After a period of slow contracting activity, a couple of new floater awards have emerged this week. Meanwhile, offshore drilling activity has remained high, with Vår Energi and Aker BP making new discoveries in Norway, but Equinor has had no such luck in Argentina.

In case you missed it, you can access our previous Rig Market Roundup here.

Contracts

Ventura Offshore has been granted exclusive marketing rights from Hanwha Drilling LLC for the newbuild 12,000-ft 7th generation drillship, Tidal Action, for an ongoing tender process in Brazil. Ventura Offshore stated that, subject to a successful tender and contract award, it is the parties’ intention that Ventura will operate the rig on behalf of Hanwha Drilling LLC pursuant to a charter or operating agreement. Ventura Offshore became a listed company in early June 2024, following its May 2024 acquisition of the assets of Brazilian drilling contractor Petroserv Marine Inc. Ventura stated that “potential further expansion of the Ventura platform through marketing agreements is aligned with the company’s strategy of increasing its operational footprint and asset base.” Ventura Offshore will manage the Eldorado Drilling-owned 12,000-ft drillship, Zonda, on its upcoming contract with Petrobras in Brazil, an agreement originally made by Petroserv. Tidal Action is a 12,000-ft drillship under construction at the Hanwha Ocean yard in South Korea. The rig was originally ordered by Seadrill and previously named West Libra. Daewoo Shipbuilding & Marine Engineering, now Hanwha Ocean, took over the rig after Seadrill cancelled. An agreement for the company Northern Drilling to buy the rig also fell through. Hanwha Ocean established Hanwha Drilling to handle the rig. Ventura Offshore is not the first company to announce marketing rights for the newbuild. In May 2024, Diamond Offshore announced an agreement with Hanwha to market the rig in the US GOM.

Transocean has announced a 365-day contract extension for the 12,000-ft drillship Deepwater Asgard with an independent operator in the U.S. Gulf of Mexico. The programme is expected to begin in direct continuation of the rig’s current campaign, which is scheduled to end around June 2025. It is estimated to contribute approximately $188 million in backlog, including additional services. The rig has been working for Hess in the Gulf of Mexico since April 2023 on a contract fixed in 2022, which was understood to have multiple year-long extensions available. The previous one-year extension was announced at the beginning of April 2024. This latest extension means the rig is firm through the first half of 2026 with a further one-year option available.

Northern Ocean Ltd.-owned 7,500-ft semisubmersible Deepsea Bollsta has been awarded a one-well contract with an undisclosed operator offshore Namibia. The contract has an estimated duration of 63 days and is expected to commence in the fourth quarter of 2024. Northern Ocean did not confirm the operator for this well but stated that it is a “subsidiary of a major operator.” Market sources have indicated that the operator may be Chevron, which had been seeking a floating rig to drill an exploration well at PEL 90 on Block 2813B offshore Namibia, with work scheduled to begin in the fourth quarter of 2024. Chevron holds an interest in PEL 90 via its affiliate company Harmattan Energy. The Deepsea Bollsta worked for Shell offshore Namibia from December 2022 until the beginning of May 2024 and since then has been anchored in Walvis Bay, Namibia. Northern Ocean stated that the rig will undertake its five-year class survey before commencing the new contract, with a short idle period also likely. Both Deepsea Bollsta and the 10,000-ft semisub Deepsea Mira are owned by Northern Ocean and managed by Odfjell Drilling. Deepsea Mira is under contract to TotalEnergies into the fourth quarter of 2024 and is currently drilling offshore the Congo after working offshore Namibia for close to a year. Northern Ocean stated that it continues to be “in discussions and processes” with potential clients over securing additional backlog for these units. With the new contract award, Northern Ocean estimates its aggregate revenue backlog to be between $80 million and $95 million.

Drilling Activity and Discoveries

ExxonMobil is drilling the Lau Lau-2 appraisal well on the Stabroek block offshore Guyana with Noble 12,000-ft drillship Noble Sam Croft. Drilling operations at the well are expected to continue until the end of July 2024. The appraisal well follows up the Lau Lau-1 discovery, announced in January 2022. The discovery well encountered 315 ft of hydrocarbon-bearing sandstone reservoirs in 4,793 ft of water, 42 miles southeast of the Liza field. ExxonMobil currently has five drillships working offshore Guyana. The company has been drilling the Trumpetfish-1 exploration well with Stena Drilling 10,000-ft drillship Stena Carron, which previously drilled the Red Mouth-1 exploration well. Noble 12,000-ft drillships Noble Bob Douglas, Noble Don Taylor, and Noble Tom Madden are engaged in development drilling on Stabroek.

