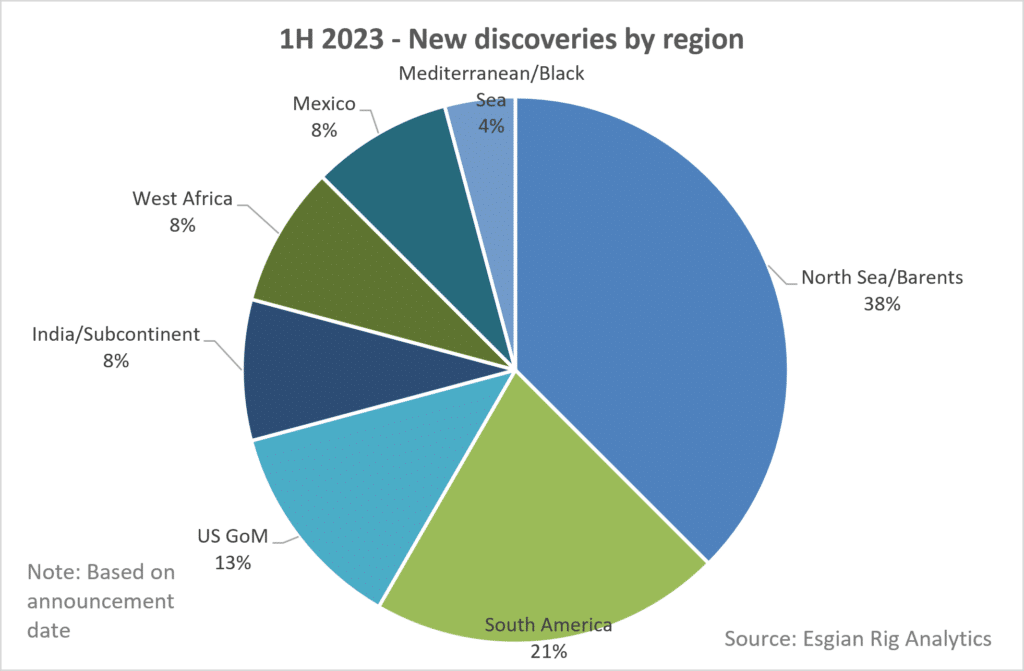

In the first half of 2023, 24 new discoveries were confirmed across 7 offshore regions. The North Sea/Barents proved to be the most successful region in the period, with the highest number of announced discoveries.

Despite the overall lack of enthusiasm related to the North Sea market due to soft demand and stagnating dayrates when compared to the rest of the world, save for the latest options for the Transocean Encourage in Norway, there were a total of nine announced discoveries in the region, of which eight were in Norway and one in the UK. This is according to Esgian’s Well Results dataset within the Rig Analytics product.

Considering that the largest number of confirmed discoveries in the first half of the year were made in Norway, the country where the semisub fleet is double the size of the jackup fleet, it is no surprise that more than half of the total global discoveries were made using semisubmersible rigs, while the remaining wells were drilled with drillships and jackups.

Norway dominates

The first discovery made on the Norwegian Continental Shelf (NCS) in 2023 was Equinor’s Obelix Upflank located in the Norwegian Sea. This gas discovery was made using Odfjell Drilling’s Deepsea Stavanger semisub, some 23 kilometres south of the Irpa gas discovery, which provides an option for a tie-back. The discovery is estimated at between 2 and 11 billion standard cubic metres of recoverable gas, or about 12.6-69.2 million barrels of oil equivalent.

Equinor has been concentrating its drilling efforts on areas close to existing infrastructure and this strategy has resulted in two new discoveries close to the producing Troll field in the North Sea, the Røver Sør and Heisenberg. These were the seventh and eighth discoveries, respectively, made in this area since the autumn of 2019. The previous discoveries were Echino Sør, made in 2019, Swisher in 2020, Røver Nord in 2021, Blasto in 2021, Toppand in 2022, and Kveikje in 2022.

Also in the North Sea, Austrian operator OMV earlier this year drilled the Eirik HPHT well, using the Odfjell Drilling-managed semisub Deepsea Yantai. The well resulted in an oil discovery with the preliminary estimate between 0.95 – 5.55 million standard cubic metres (Sm3) of recoverable oil equivalent. The discovery will be assessed alongside other prospects in production licence 817.

But this wasn’t the only HPHT well in the rig’s backlog for this year. The semisub started drilling the Carmen exploratory well for Wellesley Petroleum in early April and finished it in June. While the results announcement date for this well is beyond 1H 2023, it is important to mention that this gas and condensate discovery was described as the largest one on the NCS since 2013. The rig is also scheduled to drill the Norma HPHT prospect for DNO.

Other notable drilling efforts in the country that resulted in a discovery include Aker BP’s Øst Frigg Beta/Epsilon, which is said to be the longest exploration well ever drilled on the NCS after reaching its target depth of 8,168 metres. The well was drilled by Saipem’s Scarabeo 8 semisubmersible and finished in June with an updated estimate of 53-90 mmboe. The discovery contributes to increasing the resource base for the ongoing Yggdrasil project, which was recently approved for development, by approximately 10%.

These high levels of exploration activity are expected to continue in Norway through the autumn, with a total of just under 40 wildcat and appraisal wells expected to be drilled in the country this year. Equinor plans to drill between 20-30 exploration wells each year going forward.

UK lags far behind

When compared to Norway, the UK’s drilling efforts haven’t achieved a lot of success this year. One such example is bp’s Shetland well Ben Lawers, which was drilled with Diamond Offshore’s Ocean GreatWhite semisub and came back with disappointing results. The rig has since moved on to drill development wells for bp in the Schiehallion area.

