As a result of the ambitious climate targets of the countries surrounding the North Sea, decarbonization of the oil and gas industry sits high on the agenda. One of the key methods used for decarbonization is the electrification of oil and gas fields.

As a result of the ambitious climate targets of the countries surrounding the North Sea, decarbonization of the oil and gas industry sits high on the agenda. One of the key methods used for decarbonization is the electrification of oil and gas fields. This way, power needs for offshore operations can be covered by renewable energy instead of fossil fuels from gas turbines. Norway already has experience from electrification of their oil and gas fields through land-based power, which has been feasible because of the periodic abundance of hydropower in its electricity mix. However, going forward both Norway and the UK is betting heavy on floating wind for decarbonization. Since floating wind can be installed in deeper waters, it is a good solution for providing renewable energy to oil and gas installations. Floating wind is currently at a total installed capacity of about 200 MW globally and is expected to see major growth towards 2030, and the first capacity of scale might emerge from oil and gas field connected projects.

Hywind Tampen

Equinor’s Hywind Tampen project is currently the world’s largest floating wind farm, even with only seven of the total eleven turbines having been installed. The wind farm is located offshore Norway and being built for the electrification of the Snorre and Gullfaks fields. The wind farm will have a capacity of 94.6 MW when fully installed and is estimated to on average meet about 35% of the annual electricity power demand of the five Snorre A and B, and Gullfaks A, B and C platforms. In periods of higher wind speed, this percentage will be significantly higher.

The project was the third floating project using the Hywind spar technology. However, this time it introduced a concrete foundation and shared concrete anchors solution, bringing the number of anchors down to 19 for 33 mooring lines. Set out to innovate floating offshore wind while also decarbonizing oil and gas production, the project received $230 million in support from the Norwegian government, covering almost half of the total $500 million projected cost.

Trollvind

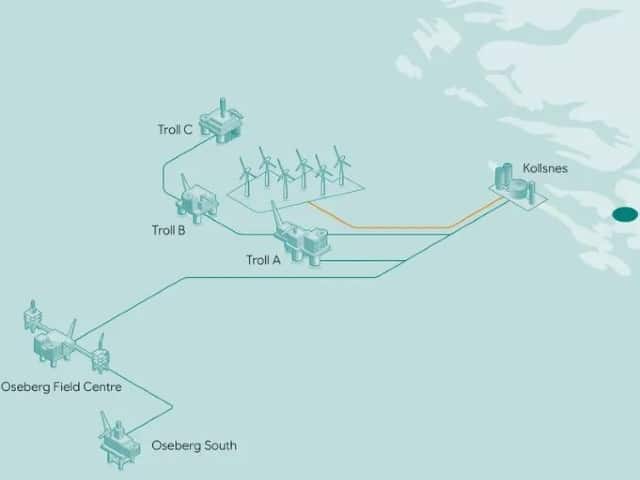

Trollvind is another Equinor-led decarbonization project in Norway, which intends to supply power to the Troll and Oseberg oil and gas fields. The project is still in an early state, but a study has been initiated and the project partners Equinor, Petoro, TotalEnergies, Shell and ConocoPhillips are looking at the possibility of a floating offshore wind farm about 65 kilometres west of Kollsnes in Vestland. The planned capacity for the project is 1.0 GW with an estimated yearly power production of 4.3 TWh. The project partners are planning to develop the project without government support, as the partnership highlights that they might buy the produced power at a price that makes the development feasible.

With an optimistic timeline of Commercial Operational Date (COD) within 2027, the open-door alike Trollvind project might come live two years before floating projects emerge from the Utsira Nord auction in Norway held this year. This auction will bring a total of 1.5 GW divided into three blocks of 500 MW. Furthermore, the Sørlige Nordsjø II auction, which will be launched by March this year, is aiming at 3.0 GW divided into two 1.5 GW phases that are to come online before 2030. As the water depths range between 50-70 m, some developers have hinted that they might want to deploy floating wind instead of bottom-fixed. If Trollvind gets the green light from the Norwegian government, it will play an important role in building floating wind projects of scale and kick off the floating wind supply chain in the country, paving the way for scalability towards the end of the decade. However, some uncertainty has arisen following Denmark’s backlash from the EU towards their open-door policy that has put their projects on hold. If Trollvind will be in the same category is yet to be determined.

INTOG

In the UK, bids for the INTOG auction have been submitted and the results are expected to be published during the second quarter of this year. INTOG is an offshore wind leasing round designated for reducing emissions from oil and gas production and boosting innovation for offshore wind. The leasing round can be separated into two categories: IN will bring small-scale innovative projects of less than 100 MW, and TOG is targeting projects directly connected to oil and gas infrastructure to reduce carbon emissions associated with production. The INTOG leasing target is set at 4.5 GW of floating wind, with 4.0 GW aimed at decarbonization and 500 MW for innovation.

Although INTOG is far smaller than the 15.0 GW floating wind capacities coming from Scotwind, the fast deployment of the INTOG projects makes the lease round an important enabler of the floating supply chain in the UK. Bidders for decarbonization projects in the INTOG leasing round are Cerulean Winds, Flotation Energy and CNOOC.

The majority of floating projects originating from Scotwind and the Norwegian auctions will have an expected COD towards the very end of this decade, which increases the risk for projects being pushed beyond 2030 making the emission reduction and renewable energy targets more uncertain to achieve. In that sense, decarbonization of oil and gas projects might lead the way for floating wind and accelerate the floating wind pipeline. Hywind Tampen has already emerged for this purpose, and Trollvind and INTOG seem likely to continue pushing floating wind towards large-scale commercialization.