With the summer season approaching, the offshore drilling market is showing signs of slowing down, with no new contract awards being announced this week. Meanwhile, several drilling rigs changed their locations either to start a new contract or to visit a yard, and the UK decided to make changes to its Energy Profits Levy (EPL).

In case you missed it, you can access our previous Rig Market Roundup here.

Drilling Activity and Discoveries

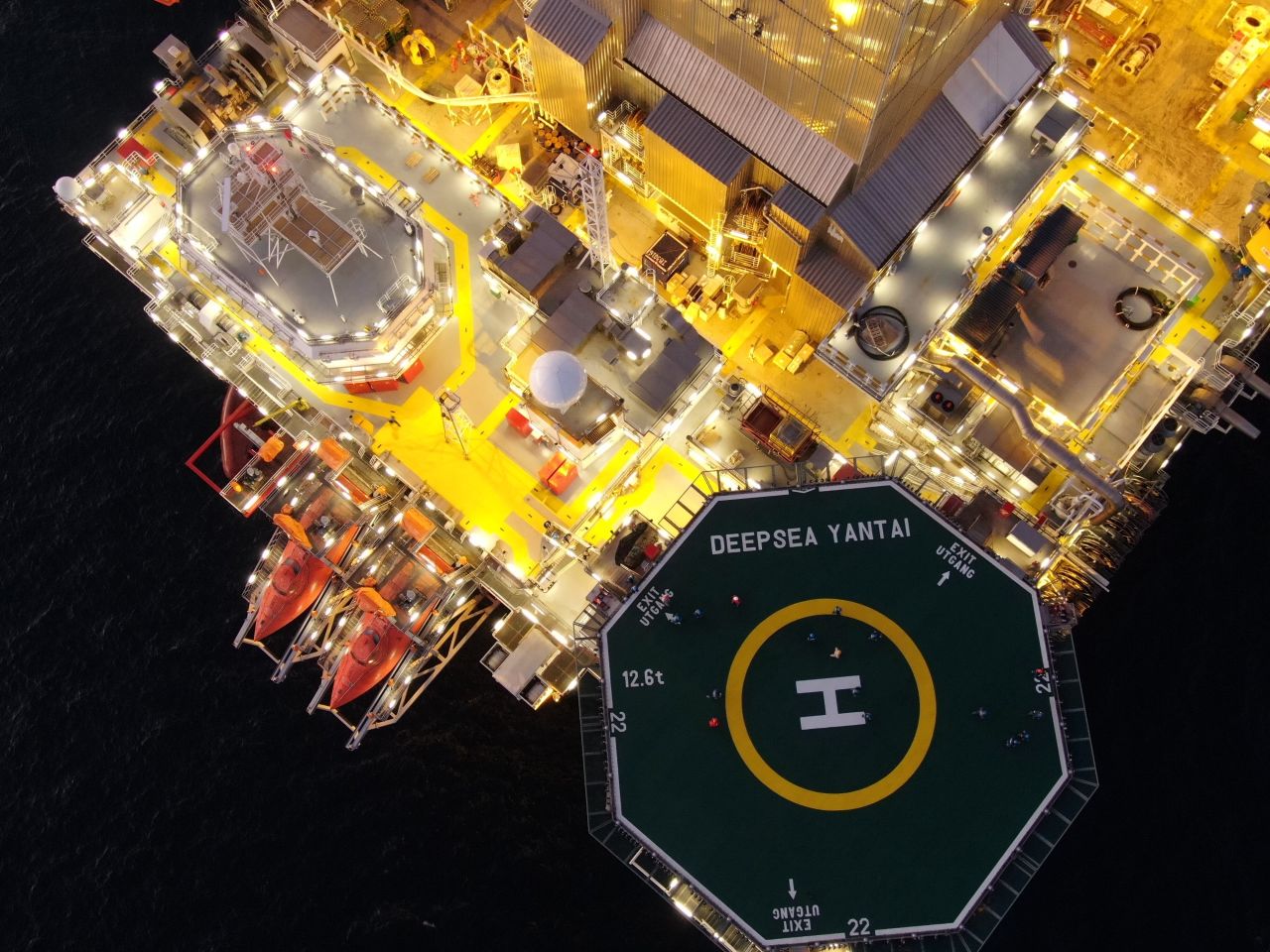

Norway’s Petroleum Safety Authority (PSA) has given Neptune Energy consent for exploration drilling in block 36/7 in the North Sea offshore Norway. The well 36/7-5 S, targeting the Cerisa prospect, is located in production licence 636. The licence is operated by Neptune Energy with INPEX Idemitsu Norge, PGNiG Upstream Norway, and Sval Energi participating as partners. The well is located in the North Sea, approx. 17 km northeast of Gjøa and approx. 30 km from land. The water depth at the site is 335 metres. The Cerisa well will be drilled using the 3,900-ft Deepsea Yantai semisub, which is expected to come on contract with Neptune later in the summer. The rig has also recently secured two new contracts with DNO and ConocoPhillips in Norway for operations in 2024.

