Esgian Shipping RoRo and MPP Market Reports for October 2024

We are pleased to share the key highlights from the executive summary of the RoRo and MPP reports for October 2024.

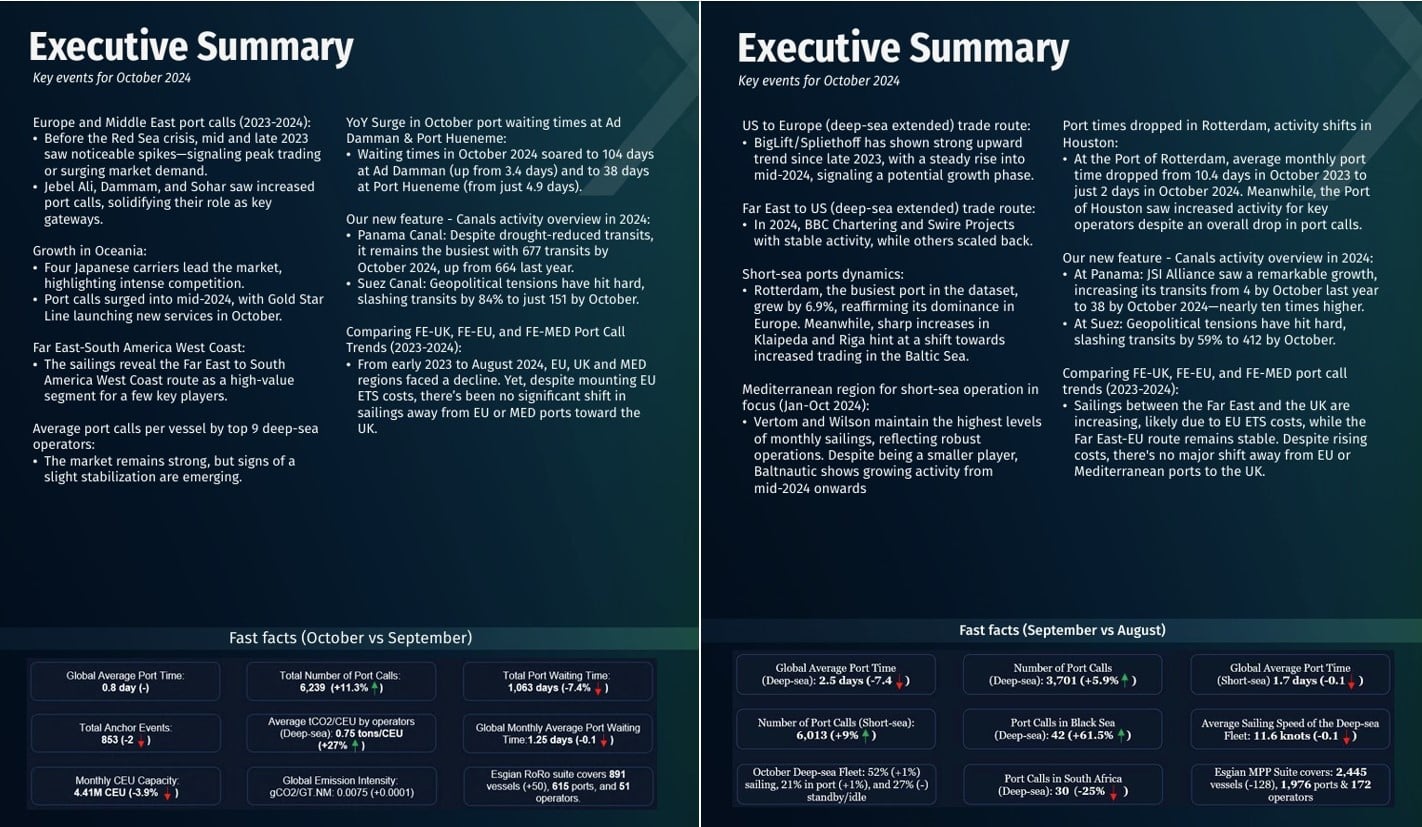

(RORO)

Europe and Middle East port calls (2023-2024):

- Before the Red Sea crisis, mid and late 2023 saw noticeable spikes—signaling peak trading or surging market demand.

- Jebel Ali, Dammam, and Sohar saw increased port calls, solidifying their role as key gateways.

Growth in Oceania:

- Four Japanese carriers lead the market, highlighting intense competition.

- Port calls surged into mid-2024, with Gold Star Line launching new services in October.

Our new feature – Canals activity overview in 2024:

- Panama Canal: Despite drought-reduced transits, it remains the busiest with 677 transits by October 2024, up from 664 last year.

- Suez Canal: Geopolitical tensions have hit hard, slashing transits by 84% to just 151 by October.

(MPP)

US to Europe (deep-sea extended) trade route:

- BigLift/Spliethoff has shown a strong upward trend since late 2023, with a steady rise into mid-2024, signaling a potential growth phase.

Mediterranean region for short-sea operation in focus (Jan-Oct 2024):

- Vertom and Wilson maintain the highest levels of monthly sailings, reflecting robust operations. Despite being a smaller player, Baltnautic shows growing activity from mid-2024 onwards.

Comparing FE-UK, FE-EU, and FE-MED port call trends (2023-2024):

- Sailings between the Far East and the UK are increasing, likely due to EU ETS costs, while the Far East-EU route remains stable. Despite rising costs, there’s no major shift away from EU or Mediterranean ports to the UK.

The full report is available exclusively to our clients. If you’d like more information, feel free to reach out at shipping@esgian.com

Image left: Market Report for RoRo (October), Right: Market Report for MPP (October)