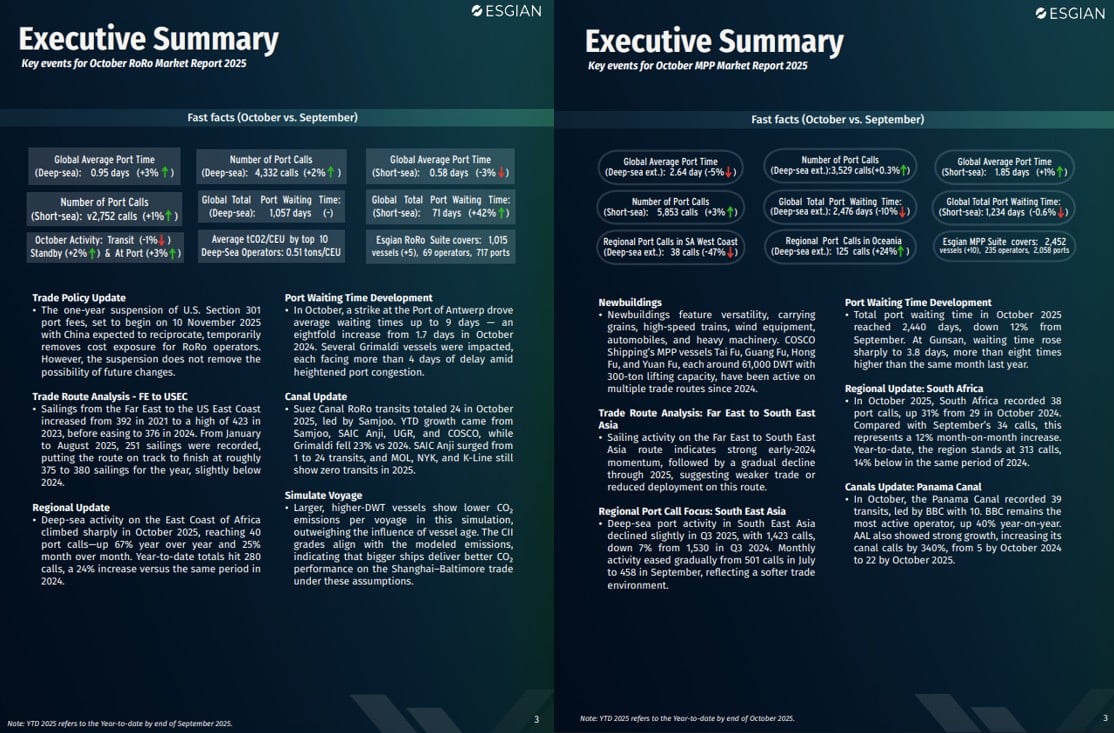

Trade policy update: The one-year suspension of U.S. Section 301 port fees, set to begin on 10 November 2025 with China expected to reciprocate, temporarily removes cost exposure for RoRo operators. However, the suspension does not remove the possibility of future changes.

Trade route analysis – FE to USEC: Sailings from the Far East to the US East Coast increased from 392 in 2021 to a high of 423 in 2023, before easing to 376 in 2024. From January to August 2025, 251 sailings were recorded, putting the route on track to finish at roughly 375 to 380 sailings for the year, slightly below 2024.

Regional update: Deep-sea activity on the East Coast of Africa climbed sharply in October 2025, reaching 40 port calls—up 67% year over year and 25% month over month. Year-to-date totals hit 280 calls, a 24% increase versus the same period in 2024.

Canal update: Suez Canal RoRo transits totaled 24 in October 2025, led by Samjoo. YTD growth came from Samjoo, SAIC Anji, UGR, and COSCO, while Grimaldi fell 23% vs 2024. SAIC Anji surged from 1 to 24 transits, and MOL, NYK, and K-Line still show zero transits in 2025.

MPP October 2025 highlights:

Newbuildings: Newbuildings feature versatility, carrying grains, high-speed trains, wind equipment, automobiles, and heavy machinery. COSCO Shipping’s MPP vessels Tai Fu, Guang Fu, Hong Fu, and Yuan Fu, each around 61,000 DWT with 300-ton lifting capacity, have been active on multiple trade routes since 2024.

Trade route analysis – Far East to South East Asia: Sailing activity on the Far East to South East Asia route indicates strong early-2024 momentum, followed by a gradual decline through 2025, suggesting weaker trade or reduced deployment on this route.

Regional port call focus – South East Asia: Deep-sea port activity in South East Asia declined slightly in Q3 2025, with 1,423 calls, down 7% from 1,530 in Q3 2024. Monthly activity eased gradually from 501 calls in July to 458 in September, reflecting a softer trade environment.

Explore the full details and market insights in our comprehensive report! Our reports are exclusively available to our clients. Please contact us with any inquiries at shipping@esgian.com. For more updates and insights, follow us on LinkedIn.