Aker BP has completed the drilling of the Øst Frigg Beta/Epsilon exploration well in the Yggdrasil area in the North Sea, resulting in a significant oil discovery. When the wildcat well reached its target depth, the team had drilled 8,168 metres and Aker BP says this was the longest exploration well ever drilled on the Norwegian Continental Shelf. The discovery was first announced on 25 May 2023 with preliminary estimates indicating a gross recoverable volume of 40-90 million barrels of oil equivalent (mmboe). The discovery is located within production licences 873 and 442, both operated by Aker BP. The appraisal wells 25/2-24 S, 25/2-24 A, 25/2-24 B and 25/2-24 C are located in production licence 873. The water depth at the site is 110 metres. The wells are now permanently plugged and abandoned. The updated estimate of the discovery size is 53-90 mmboe, which is twice as large as the original pre-drill estimate and slightly larger than the preliminary estimates. The discovery contributes to increasing the resource base for the ongoing Yggdrasil development by approximately 10%. The Yggdrasil development was recently approved by the Norwegian Parliament and is planned to begin production in 2027. The wells were drilled by Saipem’s 10,000-ft Scarabeo 8 semisubmersible, which will now proceed to drill wildcat well 6405/7-2 S in production licence 1005, where Aker BP also is the operator.

Demand

Hokchi Energy has released a jackup tender for operations off Mexico in Area 31. The operator is planning to drill three exploration wells – two at the Woolis prospect and one at the Tojol prospect. The project scope also covers workover/intervention activities at two wells in the Hokchi field, with the possibility of a third well. Proposed rigs must be built post 2008. Newbuilds are also acceptable. If a cold-stacked rig is offered, it must not have been cold for more than 24 months by the operations start date. The max water depth is 27 m (89 ft).

Mexico’s National Hydrocarbons Commission (CNH) has approved some major components related to the development project for the Pemex-operated Zama field. The regulator approved the unification with the nearby Uchukil discovery, along with the initial work programme, and the first budget (2023-2024) for the project. The plan presented to the CNH outlines 46 wells to be drilled by 2045, plus the use of two platforms, dubbed Zama-A and Zama-B. Production is expected to begin in 2025. The operator anticipates an investment of $4.5 billion, plus operating expenses of another $4.5 billion through 2045. Pemex and its partners are expected to reach a final investment decision by the end of this year.

Eni has issued a market survey for two jackups to work offshore the Republic of Congo. According to market sources, responses to this survey are due in mid-May 2023. Eni issued a market survey for a jackup with a 400-ft capability to drill five wells over a 400-day period starting from June to December 2024, with a three well option. Additionally, the company is looking for a jackup with a 300-ft capability to drill 10 development wells over a 450-day period starting from August 2024 to January 2025, with a five-well option. Eni currently has two Borr Drilling jackups under contract offshore the Congo. The 400-ft Natt is currently with Eni into March 2024 with an option to extend that could keep it working into the third quarter of 2024. The 400-ft Prospector 5 is firm with Eni into February 2024, with options available for work into mid-2025. Eni is the operator of the Marine XII permit offshore the Congo. This permit contains the producing fields Nene and Litchendjili and the undeveloped Minsala and Nkala discoveries.

Baron Oil Plc subsidiary SundaGas Banda Unipessoal Lda has been granted a further six-month extension to Contract Year Two of the Chuditch production sharing contract (PSC) offshore Timor-Leste. Contract Year Two of the PSC will now expire on 18 December 2023, with a subsequent commitment, on entry into Contract Year Three, for the drilling of one well to appraise the Chuditch-1 discovery. The Chuditch-1 natural gas discovery was made by Shell in 1998. Baron Oil said that the extension was requested to allow additional time for preparations prior to entering the drilling phase of the PSC, including evaluating drilling locations and well trajectories for the final well design. Baron expects to make a decision on drilling the Chuditch appraisal well on or before 18 December 2023. Baron Oil is in ongoing discussions with third parties regarding a farmout and participation in the Chuditch appraisal and future activities.

