The UK government has recently made a step forward with its 33rd licensing round process, which is meant to drive its efforts to increase domestic production at a time when the security of supply is at the top of every government’s agenda. However, with the current political environment in the UK eroding investor confidence, the increased burden of the windfall tax, and the limited availability of rigs for near-term programmes, it remains to be seen how all this will play out over the next couple of years and whether the current government’s plans will be thwarted.

About a year before this latest licensing round was launched, the UK hosted the COP26 climate conference but decided not to join an alliance of countries committed to ending future oil and gas production.

Following the beginning of the Russia-Ukraine war in early 2022, energy security became a major concern, especially in countries heavily reliant on the Russian supply. Amid growing geopolitical tensions, the mood shifted towards ensuring the security of supply.

After a two-year pause in licensing, the UK completed its review into the regime and concluded that its continued licensing for oil and gas is not inherently incompatible with its climate objectives. The resulting climate compatibility checkpoint was then published and the UK’s first round since 2019 was launched in October 2022 and closed on 12 January 2023. The North Sea Transition Authority (NSTA) on 17 January revealed that the round had attracted a total of 115 bids across 258 blocks and part-blocks, from a total of 76 companies, similar to the 2019 round.

Now, the new blocks haven’t been awarded yet but those in the four priority clusters in the Southern North Sea, which have the potential to produce quickly, could be awarded during spring. These four clusters – the Greater Pegasus Area, Greater West Sole Area, Greater Cygnus Area, and Cotton Area – all have existing processing and export infrastructure within a 25-50km radius with the first three areas focused on discovered volumes and exploration opportunities and the last one only on discovered volumes.

In addition, Scotland has just recently published its draft energy strategy and transition plan, setting out final policy positions on fossil fuel energy, including consulting on a presumption against new exploration for North Sea oil and gas.

But the key element of the NSTA’s strategy to strengthen the UK’s energy security by producing more of its own oil and gas as Europe is working to wean itself off Russian supply is facing a hurdle as environmental groups have strongly objected these plans. They are planning to take the UK government to court due to the belief that the new licensing plan is unlawful and that the new licenses would fuel the climate crisis further.

Against this backdrop of geopolitical tensions, the instability of the UK’s fiscal regime, and the opposition towards new oil and gas projects, the availability of rigs in the North Sea to cover the future demand is also being brought into question.