The Norwegian Offshore Directorate (NOD) has granted Equinor a drilling permit for an exploration well in the North Sea offshore Norway. The wellbore 35/10-13 S is targeting the Angel prospect. It is located in production licence 827 SB, which is operated by Equinor in partnership with DNO Norge. The well will be drilled with Odfjell Drilling’s 10,000-ft semisub Deepsea Atlantic, which is scheduled for a yard stay and its 15-year SPS activities this summer

Masirah Oil Limited (MOL) is evaluating the performance of the Yumna-5 well at the Yumna field on Block 50 offshore Oman after the recent completion of a multi-well programme on the block ahead of schedule. MOL spudded the Yumna-5 well on 28 March 2024 with Northern Offshore 375-ft jackup Energy Emerger. The well started production on 26 April 2024. MOL also used Energy Emerger for workovers at the Yumna-2, Yumna-3 and Yumna-4 wells, wrapping up the drilling campaign on 8 June 2024. MOL stated that production from Yumna is being optimised, with plans to improve and increase the fluid production capacity of the flowline after the monsoon season in September 2024. Energy Emerger has moved on to continue its work with Oman Oil Company.

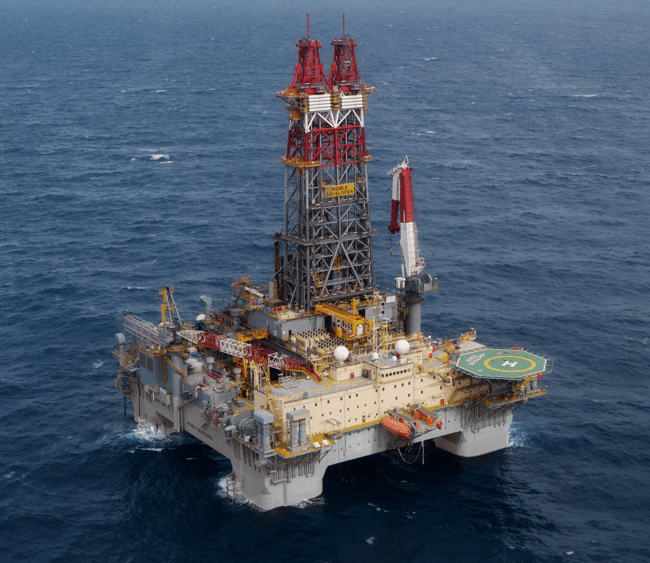

Partner Ecopetrol has confirmed that Petrobras is currently drilling the appraisal well Uchuca-2 on the Tayrona Block offshore Colombia. The well will allow Petrobras to evaluate the size of the Uchuva-1 natural gas discovery, made in 2022. Uchuva-2 is being drilled with Noble 10,000-ft semisubmersible Noble Developer, which moved into Colombian waters to begin work for Petrobras in May 2024. Petrobras has the rig contracted until July 2025, with a 390-day option available. Petrobras is the operator of the Tayrona block with a 44.4% interest while Colombian state oil company Ecopetrol holds a 55.6% interest.

OMV (Norge) AS has started drilling the Haydn gas prospect in the Norwegian Sea with the 10,000-ft semisub Transocean Norge. The Haydn exploration deepwater well (6605/6-1 S) is located in the northern part of the Norwegian Sea, 60 kilometres southwest of the Aasta Hansteen field and approximately 275 kilometres west of Sandnessjøen. The water depth at the well site is 1,064 meters. The operator secured a drilling permit for the well in early June 2024. The well is being drilled by the Transocean Norge rig on behalf of the operator OMV (Norge). The drilling campaign is expected to last up to 56 days in case of a discovery. The Aasta Hansteen platform, located nearby, is a potential future hub for third-party subsea tiebacks. In case of a commercial discovery, Haydn can be developed relatively fast due to the proximity to existing infrastructure. The semisub is under a rig-share agreement between Wintershall Dea and OMV. Last week, Wintershall Dea announced a gas condensate discovery in the North Sea after drilling the Cuvette (35/11-27 S) exploration well using the Transocean Norge. The rig has also recently secured a 140-day contract extension with Wintershall Dea, which is expected to start in the first quarter of 2028 in direct continuation of the current programme.