Jersey Oil & Gas has reported that the UK’s North Sea Transition Authority (NSTA) has approved an extension to the Second Term of its P2498 “Buchan” Licence located in the UK Central North Sea. The company also reported that the NSTA has approved the company’s request to assign a 50% working interest in both licence P2498 and licence P2170 (Verbier) to NEO Energy, as part of the recently announced Greater Buchan Area farm-out transaction. The Second Term of licence P2498 has been extended by 18 months to 28 February 2025. The extension was requested in order to provide the licensees with the time required to prepare a Field Development Plan (FDP) for the redevelopment of the Buchan field, which is planned for submission to the NSTA during 2024. Following FDP approval, the licence moves into the Third Term, which covers the development and production phase of activities for the life of the field. Following these approvals, the company has now satisfied the conditions precedent associated with the farm-out of the 50% interest in licence P2498 to NEO. In terms of the P2170 licence assignment to NEO, the company is in the process of completing the final outstanding condition precedent and it is anticipated that completion of both licence assignments will occur in June 2023.

Suriname’s 2022-2023 Demerara Bid Round officially closed for bid submissions on 31 May. State oil company Staatsolie confirmed qualified bids were received for three of the six blocks offered and that the bids came from several companies and/or consortia. Bid evaluations will now take place, with winning bids expected to be announced before 30 June 2023. Company names will be revealed at the signing of the production sharing contracts. Six blocks were offered in the round, which ran from November 2022 to May 2023. The Demerara area is located in the northeast of Suriname.

Chevron subsidiary Cabinda Gulf Oil Company has issued a request for information (RFI) for a semisubmersible to work offshore Angola. According to market sources, the RFI is for a semisubmersible to carry out development drilling and P&A work offshore Angola over a two to three year period, beginning in the first quarter of 2025. The work is understood to be open to moored semisubmersibles. Cabinda Gulf has recently carried out drilling offshore Angola with Shelf Drilling 375-ft jackup Shelf Drilling Tenacious and Valaris 12,000-ft drillship Valaris DS-12.

Market sources indicate Lukoil has pushed the start date for its next Mexico campaign to early 2024 as it continues to work towards securing a rig for the programme. The scope covers two wells over about 150 days. It is understood the operator is seeking a conventionally moored semisub. Lukoil Mexico’s last operated rig programme used the 8,500-ft semisub Valaris DPS-5 from August-October 2021. Valaris DPS-5 is currently working with Eni off Mexico until July. It is understood the rig is close to finalising its next assignment, which should see it return to the US Gulf.

Mobilisation/Rig Moves

The jackup drilling rig ArabDrill 150, which is in Singapore undergoing preparations for its maiden charter, is preparing to leave the shipyard. The PPL Pacific Class 400 unit will be mobilised to Saudi Arabia, where it has a multi-year charter with Saudi Aramco that is expected to begin in Q3 2023. Arabian Drilling purchased the jackup from Borr Drilling in late 2022.

Seadrill semisub Sevan Louisiana has mobilised to Talos Energy’s Sunspear prospect in Green Canyon Block 78. Water depth at the well site is 2,211 ft. Talos took over the prospect when it acquired EnVen earlier this year. If successful, Sunspear is expected to be tied back to the Prince TLP. Sevan Louisiana is committed to Talos until the end of this year.

Island Drilling’s only rig, the semisubmersible Island Innovator, has started its journey from a yard in Norway to the UK North Sea to work for Dana Petroleum. The 4,000-ft Island Innovator has been in Semco Maritime’s Hanøytangen yard since April 2023 after arriving from Mauritania where it had been working during the first quarter of the year, conducting plugging and abandonment work at Tullow Oil’s Banda and Tiof fields. The rig has a four-well work programme with Dana Petroleum lined up, expected to run for around 110 days. It is expected to reach the Guillemot field location on 8 June 2023. After this contract, it will move to Africa again later this year to work for Trident Energy in Equatorial Guinea. Island Drilling has recently upgraded the rig with two SpaceX’s Starlink systems, bringing real-time data relay between offshore and onshore teams for faster decision-making and high-speed internet for data-heavy tasks and software updates.

Ocyan’s 10,000-ft drillship ODN I is now at Rio Grande Shipyard, where it will undergo about 60 days of scheduled maintenance. ODN I is committed to Petrobras into January 2026 with an option that could keep it working into 2029. The rig was delivered in 2012 and completed its most recent five-year SPS in April 2022.