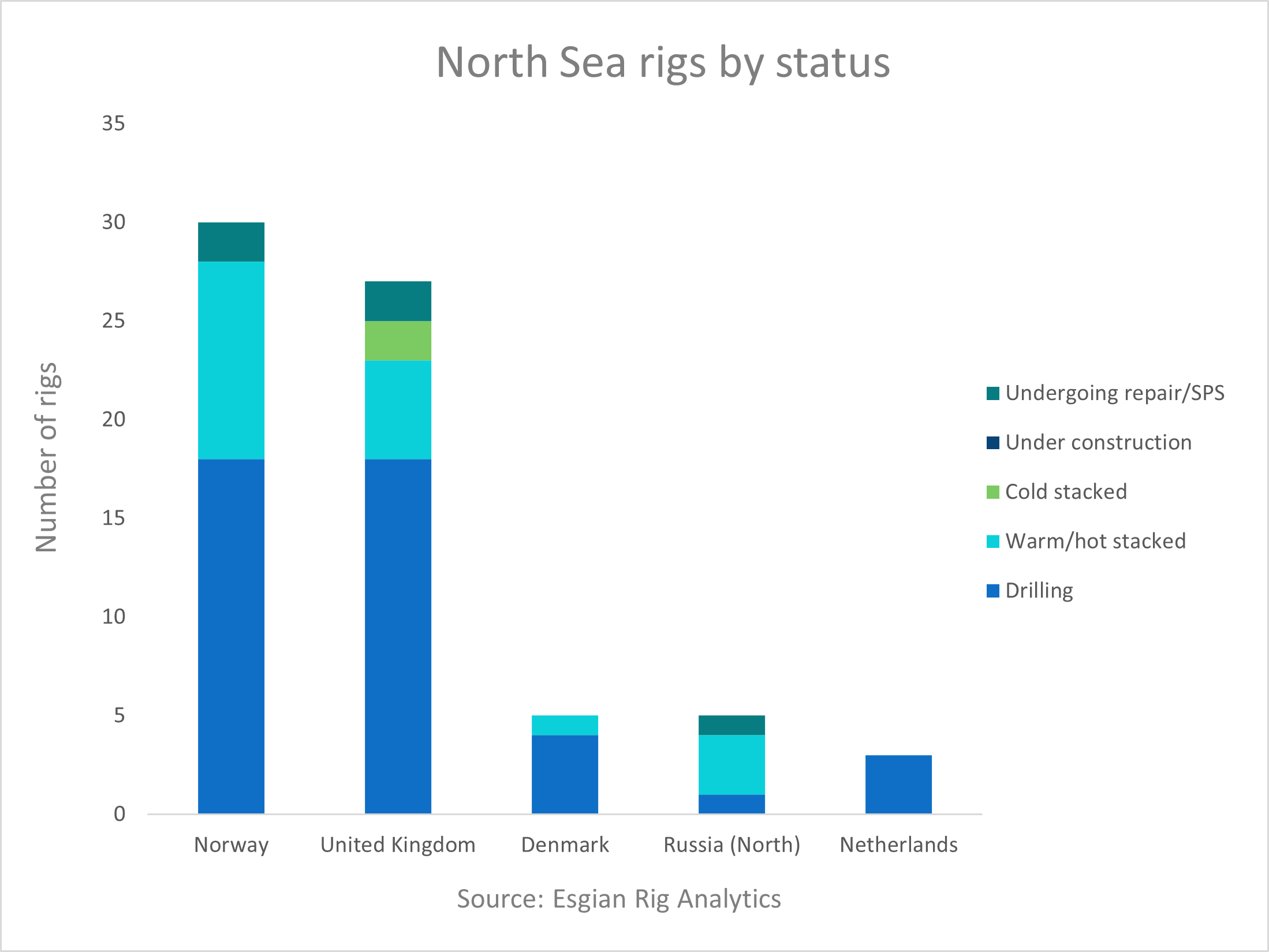

Currently, there are 44 rigs drilling in the North Sea region – 18 of those are off the UK – while 26 are either warm or cold stacked or undergoing repair/SPS.

Jackup situation

The new UK blocks will be awarded in tranches and more details about the round will become clear following the first awards for the priority areas in the Southern North Sea, which are expected in April. This is a shallow water area suitable for jackup rigs.

Global offshore drilling market is currently believed to be at the beginning of a multi-year super-cycle. Last year’s pick-up in demand in the jackup market was predominantly driven by the Middle East and this is expected to continue in 2023. As a result, some cold stacked units were reactivated and previously stranded newbuilds bought and committed to long term contracts, some of them leaving their previous operating regions, including the North Sea. Should the North Sea demand pick up over the next couple of years, those that remain stacked are potential candidates for reactivation.

Valaris has the largest number of these with three jackups cold stacked in the U.S., one in Namibia, and another one in Croatia. One of these units, which has been cold stacked since late 2021, is suitable for UK work. Valaris also has three other jackups, which could be available for work from late 2023. One of these is Valaris 249, which is rolling off its contract in New Zealand in April.

In Noble’s fleet, the Noble Highlander has been warm stacked in Denmark since late 2021 and Noble Tom Prosser has been available from late 2022 after completing its contract with Santos in Australia. Aside from the Noble Regina Allen – currently undergoing repair after experiencing mechanical failure in Trinidad and Tobago with plans for potential redeployment in 2H 2023 – Noble only has one other unit that could be available for work from mid-2023.

Shelf Drilling entered the North Sea market after buying five jackups from Noble in late 2022. Four of these are currently based in the North Sea. Noble Sam Turner (to be renamed Shelf Drilling Winner) and Noble Houston Colbert (Shelf Drilling Odyssey) only become available from March 2025 and 2026, respectively.

