Esgian Shipping has released the July market reports for RoRo and MPP, which are now available to our customers.

We are excited to share the key highlights from the executive summary of the RoRo and MPP report for July 2024.

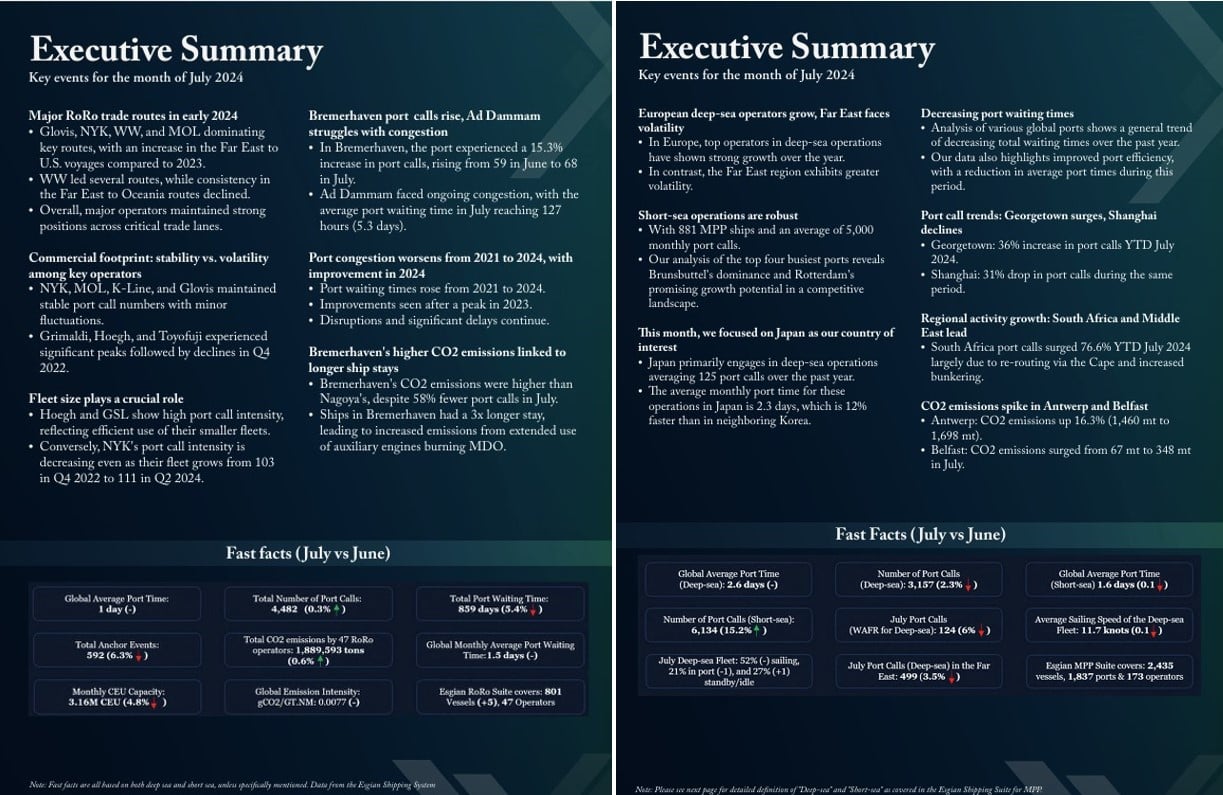

(RoRo)

Major RoRo trade routes in Q1 2024

- Glovis, NYK, WW, and MOL dominating key routes, with an increase in the Far East to U.S. voyages compared to 2023.

- WW led several routes, while consistency in the Far East to Oceania routes declined.

- Overall, major operators maintained strong positions across critical trade lanes.

Commercial footprint: stability vs. volatility among key operators

- NYK, MOL, K-Line, and Glovis maintained stable port call numbers with minor fluctuations.

- Grimaldi, Hoegh, and Toyofuji experienced significant peaks followed by declines in Q4 2022.

Port congestion increased from 2021 to 2024, with improvement in 2024

- Port waiting times rose from 2021 to 2024.

- Improvements seen after a peak in 2023.

- Disruptions and significant delays continue.

(MPP)

European deep-sea operators grow, Far East faces volatility

- In Europe, top operators in deep-sea operations have shown strong growth over the year.

- In contrast, the Far East region exhibits greater volatility.

Decreasing port waiting times

- Analysis of various global ports shows a general trend of decreasing total waiting times over the past year.

- Our data also highlights improved port efficiency, with a reduction in average port times during this period.

Port call trends: Georgetown surges, Shanghai declines

- Georgetown: 36% increase in port calls YTD July 2024.

- Shanghai: 31% drop in port calls during the same period.

Image left: Market Report for RoRo (July), Right: Market Report for MPP (July)