Noble’s ultra-harsh environment CJ70 jackup Noble Interceptor has arrived in Norway following the completion of operations for TotalEnergies in the Danish sector of the North Sea. The 492-ft jackup had been working for TotalEnergies under an accommodation services contract, which started in March 2022 and ended in May 2023. According to the latest AIS data, the rig arrived in Ågotnes, Norway on 6 June 2023 and it is available for new work. Noble previously shared its view that late 2024 was going to bring back the demand for its CJ70 fleet. The rig owner has several other units of the same type in the Scandinavian country, all of which are currently working.

Other News

Energean has been granted official recognition of a natural gas discovery by the Israeli government’s Ministry of Energy and Infrastructure for its finds in the Olympus Area in Block 12. This official recognition permits Energean to submit an application for a deed of possession; submit a development plan, and with Israeli Government approval, begin development as a producing gas field. In connection with this recognition, Energean has renamed the Olympus area to Katlan, the Hebrew word for Orca. Energean states that Katlan has around 68 BCM of natural gas. Energean plans to develop the area as a tieback to its Energean Power FPSO, with a final investment decision to be made before the end of the year.

Uruguay’s National Administration of Fuels, Alcohol and Portland, or ANCAP, has advised the market that it received an offer under the Open Uruguay Round process on 31 May from Challenger Energy Group. The offer is for Area OFF-3. The work programme in Challenger’s offer consists of geological modelling, along with licensing and reprocessing existing 2D seismic data. There is no obligation to acquire new seismic or drill a well in the first four-well exploratory period. ANCAP confirmed that with this new offer, there are no more areas available under the Open Uruguay Round. Challenger stated that it expects the licence will be formally awarded within the next 3-4 weeks. Water depth in OFF-3 range from 20-1,000 m (66-3,281 ft). Challenger indicated that mapped prospects of interest are in water depths of about 250 m (820 ft). The block was previously held by bp, which acquired seismic data in 2012 ahead of relinquishing the block in 2016. No wells have been drilled on the block to date. Two “material-sized prospects” were previously identified – Amalia and Morpheus. Amalia straddles the boundary with OFF-2, which is currently held by Shell. The Morpheus prospect is located entirely within OFF-3. Meanwhile, Challenger already has a signed production contract for Area OFF-1 that was signed in May 2022. ANCAP notes the operator is satisfactorily fulfilling its exploratory work commitment for OFF-1.

Daewoo Shipbuilding and Marine Engineering (DSME) has changed its name to Hanwha Ocean following the 23 May completion of the acquisition of DSME by Hanwha Group. Hanwha Ocean is now an affiliate of Hanwha Group. Four drillships remain under construction at Hanwha Ocean – Deepwater Aquila, Valaris DS-13, Valaris DS-14, and West Libra. The rig known as West Libra is also owned by Hanwha.

The Norwegian Parliament (Storting) has approved Aker BP’s plans for the further development of Valhall and the development and operation of the Fenris project located offshore Norway. The Valhall PWP-Fenris project is ready to begin construction as planned before summer. The Valhall PWP-Fenris is one of the projects for which Aker BP submitted the plans to the authorities in December 2022. The final approval is on the Norwegian Ministry of Petroleum and Energy. Aker BP plans to deploy four rigs from its alliances with Noble and Odfjell Drilling on the upcoming development projects. The fields are located 50 kilometres apart and are operated by Aker BP. Pandion is a partner in Valhall and PGNiG Upstream Norway is a partner in Fenris. The joint development comprises a new centrally located production and wellhead platform (PWP) bridge linked to the Valhall central complex and an unmanned installation (UI) on Fenris that will be a subsea tie-back to the PWP. New reserves resulting from the joint development project are estimated at 230 million barrels of oil equivalents. The project also ensures a lifetime extension for Valhall beyond 2028 and continued production from the existing Valhall reserves, estimated at 137 million barrels.

ADNOC Drilling has acquired two Gusto MSC CJ46 jackups. The rigs will be delivered into Abu Dhabi waters and become operational in Q4 2023 with meaningful revenue contribution starting 2024. The total cost of the acquisition is $220 million. The company has acquired 14 jackups and almost doubled its fleet since early 2021. The acquisition is part of the company’s fleet expansion and growth strategy, which is a key enabler of ADNOC’s accelerated production capacity growth to meet rising global energy demand. When delivered, the jackups are expected to work for ADNOC Offshore with drilling and completion services.