Noble Sam Hartley (Shelf Drilling Fortress) has recently completed its contract with TotalEnergies and Noble Hans Deul (Shelf Drilling Perseverance) could be available for work by Q3 2023 depending on an option exercised. Meanwhile, Equinor has Noble Lloyd Noble aka Shelf Drilling Barsk under contract offshore Norway into mid-2023 with options that could keep the rig working into 2024.

Esgian Rig Analytics shows that Borr Drilling only has one warm stacked jackup, which is currently in Singapore. Its Prospector 1 is booked with Neptune in the UK and the Netherlands until August 2023 and the other unit of the same design, Prospector 5, is firm until February 2024 in Congo but with options to extend well into 2025. Borr’s Ran, which previously worked in the North Sea and left in late 2022 for a job with Wintershall Dea in Mexico, recently secured new work in Latin America. Depending on whether the well it drills is a dry hole or a success case, it could be booked there until April 2024 or January 2025, respectively.

Semisubs in the mix

The harsher areas of the North Sea are suitable for semisubmersible rigs and, as it stands now, the UK already has limited availability for these units in 2023 and 2024.

Two semisubs from Dolphin Drilling, Bideford Dolphin and Borgland Dolphin, have been warm stacked in Norway since 2018 and early 2022, respectively. The two rigs are actively marketed to Norwegian as well as international operators.

After a prolonged period of unemployment in the North Sea, Dolphin’s third rig, Blackford Dolphin, left the region in late 2020 for a job with Mexico’s national player Pemex. A couple of years later and the rig is now gearing up for a dayrate of $230,000 in Nigeria, which will be followed by another campaign in the country with a noticeably higher dayrate.

Two well-publicised deals for Northern Ocean’s semisubs which previously operated in Norway mean that these units will be employed in Namibia for a while. Deepsea Bollsta has already started the contract with Shell and should continue at least until the end of this year, or throughout the first half of 2024 if Shell decides to use its available option. Deepsea Mira is now preparing for its contract with TotalEnergies and is expected to mobilise by late February at the latest. The firm part keeps it there until 2Q 2024 and options could keep it working until almost the end of the year.

Island Drilling’s 4,000-ft semisub Island Innovator is currently carrying out P&A work offshore Mauritania but is scheduled to return to UK waters for a contract with Dana Petroleum around the second quarter of 2023. By the end of the year, Island Innovator will move to Africa for a two-well term with Trident Energy offshore Equatorial Guinea.

Stena Drilling’s 5,000-ft Stena Spey is currently warm stacked in the UK and available for new work. The rig has been primarily used for P&A jobs in recent years, an important market segment in the mature fields of the North Sea.

Meanwhile two other semis, Transocean Leader and Diamond Offshore’s Ocean Valiant, have been cold stacked since late 2020 and from about mid-2020, respectively. In addition to the long duration of the process, reactivation of these two cold units amid current supply chain challenges and rising costs would require a significant investment by owners, which could only be justified by a long term commitment. Therefore, these two units are not being actively marketed.

Transocean’s 10,000-ft semisub Transocean Barents is currently preparing for a one-well job for TotalEnergies in the UK. The rig may move to another region should other opportunities arise following the conclusion of this well in mid-2023.

Market rumours indicate that another semisub may be heading out of the North Sea and the prevailing mood is that should there be no increase in demand anytime soon, more of these departures could follow. However, one semisub which is currently in the Far East may move to Norway for the right contract.

Window of opportunity closing

While the UK government is pushing forward with the licensing round, hoping to boost domestic production, some major operators have indicated that they are stepping back from the North Sea due to the windfall tax on profits made from extracting oil and gas. This tax was recently extended until March 2028.

Harbour Energy has emphasized that the tax has made investment in the country less competitive. As a result, Harbour is reducing its North Sea spending plans and will be looking to diversify internationally. Furthermore, both TotalEnergies and Shell are evaluating the impact of the windfall tax and reassessing their investment plans and EnQuest now sees Asia as its biggest growth area as opposed to the North Sea and Europe.

With the situation as it stands currently, the market sentiment for the North Sea and additional drilling activities in 2023 is not very optimistic and, with rigs moving to other regions for longer commitments and increasing dayrates, the North Sea operators may miss out on that small window of opportunity to secure rigs for any near term programmes.

Image credit: Dolphin Drilling