Esgian Shipping RoRo and MPP Market Reports for February 2025

We are pleased to share the key insights from our February 2025 RoRo and MPP Market Reports. Discover the key trends and developments that shaped the RoRo and MPP segments in February 2025.

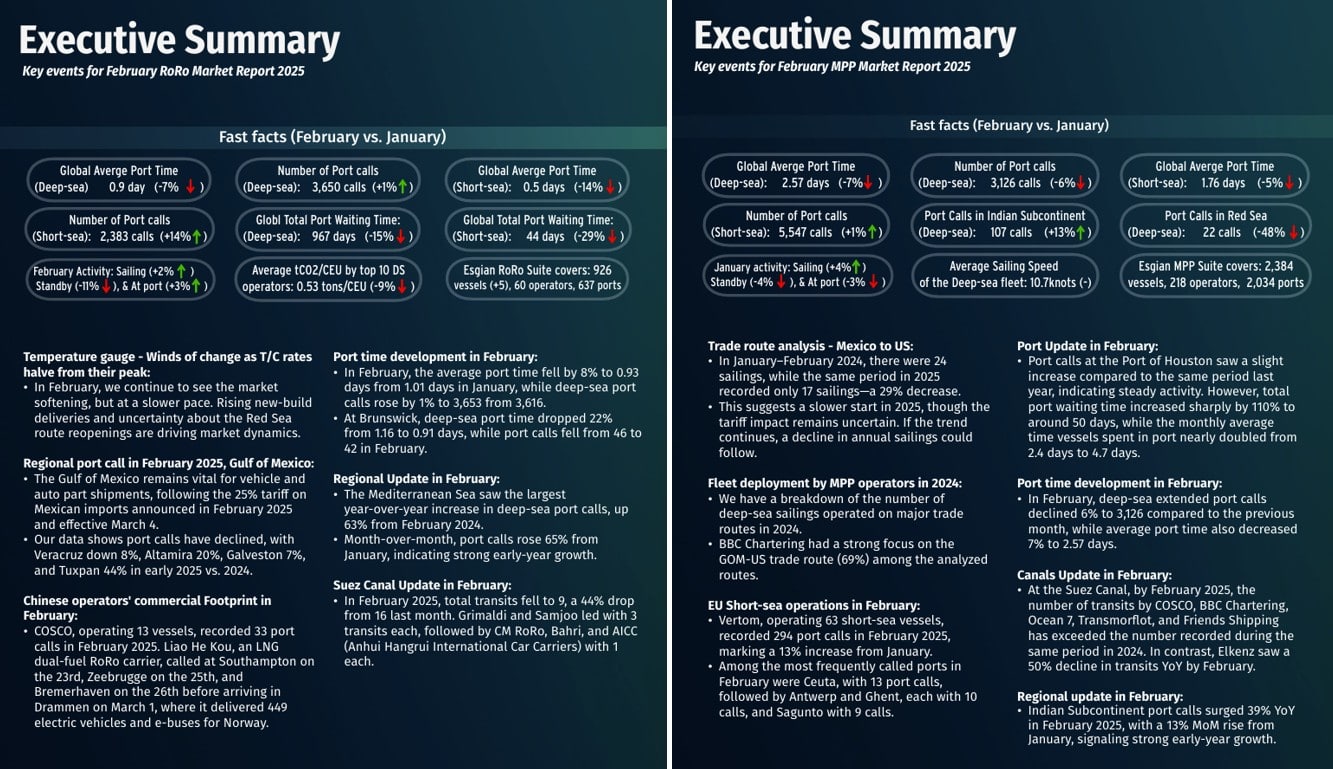

RoRo February 2025 highlights:

Regional port call in February 2025, Gulf of Mexico:

- The Gulf of Mexico remains vital for vehicle and auto part shipments, following the 25% tariff on Mexican imports announced in February 2025 and effective March 4.

- Our data shows port calls have declined, with Veracruz down 8%, Altamira 20%, Galveston 7%, and Tuxpan 44% in early 2025 vs. 2024.

Port time development in February:

- In February, we continue to see the market softening, but at a slower pace. Rising new-build deliveries and uncertainty about the Red Sea route reopenings are driving market dynamics.

- At Brunswick, deep-sea port time dropped 22% from 1.16 to 0.91 days, while port calls fell from 46 to 42 in February.

Suez Canal update in February:

- In February 2025, total transits fell to 9, a 44% drop from 16 last month. Grimaldi and Samjoo led with 3 transits each, followed by CM RoRo, Bahri, and AICC (Anhui Hangrui International Car Carriers) with 1 each.

MPP February 2025 highlights:

Trade route analysis – Mexico to US

- In January–February 2024, there were 24 sailings, while the same period in 2025 recorded only 17 sailings—a 29% decrease.

- This suggests a slower start in 2025, though the tariff impact remains uncertain. If the trend continues, a decline in annual sailings could follow.

Fleet deployment by MPP operators in 2024:

- We have a breakdown of the number of deep-sea sailings operated on major trade routes in 2024.

- BBC Chartering had a strong focus on the GOM-US trade route (69%) among the analyzed routes.

EU Short-sea operations in February:

- Vertom, operating 63 short-sea vessels, recorded 294 port calls in February 2025, marking a 13% increase from January.

- Among the most frequently called ports in February were Ceuta, with 13 port calls, followed by Antwerp and Ghent, each with 10 calls, and Sagunto with 9 calls.

Explore the full details and market insights in our comprehensive report! Our reports are exclusively available to our clients. Please contact us with any inquiries at shipping@esgian.com. For more updates and insights, follow us on LinkedIn.