TotalEnergies in early January 2023 encountered signs of hydrocarbons following appraisal drilling at the Isabella discovery located in the Central North Sea but the commerciality of the reservoir is yet to be established. The well was drilled to a total depth of 4,754 meters in water depths of 80 meters with the Shelf Drilling Fortress jackup, which has been idle since finishing.

The French operator in June drilled another well in the region, named Benriach. Located in the West Of Shetland area, the well was spud in March and finished in June using the Transocean Barents semisub. The well encountered gas-bearing sands in the target Royal Sovereign formation. However, the discovered resource is expected to be sub-commercial. TotalEnergies will carry out the analysis of the acquired data. The rig is now preparing to leave the North Sea for a contract in Lebanon, also with TotalEnergies.

While the UK hasn’t seen many new exploration wells drilled so far this year, there has been one significant discovery in the area. Oil major Shell has made a gas and oil discovery at its Pensacola well in the Southern North Sea with the Noble Resilient jackup. Estimated at approximately 300 Bcf, the discovery could represent one of the largest natural gas discoveries in the Southern North Sea in over a decade. The partnership is working on the forward appraisal and development plan.

Looking ahead, the 400-ft jackup Valaris Norway is expected to drill the Devil’s Hole Horst appraisal well in the UK Central North Sea this summer. A couple of other exploration wells, Shell’s Selene and Parkmead’s Skerryvore, are scheduled to be drilled in the second half of 2024.

South America comes in second

South America is the second region when looking at the number of announced discoveries, with three in Guyana and two in Brazil. Over in Guyana, two new discoveries were made by ExxonMobil in the prolific Stabroek Block, further contributing to the operator’s huge resource base in the region. Fangtooth SE, located about 8 miles southeast of the original Fangtooth-1 discovery well, was drilled with the Stena Carron drillship and encountered approximately 200 ft of oil-bearing sandstone reservoirs. ExxonMobil drilled two other wells in the block in Q1 2023, but only one, the Lancetfish, resulted in a discovery, while the other one, named Kokwari, did not encounter commercial quantities of hydrocarbons.

Meanwhile, in Guyana’s Corentyne Block, CGX Energy encountered hydrocarbon shows in the Wei-1 well drilled with the Noble Discoverer semisub. The well encountered an aggregate of approximately 77 ft of net oil pay in the secondary target reservoirs in the Maastrichtian and Campanian trends and 210 ft of hydrocarbon bearing sands in the Santonian horizon.

In the U.S. Gulf of Mexico, Talos Energy leads the way with two discoveries announced at Lime Rock and Venice, both of which were drilled with Seadrill semisub Sevan Louisiana. The wells encountered 78 ft and 72 ft, respectively, of net hydrocarbon pay in the primary targets. Both wells will be tied to the Talos-owned Ram Powell platform with completions expected in 2H 2023, followed by first production in Q1 2024. The rig also drilled the Rigolets prospect but encountered non-commercial hydrocarbons.

A couple of new discoveries were also reported in India by the state-owned operator ONGC. A detailed assessment of the Amrit and Moonga discoveries is in progress.

Namibia as exploration hotspot

Following its two previous discoveries in waters offshore Namibia, Shell made another oil discovery in PEL 0039 Exploration License located in the Orange Basin. The Jonker-1X well was drilled using semisub Deepsea Bollsta, which will continue working there through the first half of 2024 or until the end of 2024 if an existing option gets exercised. The acquired data is being evaluated while further appraisal is planned to determine the size and recoverable potential of the discovery.

Namibia is becoming an exploration hotspot with two semisubs and one drillship already operating in the country and plenty of activity ahead with Shell alone planning to drill up to 10 additional exploration and appraisal wells on licence PEL 0039. What’s more, the Odfjell Drilling-managed semisub Hercules is scheduled to arrive in the country in late 2023.

Elsewhere in Africa, TotalEnergies made an oil and gas discovery at OML 102 located offshore Nigeria. The Ntokon-1AX discovery was drilled using Shelf Drilling jackup Baltic and encountered 38 meters of net oil pay and 15 meters of net gas pay, while sidetrack Ntokon-1G1 encountered 73 meters of net oil pay.

Over in Mexican waters, two notable discoveries have been reported so far, Eni’s Yatzil and Wintershall Dea’s Kan. The Yatzil-1 EXP well was the eighth successful one drilled by Eni in the Sureste Basin. Drilled by semisub Valaris DPS-5, the new find may contain around 200 million barrels of oil in place, according to preliminary estimates. This could contribute to the potential synergic cluster development of several prospects located nearby. Drilled in the Cuenca Salina area of Mexico’s Sureste Basin with Borr Drilling 400-ft jackup Ran, the Kan discovery may contain 200 to 300 million boe in place. Wintershall Dea and its partners will evaluate the subsurface data collection in order to prepare the Kan discovery appraisal plan, which is expected to be submitted to Mexico’s Comisión Nacional de Hidrocarburos before the end of July 2023.

In the Mediterranean Sea offshore Egypt, Chevron made a new gas discovery at the Nargis-1 exploration well located in Nargis Offshore Area Concession. The well was drilled by drillship Stena Forth and encountered approximately 200 net feet (61 m) of Miocene and Oligocene gas-bearing sandstones. The discovery is considered for development leveraging the proximity to existing facilities.

When it comes to the second half of the year, TotalEnergies’ Nara-1 well off Namibia is one to keep an eye on as well as Eni’s Nabte off Mexico, North Sea Natural Resources’ Devil’s Hole Horst off the UK, and DNO’s Norma off Norway.

Image: SS Deepsea Stavanger; Credit: Odfjell Drilling