Germany is preparing to issue in an new era for offshore wind in the country, as they open a 7.0 GW auction round for bids

As a first-mover Germany now has the second largest offshore wind capacity in Europe, having started back in the 2000s with the construction of several commercial scale projects in the North Sea and the Baltic Sea. Germany saw a steady stream of projects up until 2010, after which time, there was more-or-less a full stop. Not until the launch of auction rounds beginning in 2016 was there a considerable number of new projects awarded. However, this trend also slumped after 2018, only awarding five areas since. The result of the lack of new projects can be felt today. Between 2020 and 2024, only 1338 MW will be connected to the national grid, bringing the offshore wind capacity of the country up to 9.6 GW in total, and far behind its previous 2030 goal of 20 GW.

However, the slow growth trend is about to change. Germany is now preparing to issue inn a new era for offshore wind, setting out to allocate and develop massive projects at an almost breakneck speed.

WindSeeG + FEP

To kickstart the growth of offshore wind, as of January the German government has an updated version of the WindSeeG Act from 2017 and introduced a new Area Development Plan (FEP). Through the updated WindSeeG, Germany has set new ambitious offshore wind targets:

2030: Up from 20 GW to 30 GW

2035: At least 40 GW

2040: Up from 40 GW to 70 GW

In addition, the new FEP details the timeline for allocation rounds and capacities, presenting a long-term roadmap for the WindSeeG targets. The largest allocation rounds are scheduled for 2023 and 2024, with Commercial Operation Date (COD) set mostly at 2030 or before. 8.8 GW will be awarded in 2023, 8 GW in 2024, and an average of 4 GW in the following years. The upcoming allocation rounds signal a drastic uptick in the pace of allocation, with the 2023 round alone awarding more capacity than what Germany has connected as of today.

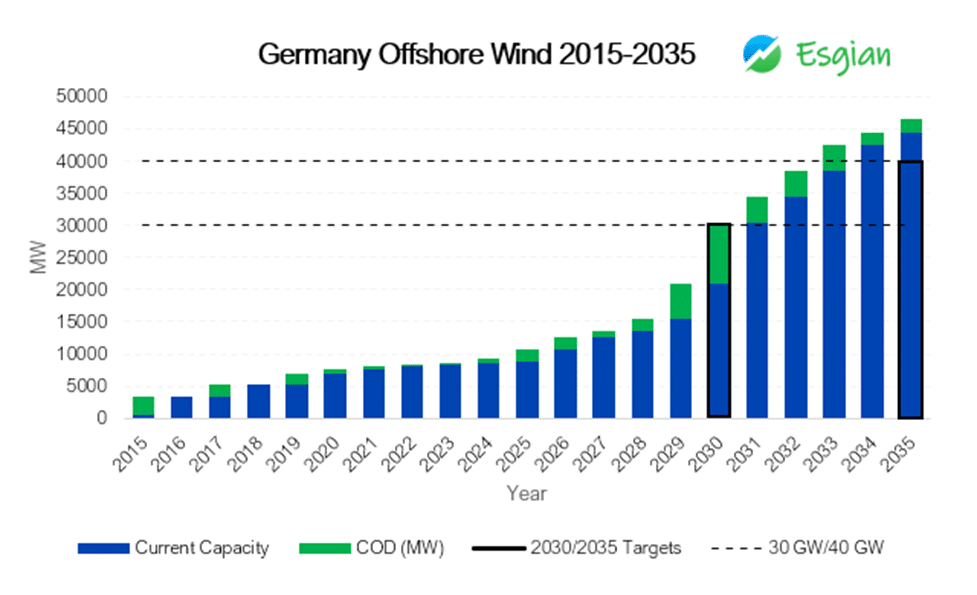

At present, Germany expects to have 10.8 GW of offshore wind capacity online by 2025 (as in the graph below), with connected capacity scheduled to reach 30.4 GW in 2030 and 46.4 GW within 2035. The FEP has also given us a glimpse of future projects and draws the outlines of the roadmap towards 70 GW by 2050 target. As the Germany Exclusive Economic Zone (EEZ) is limited in the Baltic Sea, future sites will mostly be in the North Sea, more precisely near the old shipping route SN10. Although located far from the German coast, these projects may, at a future point, be connected to the Danish North Sea Energy Island, set to be complete in 2030.

The winning bids

The updated WindSeeG also introduces a more dynamic way of selecting winners in bid rounds. There will be two types of lease areas up for auction: centrally pre-examined and non-pre examined sites. The central sites are surveyed by the German authorities and bidding developers will have access to all lease area data. Non- examined sites have not been surveyed by the authorities, and the winner of the bid round is responsible for conducting necessary investigative activity.

Winners of central sites will be selected based on a scoring system, with a weighting of 60/100 points on bid value amount and 40/100 points based on other criteria, including sustainability, potential capacity, and workforce development.

The non-examined sites will be awarded based solely on monetary bids in a descending auction wherein the proposal seeking the lowest amount of subsidy is the winner. If multiple bidders submit a bid value equal to 0 cents per kilowatt hour for a site, the authorities will carry out a secondary dynamic bidding round, which will be an ascending auction wherein the proposal offering the highest payment to the government is the winner. The second round will consist of several stages with increased bidding level, where developers bid with their willingness to pay for the area, referred to as negative bidding.

The updated rules for selecting winning bids set Germany more in line with the auction rounds in the Netherlands, Norway, and Japan, where a scoring system is used. It is seen as a necessary step to differentiate bids, as bidding rounds in attractive markets have become more competitive and bids close to 0 are becoming normal.

Using negative bidding in the lease rounds has, however, drawn criticism from developers eager to take part in the bid processes. The main arguments cite the lack of limit on the negative bids, reduced profitability and increased costs for both suppliers and consumers. Amongst other, leading turbine manufacturers have warned that and overly focus on price is a major concern that can jeopardize the future of the offshore wind supply chains.

Supply chain squeeze

A long-term plan committing to development of offshore wind projects has been long sought after by companies wanting to invest in new capacities. Despite the new plans presented by the German authorities, there are some supply chain bottlenecks on the horizon.

With the aim to award a total of 16.8 GW of new offshore wind capacity within the next two years, and most of the capacity scheduled to be connected before or in 2030, the volumes could easily put the supply chain under considerable pressure. The current lead time on substations is 5 years, with turbines, foundations, and cables close to 4 years.

When accounting for factors such as the current lead times for key components, permitting times, vessel availability and the lack of skilled works, CODs before 2030 might prove overly ambitious for many of the projects materializing from the revamped German volumes. The FEP trajectory of 30,5 GW within 2030 is in closely aligned with the German offshore wind target of 30 GW by 2030, but it leaves practically no room for delays or postponements.

The release of a long-term roadmap and updating the criteria to award lease areas will greatly contribute to strengthening the growth of offshore wind in Germany. New ambitious targets and clear allocation plans will help reassure investors and spur further development in ports, factories, and vessel capabilities. There are however some challenges ahead for the supply chain to reach the goals. But, no matter potential challenges, it is hard to deny that Germany is going all in on offshore wind.