The offshore drilling market is navigating a complex landscape marked by both recovery and caution. As the industry adjusts to past lessons and current economic realities, the viability of placing newbuild orders remains a recurring question. With this in mind, Esgian has examined the key considerations influencing this issue, as well as the perspectives of drilling contractors on the potential for newbuilds in the current market environment.

Strong demand for oil combined with high oil prices during the previous offshore drilling upcycle (2010-2014) spurred a wave of new orders for offshore drilling rigs, particularly for high-specification deepwater and ultra-deepwater floating rigs and jackups. However, this surge in new orders led to a large influx of new units, so when oil prices collapsed in late 2014 and rig demand plummeted, the market became oversaturated. Many contractors decided to delay or cancel deliveries, while some delivered newbuilds ended up being cold stacked or warm stacked.

As exploration and production activity increased over the last couple of years, many stranded newbuilds have been bought by drilling contractors to capitalise on growing demand and rising dayrates. The drillship segment, which has been leading the way in the offshore drilling market recovery, is now boasting high utilisation and limited sideline capacity.

But despite the current optimism that the offshore drilling market is moving into an extended upcycle, drilling contractors are being far more disciplined and cautious than during previous upcycles. Rather than ordering new units on speculation, as has been the case previously, drilling contractors are focusing on reactivating their cold stacked units and acquiring assets that have been stranded in shipyards for years. One of the more recent examples of such acquisitions is the delivery of two 12,000-ft drillships, Zonda and Dorado, by South Korea’s Samsung Heavy Industries to Eldorado Drilling.

Other reasons for this cautious approach include limited yard availability, long lead times, and the challenging economics of such an endeavour. One of the largest offshore drilling contractors, Noble Corp., believes that newbuilds are “prohibitively uneconomic.” According to Transocean, newbuilds drillships are expected to cost $1billion+, with a minimum five-year lead time.

Valaris says that, when adjusted for inflation, prior cycle peak drillship dayrates were > $800,000. The contractor expects dayrates would need to be at these levels or higher for an extended period to incentivise newbuild orders.

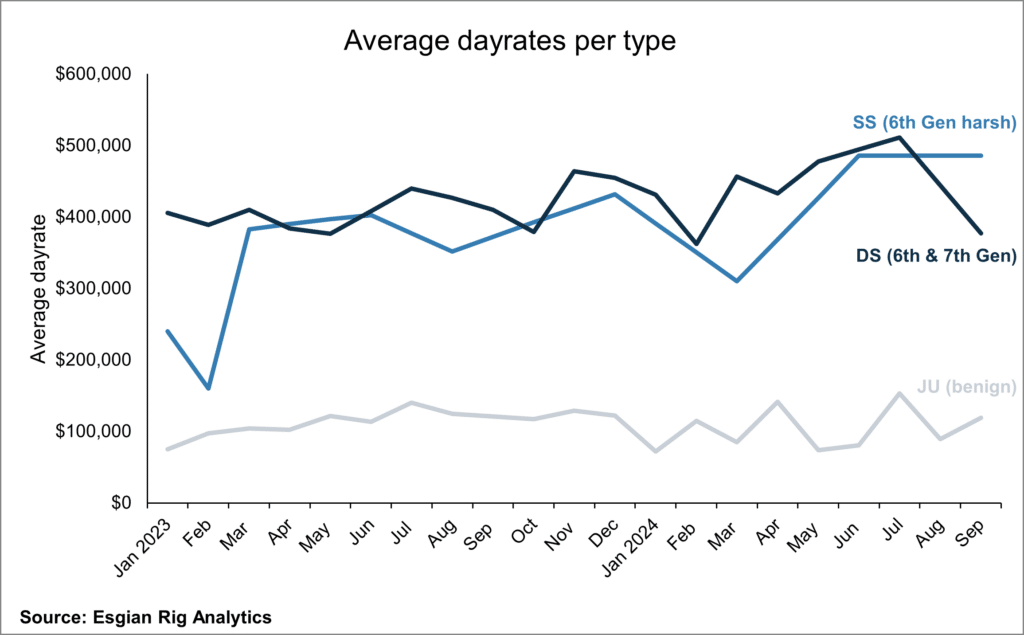

Leading-edge dayrates for 7th Gen drillships have exceeded $500,000 this year, with some instances surpassing $600,000 for the highest spec unit with a 20K capability. However, that’s still a long way from the required levels. Meanwhile, average dayrates for 6th and 7th Gen drillships rose steadily from April to July 2024, but dipped in September due to the extension of four long-running contracts in Guyana under a market-based rate and a new fixture for a 6th Gen unit in India. This decline was somewhat offset by the latest US GOM award for a drillship with a 20K capability.

