Esgian Shipping RoRo and MPP Market Reports for April 2025

We are pleased to share the key insights from our April 2025 RoRo and MPP Market Reports. Discover the key trends and developments that shaped the RoRo and MPP segments in April 2025.

RoRo April 2025 highlights:

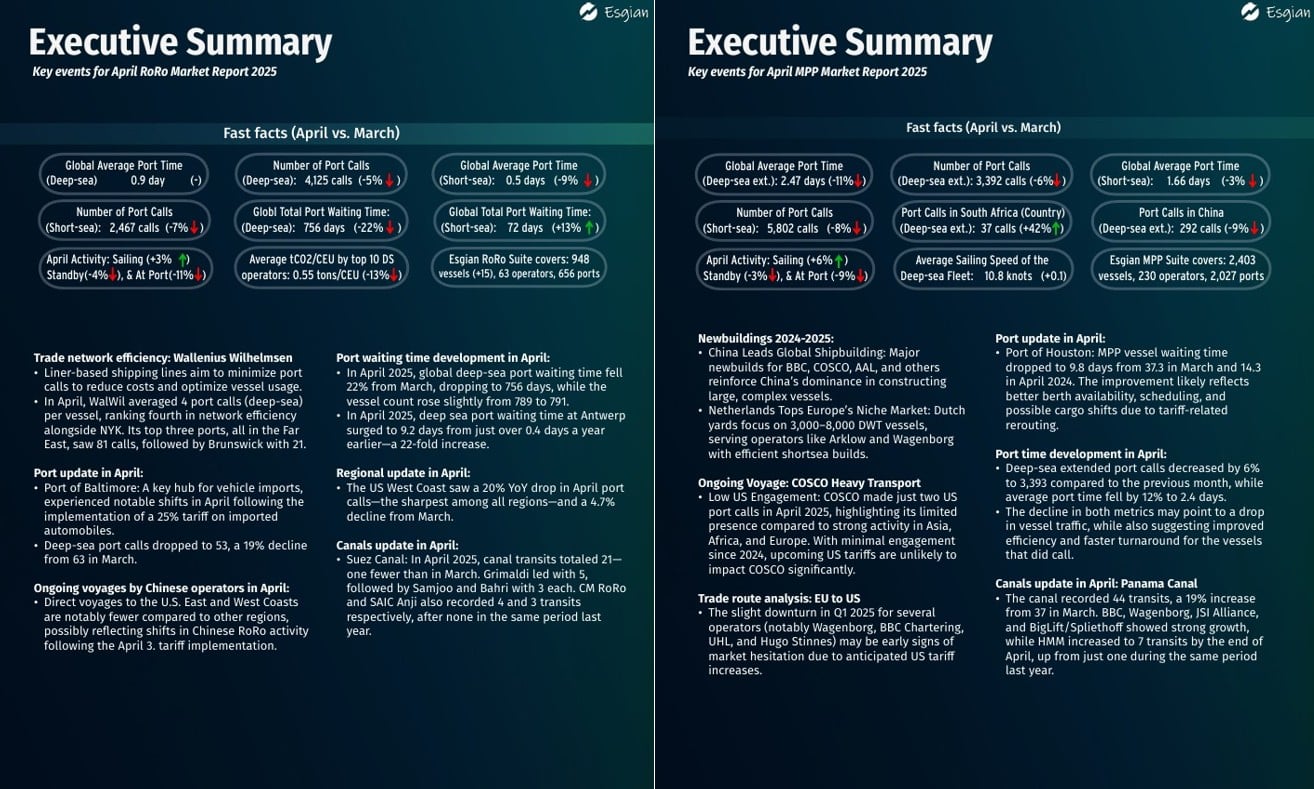

Port Update: Port of Baltimore – A key hub for vehicle imports, experienced notable shifts in April following the implementation of a 25% tariff on imported automobiles. Deep-sea port calls dropped to 53, a 19% decline from 63 in March.

Port waiting time development: In April 2025, global deep-sea port waiting time fell 22% from March, dropping to 756 days, while the vessel count rose slightly from 789 to 791. In April 2025, deep-sea port waiting time at Antwerp surged to 9.2 days from just over 0.4 days a year earlier—a 22-fold increase.

Canals update: Suez Canal – In April 2025, canal transits totaled 21—one fewer than in March. Grimaldi led with 5, followed by Samjoo and Bahri with 3 each. CM RoRo and SAIC Anji also recorded 4 and 3 transits, respectively, after none in the same period last year.

MPP April 2025 highlights:

Newbuildings 2024-2025: China Leads Global Shipbuilding: Major newbuilds for BBC, COSCO, AAL, and others reinforce China’s dominance in constructing large, complex vessels. Netherlands Tops Europe’s Niche Market: Dutch yards focus on 3,000–8,000 DWT vessels, serving operators like Arklow and Wagenborg with efficient shortsea builds.

Trade Route Focus: Europe to the US – The slight downturn in Q1 2025 for several operators (notably Wagenborg, BBC Chartering, UHL, and Hugo Stinnes) may be early signs of market hesitation due to anticipated US tariff increases.

Port Update: Port of Houston – MPP vessel waiting time dropped to 9.8 days from 37.3 in March and 14.3 in April 2024. The improvement likely reflects better berth availability, scheduling, and possible cargo shifts due to tariff-related rerouting.

Explore the full details and market insights in our comprehensive report! Our reports are exclusively available to our clients. Please contact us with any inquiries at shipping@esgian.com. For more updates and insights, follow us on LinkedIn.