Esgian Shipping RoRo and MPP Market Reports for August 2025

We are pleased to share the key insights from our August 2025 RoRo and MPP Market Reports. Discover the key trends and developments that shaped the RoRo and MPP segments in August 2025.

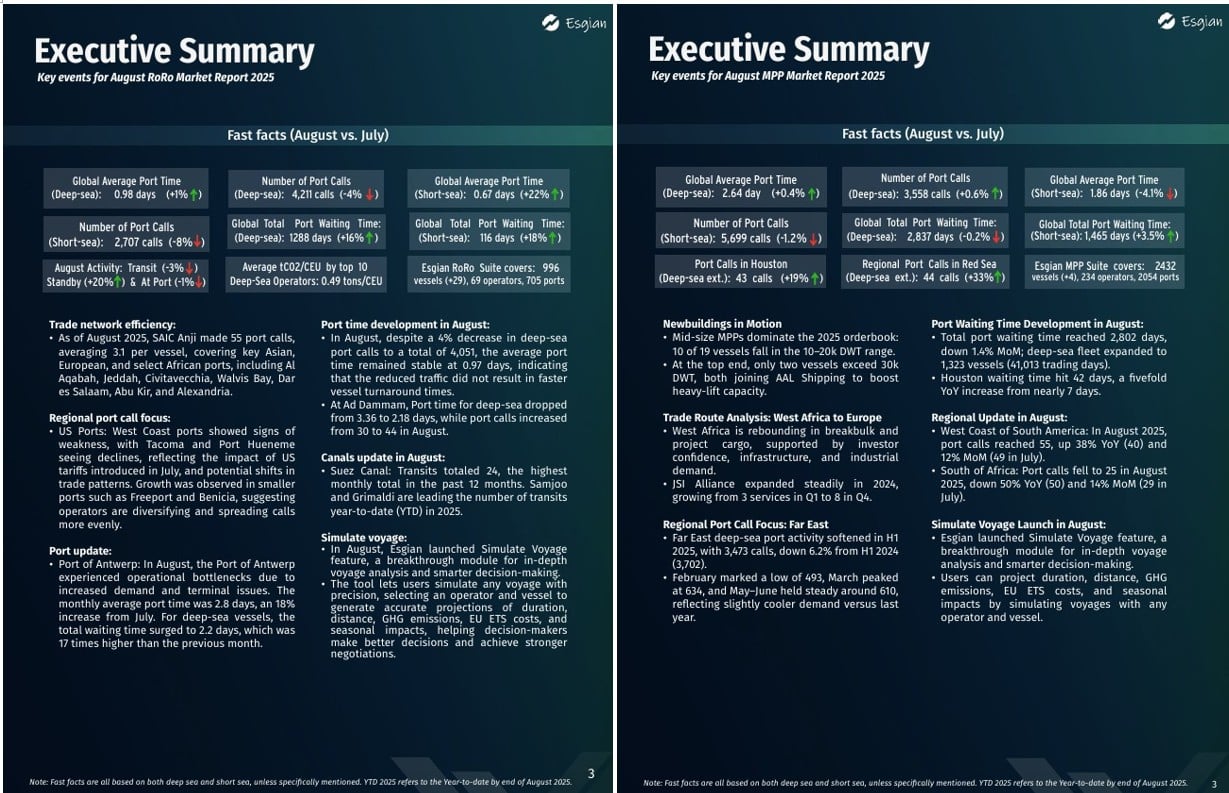

RoRo August 2025 highlights:

Regional port call focus -US Ports: West Coast ports showed signs of weakness, with Tacoma and Port Hueneme seeing declines, reflecting the impact of US tariffs introduced in July, and potential shifts in trade patterns.

Port update – Port of Antwerp: In August, the Port of Antwerp experienced operational bottlenecks due to increased demand and terminal issues. The monthly average port time was 2.8 days, an 18% increase from July.

Canals update in August – Suez Canal: Transits totaled 24, the highest monthly total in the past 12 months. Samjoo and Grimaldi are leading the number of transits year-to-date (YTD) in 2025.

Simulate voyage: In August, Esgian launched Simulate Voyage feature, a breakthrough module for in-depth voyage analysis and smarter decision-making. The tool lets users simulate any voyage with precision, selecting an operator and vessel to generate accurate projections of duration, distance, GHG emissions, EU ETS costs, and seasonal impacts, helping decision-makers make better decisions and achieve stronger negotiations.

MPP August 2025 highlights:

Newbuildings in motion: Mid-size MPPs dominate the 2025 orderbook: 10 of 19 vessels fall in the 10–20k DWT range.

Trade route analysis – West Africa to Europe: West Africa is rebounding in breakbulk and project cargo, supported by investor confidence, infrastructure, and industrial demand.

Regional port call focus – Far East: Far East deep-sea port activity softened in H1 2025, with 3,473 calls, down 6.2% from H1 2024 (3,702).

Explore the full details and market insights in our comprehensive report! Our reports are exclusively available to our clients. Please contact us with any inquiries at shipping@esgian.com. For more updates and insights, follow us on LinkedIn.