With demand for harsh-environment (HE) semisubmersibles rising amid reduced supply, this market segment is also tightening, but newbuilds are not expected any time soon.

Odfjell Drilling, the manager of eight such units, says that a new HE floater could take around four years from project sanction and cost $800 – $ 1,000 million. Furthermore, dayrates needed to justify a newbuild would need to exceed $720,000 with a five-year contract. It is noteworthy that HE rates have crossed the $500,000 threshold this year.

On the jackup side, utilisation is expected to remain tight despite near-term uncertainties following two rounds of contract suspensions in Saudi Arabia this year.

When it comes to ordering new units, Borr Drilling, the owner of 24 jackups, says there are limited yard building slots as order books are filled by other vessel types, with delivery times at 3+ years for a new order. In addition, prices for new orders are expected to exceed prior cycle prices at ~$300 million for a ready-to-drill unit. Limited financing availability will require a long-term underlying contract, lasting from 7 to 10 years. Borr also says that newbuild economics will require dayrates in excess of $200,000 for usable asset life (25 years). Excluding the Norwegian HE jackup rates, this dayrate threshold has only been crossed by one fixture this year.

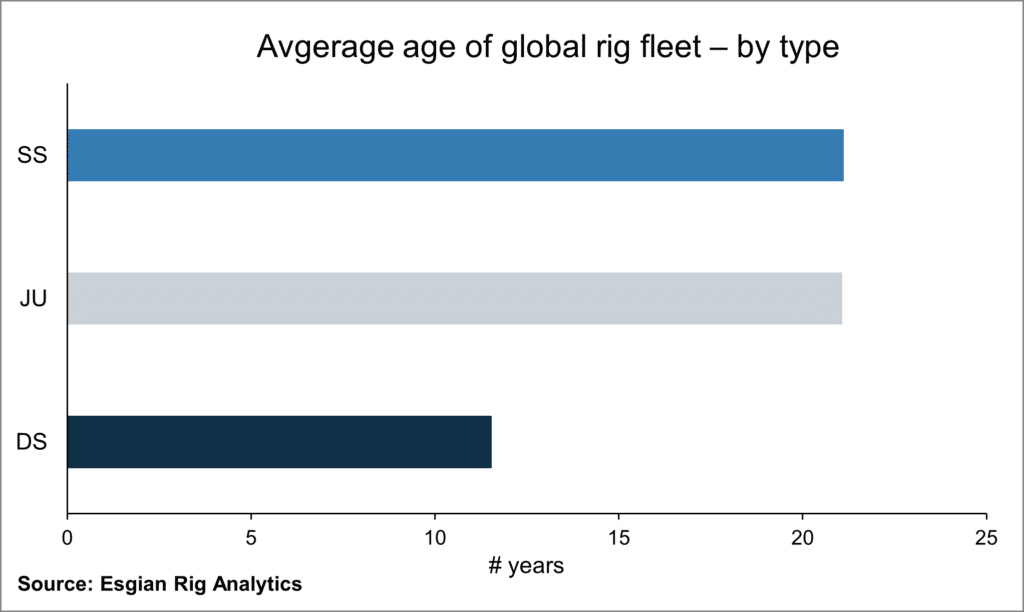

The average age of the global rig fleet varies by type, which influences contractors’ strategies in the current cycle. The average age of jackup as well as semisubmersible fleets is around 21 years, indicating a mature fleet that may require replacements or upgrades at some point in the future.

In contrast, the average age of the drillship fleet is only 11.5 years, suggesting that many of these units are still relatively modern and capable of meeting current operational demands. Similarly, the average age of the 6th Gen HE semisub fleet is 11.3 years. This further reinforces a cautious approach towards newbuild investments for these rig types. Some major drilling contractors have suggested that, in the longer term, they may focus on upgrading the capabilities and extending the lifespan of rigs in their fleet, rather than replacing them.

While the offshore drilling market is at the beginning of an extended upcycle, the cautious approach of drilling contractors towards newbuild orders highlights the ongoing challenges and uncertainties in achieving the required levels for investment viability.

Even as leading-edge dayrates for some rig types are on the rise, they remain far below the levels required to incentivise newbuilds. The shift from speculative orders to more strategic, measured investments suggests a deeper understanding of market volatility and a focus on sustainable growth. As such, the future of newbuild orders will likely hinge on a combination of sustained demand, favourable economic conditions, and a continued rise in dayrates. Until then, the industry’s cautious approach seems set to define the current phase of the offshore drilling upcycle.