Vår Energi has made an oil and gas discovery in well 36/7-5 S Cerisa and sidetracks 36/7-5 A, B, and C, located in the North Sea offshore Norway. The discovery was made in production licence 636 just north of the Duva field, 50 kilometres southwest of Florø. The licence was previously under Neptune Energy but was taken over by Vår Energi following its acquisition of Neptune’s Norwegian business. The well, targeting the Cerisa prospect, was drilled using the Odfjell Drilling-managed 3,900-ft semisub, Deepsea Yantai. Neptune secured consent from the Norwegian authorities to drill the well with the Deepsea Yantai back in 2023 and the well was initially planned for late 2023 but was delayed to 2024. The drilling permit was secured in February 2024 and the well 36/7-5 S was spud in late March. Preliminary estimates indicate between 3.9–6.2 million standard cubic metres of oil equivalent (Sm3 o.e.), which corresponds to 18-39 million barrels. The discovery is important for area development and could have an impact on the lifetime of the Gjøa facility. The licensees are considering tying the discovery back to the existing infrastructure in the area. The well 36/7-5 S encountered a 46-metre gas column and an oil column of around 9 metres in the Agat Formation, 34 metres of which were sandstone layers with good to moderate reservoir quality. The oil/water contact was not proven. The well 36/7-5 A encountered a 39-metre oil column in the Agat Formation, 28 metres of which were sandstone layers with good to moderate reservoir quality. The oil/water contact was not proven. The well 36/7-5 B encountered a 29-metre oil column in the Agat Formation, 20 metres of which were sandstone layers with good to moderate reservoir quality. The oil/water contact was not proven. The well 36/7-5 C encountered a 61-metre oil column in the Agat Formation, 26 metres of which were sandstone layers of good to moderate reservoir quality. The oil/water contact was not proven.

Longboat Energy, the operator of Block 2A, offshore Sarawak, Malaysia, said Thursday that a Competent Person’s Report has confirmed the giant scale of the Kertang prospect located within the block. The CPR, produced by ERC Equipoise Ltd (ERCE), has assigned a total gross, unrisked mean prospective resources of 9.1 TCF, plus 146 mmbbl of NGLs across the four target horizon Cycle I, Cycle II/III, Cycle V/VII AA, Cycle V/VII AA2. Cycle I and Cycle II/III, Oligo-Miocene reservoirs, represent the primary targets and shallower Cycle V/VII reservoirs representing the secondary targets. Preliminary work undertaken by Longboat indicates that all target horizons are capable of being tested by a single exploration well. Block 2A is located offshore Sarawak in the North Luconia hydrocarbon province covering approximately 12,000 km2 in water depths between 100-1,400 metres. Longboat is the operator of the block with a 52.5%, alongside partners Petronas and Petros, and has plans to run a farm-out process during H2-24 to identify a suitable partner. Nick Ingrassia, CEO of Longboat, said he was extremely pleased that the results of the ERCE CPR confirmed Longboat’s internal view of the world-class scale of the Kertang prospect. He added that, based on the excellent subsurface work undertaken to date by the Longboat team, they believe Kertang is one of the largest undrilled structures in Malaysia and look forward to working with partners Petronas and Petros to progress the prospect towards drilling in the next 18 months. A Longboat presentation from April showed that the drilling would be conducted either in 2025 or 2026.

Equinor has completed the drilling of the Argerich-1 well on CAN-100 offshore Argentina with the 12,000-ft Valaris drillship Valaris DS-17. The company stated that no clear signs of hydrocarbons have been found and the well is considered dry. Equinor stated that it was able to confirm the geological model with the well and that in the coming months, data and information gathered through Argerich-1 and seismic surveys will be analyzed “towards inreasing the understanding of the hydrocarbon potential in these areas.” Equinor operates the CAN-100 licence with a 35% interest, alongside partners YPF with 35% and Shell with 30%. The Valaris DS-17 remains under contract to Equinor and is now expected to return to Brazil for further work.

CGX Energy Inc. and Frontera Energy, joint venture partners in the Corentyne block offshore Guyana, have submitted a notice of potential commercial interest for the Wei-1 discovery to the government of Guyana. The Wei-1 well was drilled with the 10,000-ft Noble semisubmersible Noble Discoverer in 2023, with the company announcing in November 2023 that they had encountered 114 ft of net pay. The well fulfilled the partners’ obligation under Phase Two of the second renewal period for the licence and served as an appraisal well for the Kawa-1 well. CGX stated that the notice of potential commercial interest “preserves the joint venture’s interests in the licence.” The joint venture said that is has been engaging in regular conversations with the government of Guyana, including “discussions regarding conditions under which further activities could be performed by the joint venture in the Corentyne block.”