The Norwegian Ministry of Petroleum and Energy has approved Aker BP’s plan for development and operation (PDO) for the Tyrving project (previously Trell & Trine), located in the Alvheim area in the North Sea off Noway. The operator Aker BP and licence partners Petoro and PGNiG Ustream Norway submitted the PDO to the Ministry in August last year. The Tyrving development will utilise the planned extended lifetime for the Alvheim field, increase production and reduce both unit costs and CO2 per barrel. Total investments are estimated to be approximately NOK 6 billion (about $700 million). Production is scheduled to start in the first quarter of 2025. Recoverable resources in Tyrving are estimated to be approximately 25 million barrels of oil equivalent.

Midstream and downstream energy group Prax has completed its acquisition of the UK-listed oil and gas operator Hurricane Energy following a court sanction of the scheme of arrangement. Hurricane and Prax announced that the recommended acquisition by Prax of the entire issued, and to be issued, share capital of Hurricane, which was announced by Hurricane and Prax on 16 March 2023, has been sanctioned by the Court. The acquisition of Hurricane provides the opportunity to Prax to integrate Hurricane’s expertise and infrastructure into the company’s footprint, to enable the continued exploration of new business opportunities as part of a long-term growth strategy. Hurricane’s assets are focussed on the Rona Ridge, in the West of Shetland region of the UK Continental Shelf. The company has a 100% operated interest in the Lancaster field. Production of 2P Reserves is projected to continue until August 2025 at an assumed $80/bbl oil price, at which point the Lancaster field will be abandoned.

Vår Energi and Halliburton have entered into a strategic partnership for drilling services on the Norwegian Continental Shelf. The agreement covers drilling services related to exploration and production drilling and has a duration of five years with options that could add up to four more years. Vår’s portfolio covers 158 licences and 39 producing fields. The company’s drilling activities are focused around four strategic hubs – the Balder/Grane area, the North Sea, the Norwegian Sea, and the Barents Sea. Vår has Seadrill’s 7,874-ft semisub West Phoenix under contract until August 2024 and recently issued requests for information for two rigs to work off Norway.

Petrobras has now closed the sale of the Potiguar Cluster to 3R Potiguar, which is controlled by 3R Petroleum. The sale of the Potiguar Cluster was originally announced in January 2022. In May 2023, Petrobras received the operational licence from regular IBAMA in favour of 3R Potiguar. The transaction covers 100% interest in 20 concessions (onshore and shallow water fields) with integrated facilities. An upfront payment of $1.1 billion was made to Petrobras, with the adjustments foreseen in the contract. When the contract was signed in January 2022, $110.0 million was paid to Petrobras. Furthermore, Petrobras expects to receive another $235.0 million, to be paid in four annual instalments of $58.75 million, beginning in March 2024. 3R is now the operator of the Potiguar Cluster and related infrastructure.

Italian contractor Saipem has added the 400-ft jackup Perro Negro 13 to its fleet ahead of its long-term contract in the Middle East. This chartered jackup has now officially become part of the Saipem offshore drilling fleet. The rig is committed to a three-year firm contract with Saudi Aramco, with an option for one additional year. This could keep the rig busy into late 2026 or late 2027 if the option is exercised.

The UK government has decided to make changes to its Energy Profits Levy (EPL), also known as the windfall tax, that will see the current total 75% tax rate removed if oil and gas prices fall to certain levels for two consecutive quarters and returned to 40%. Introduced in May 2022 at 25% and raised to 35% in November 2022, the EPL puts a marginal tax rate of 75% on North Sea oil and gas production. It will remain in place until March 2028 while oil and gas prices remain higher than historic norms – but this will fall back to 40% when prices consistently return to normal levels for a sustained period. The EPL has raised around £2.8 billion to date and is expected to raise almost £26 billion by March 2028. While the levy included an investment allowance to encourage firms to continue to invest in oil and gas extraction in the UK, the industry has warned that companies are cutting back on investment. According to the government, this puts the long-term future of the UK’s domestic supply at risk, meaning it would be forced to import more from abroad at a time when the security of energy supply is a major concern. In response to this, the government has today announced an Energy Security Investment Mechanism to give the oil and gas sector certainty to raise capital and invest in new and existing projects. This will mean that, if prices fall to historically normal levels for a sustained period, the tax rate for oil and gas companies will return to 40%, the rate before the EPL was introduced. The tax rate will only return to 40% if both average oil and gas prices fall to, or below, $71.40 per barrel for oil and £0.54 per therm for gas, for two consecutive quarters. This level is based on 20-year historical averages. However, based on the independent Office for Budget Responsibility’s forecast, the Energy Security Investment Mechanism won’t be triggered before the tax’s planned end date in March 2028. Based on current market forecasts, the Energy Security Investment Mechanism is not expected to impact receipts from the EPL.

Image credit: Odfjell Drilling