Ports in Motion: An overview of US MPP developments (2022–Q1 2025)

As part of our regional MPP port analysis, we’re highlighting key trends across the United States, with fresh insights into vessel activity, operator performance, time at berth, and port waiting times.

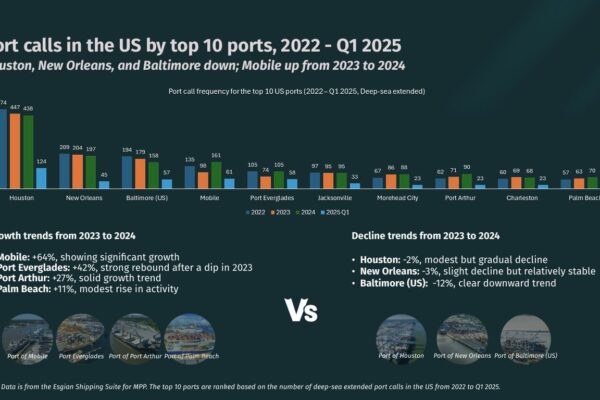

Overall Activity (2022–Q1 2025): From 2022 to 2024, Houston, New Orleans, and Baltimore saw a steady decline in port calls, while Mobile and Port Everglades rebounded, showing growth. Port Arthur and Palm Beach also recorded increases. However, new 2025 tariffs may impact mid-sized and smaller ports, potentially reversing gains.

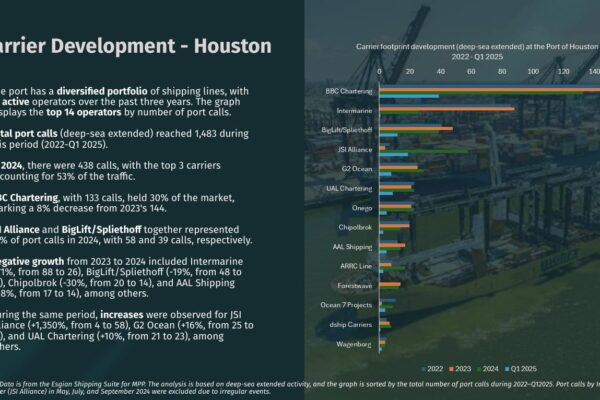

Carrier Performance (2022–Q1 2025): BBC Chartering led with over 1,800 port calls, followed by BigLift/Spliethoff (1,460). Wagenborg and Saga Welco grew from 2023 to 2024, while G2 Ocean and Intermarine declined. New trade policies in 2025 could prompt shifts in operator strategies.

Time at Berth: From March 2024 to March 2025, MPP vessels averaged 2.9 days per call across 3,278 calls. Houston, the busiest port, averaged 3.6 days—24% above the national average.

Port Waiting Time: Baltimore spiked to 222 hours in April 2024 due to a bridge collapse but steadily recovered. Houston showed volatility, while Mobile maintained low, stable waiting times.

The full details and MPP market insights are available in our comprehensive report, exclusively for clients. For inquiries, please contact us at shipping@esgian.com. For more updates and insights, follow us on LinkedIn.