Aker BP and its partners have discovered gas in wildcat well 7324/8-4 (Hassel) in the Barents Sea, around 300 kilometres from the northern coast of Norway. This is the second well to be drilled in production licence 1170, which was awarded in APA 2021. Gas was also recently proven in the first well in the production licence, 7324/6-2. Both wells were drilled by Saipem’s 10,000-ft semisub Scarabeo 8. Preliminary estimates indicate the size of the discovery at between 0.51 – 0.7 million standard cubic metres (Sm3) of oil equivalent (o.e.). This corresponds to 3.23 – 4.42 million bbls o.e. The licensees will assess the discovery together with other discoveries and prospects in the area, with a view toward a potential development. The well 7324/8-4 was drilled to a vertical depth of 781 metres below sea level, and was terminated in the Snadd Formation in the Upper Triassic. It will be permanently plugged and abandoned.

Demand

ADNOC Drilling is seeking expressions of interest (EOI) to provide one jackup rig for the Middle East for ADNOC Offshore for one of its gas fields. The commencement date has been set for October 2024 for one year. ADNOC Drilling has 35 drilling rigs contracted (32 owned by ADNOC Drilling and three subcontracted). The due date for this EOI is 27 June 2024.

ExxonMobil Guyana Limited has submitted an Application for Environmental Authorization for a potential seventh offshore project around the Hammerhead discovery on the Stabroek block offshore Guyana. In a statement to Esgian Rig Service, ExxonMobil called this application the “first step in progressing project approvals as we continue to evaluate and define its potential scope.” The Hammerhead discovery was announced in August 2018. The Hammerhead-1 well, drilled by Stena Drilling 10,000-ft drillship Stena Carron, encountered around 197 ft of oil-bearing sandstone reservoir in 3,773 ft of water. In April 2024, ExxonMobil made a final investment decision for the Whiptail development, the sixth project on the Stabroek block. Whiptail is to add a capacity of 250,000 b/d of oil by the end of 2027. ExxonMobil currently has five drillships working offshore Guyana. The company recently began drilling the Lau Lau-2 well on the block.

Mobilisation/Rig Moves

Saipem-managed 375-ft jackup Perro Negro 9 is being towed from Ras Tanura to the Arab Shipbuilding & Repair Yard (ASRY) in Bahrain. The rig was moved to Ras Tanura in May 2024 and is currently on contract suspension for up to 12 months. This is the second of three units affected by the suspensions announced by Saipem in April 2024.

Noble’s 350-ft CJ50 jackup, Noble Resilient, has completed its contract in the Danish sector of the North Sea and is now moving to the UK sector ahead of a new contract with Harbour Energy. Following a late April 2024 start, the Noble Resilient has now completed its P&A contract with Wintershall Noordzee on the Ravn field and is en route to the UK where it’s expected to arrive on 25 June. The contract with Harbour Energy was announced in late May. The well intervention job on the Jade field is expected to run for 30 to 70 days. After that, the rig is scheduled to work on a two-well contract for Petrogas, also in the UK North Sea, with a further two-well priced option available.

Transocean’s 12,000-ft drillship Deepwater Aquila has started its inaugural contract with Petrobras in Brazil. The rig arrived in Brazil on 14 April 2024 and began preparations for its three-year contract with the Brazilian operator. This is the newest addition to the Transocean ultra-deepwater fleet, which already comprises 28 floaters. Deepwater Aquila was built by Hanwha Ocean and delivered in October 2023.

Rig Sales

Transocean has entered into an agreement to sell the 9,600-ft semisubmersible Deepwater Nautilus and associated assets to an undisclosed party for $53.5 million. The transaction is expected to close in the third quarter of 2024. Transocean stated that the sale is part of ongoing efforts to dispose of non-strategic assets and will result in an estimated non-cash charge of the second quarter of 2024 ranging from $140 million and $150 million associated with the impairment of assets. Deepwater Nautilus is a Reading & Bates Falcon design unit with a design water depth of 9,600 ft and outfitted water depth of 8,000 ft. The rig was delivered from Hyundai Heavy Industries in 2000 and has been cold stacked in Malaysia since late 2022, following the completion of work with Mubadala earlier that year. Esgian Rig Values had valued the rig between $41 million and $50 million cold stacked.

Seadrill Limited has completed the sale of the 400-ft jackups West Castor, West Telesto, and West Tucana, along with the 50% equity interest in the GulfDrill joint venture that operates the units offshore Qatar, to joint venture partner Gulf Drilling International for $338 million. The three 2013-built jackups are F&G JU-2000E design units, capable of operating in up to 400 ft of water. The rigs are currently working for QatarEnergy LNG on contracts reaching into 2025. The sale of the GulfDrill units was announced in mid-May 2024. Seadrill has been focusing its activities on the floating rig market in recent years and now only owns two jackups; the 450-ft West Elara under long-term contract to ConocoPhillips in Norway and the 400-ft West Prospero which is cold stacked in Malaysia.

