South Korea shows great promise as a manufacturing powerhouse in the offshore wind industry, but not all suppliers have been able to set sail successfully.

South Korea’s strengths lie in its steel manufacturers and shipyards, which are benefiting significantly from the growing global offshore wind market. Companies like CS Wind have seen increased profits, thanks to their strong presence in key markets such as Europe and the United States. Similarly, SK Ocean Plant has capitalized on the expanding APAC market, closer to home. The country’s shipyards also play a crucial role in this burgeoning industry, with substantial growth potential in this segment.

The resurgence of floating offshore wind technology has added momentum to the sector. Samsung Heavy Industries recently secured a contract with Equinor to manufacture and deliver floating foundations for Equinor’s Firefly project in South Korea. HD Hyundai Heavy Industries is also actively involved in the floating segment for both domestic and international markets. Additionally, Hanwha Ocean is constructing Cadeler’s M-Class installation jack-up vessels, with one nearing delivery. The involvement of these shipyards is becoming increasingly important as more projects accumulate.

However, the outlook for South Korean turbine manufacturers is not as promising as it is for steel manufacturers and shipyards. Companies like Doosan Enerbility and Unison have struggled to establish a foothold in the local offshore wind market and have not succeeded in expanding into other markets. To make matters worse, they face growing pressure from Chinese suppliers who are attempting to enter the market and undercut local manufacturers.

The future for turbine manufacturers like Doosan Enerbility and Unison remains uncertain, heavily dependent on government intervention to protect local manufacturing and ensure the survival of these key players in the industry.

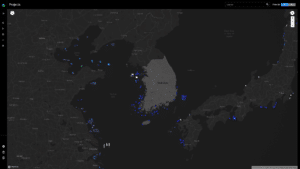

Image Source: Esgian Offshore Wind