Ventura Offshore announced on 27 June 2024 that it will acquire the 6th gen Intl 10,000-ft semisubmersible SSV Catarina for a gross price of $105 million. The 2013-built rig was previously purchased by a group of Norwegian investors, UMAS 1, in 2022 for $55 million. It was then reactivated and underwent a Special Periodic Survey (SPS). Esgian regards this deal as positive for Ventura Offshore. The gross price of $105 million consists of $100 million to be paid in cash and the remaining value in shares of Ventura. The company will also receive $7 million from Eni as a net mobilisation fee. On the other hand, UMAS 1 will be entitled to cash flow compensation. For a period of five years from this transaction, the investment group will receive 17.5% of the free cash flow generated by SSV Catarina, potentially bringing the final sale value above $130 million. In May 2024, the rig started a contract for Eni in Vietnam, and upon completion, will head to Indonesia for a one-year contract, also with Eni. The contract includes an option for 5 additional wells, 1 in Vietnam and 4 in Indonesia, potentially keeping the semisub busy in the region until mid-2026. Ventura Offshore currently manages SSV Catarina, and once this transaction is completed, its fleet will comprise three floaters, including the 6th generation 10,000-ft semisubmersible SSV Victoria and the 6th generation 10,000-ft drillship Carolina.

Other News

Mexican conglomerate Grupo Carso has completed its acquisition of PetroBal Operaciones Upstream S.A. de. CV, which holds a 50% interest in the Ichalkil and Pokoch fields on Contractual Area 4 offshore Mexico. The acquisition was announced in December 2023. Grupo Carso carried out the acquisition via its business Zamajal S.A. de C.V. PetroBal owns PetroBal Upstream Delta 1, which owns the stake in Area 4.

The Dutch Council of State (Raad van State) on Friday 21 June 2024 ruled that ONE-Dyas can continue the offshore activities on gas production project N05-A in the North Sea. Delivery of the first natural gas in December 2024 is, therefore, still possible. As a reminder, ONE-Dyas in early June mobilised Borr Drilling’s 400-ft jackup Prospector 1 to work on the N05-A gas field development. However, activists from Greenpeace occupied the rig on 4 June, preventing the start of operations. Following a request for a preliminary injunction by the activists, the Council of State suspended the operator’s permit for offshore operations in the North Sea at least until 12 June 2024, when a hearing was scheduled to be held. The rig was then moved to a port in Schiedam, the Netherlands. During the hearing on 12 June, the preliminary injunction judge listened to and assessed the arguments of opponents, the Ministry of Economic Affairs and Climate, as well as ONE-Dyas. In the Friday ruling, he indicated that he saw no reason to suspend offshore activities pending the outcome of the appeal, which will be scheduled at a date yet to be set. No appeal is possible against this decision of the Council of State and therefore ONE-Dyas can immediately proceed with its planned activities in the North Sea. Chris de Ruyter van Steveninck, ONE-Dyas CEO, commented: “This ruling means we can quickly continue all preparations to be able to supply the first natural gas from N05-A by the end of 2024.” On 24 June 2024, the Prospector 1 was still in Schiedam.

Conrad Asia Energy has signed a binding gas sales agreement (GSA) with PT Pertamina’s subsidiary PGN for the sale of gas from the Mako gas field development in Indonesia. Conrad said the GSA signing, under which Conrad will deliver up to 122.77 trillion British Thermal Units, was an important step in the commercialization of Mako, ‘the largest undeveloped gas field in the West Natuna Sea.’ The GSA will be subject to the construction of a pipeline connecting the West Natuna Transportation System (“WNTS”) with the domestic gas market in Batam. While this GSA has been signed for the sale and purchase of the domestic portion Mako gas, a separate GSA is being negotiated for the remainder of the Mako gas resource, targeted to be exported to Singapore. The GSA signing news comes a week after Conrad said it would push the Mako field development final investment decision to the fourth quarter of 2024, rather than mid-year 2024 as previously targeted. The Mako gas field sits in the Duyung PSC, in the Riau Islands Province, Indonesian waters in the West Natuna area, approximately 100 km to the north of Matak Island and 400 km northeast of Singapore. The field is estimated to contain 2C Contingent Resources (100%) of 376 billion cubic feet (“Bcf”), (of which 187 Bcf are net attributable to Conrad) and is scheduled to begin production in 2026. Phase 1 of the Mako development consists of six wells: two dry-tree wells and four subsea wells. These will be connected via subsea umbilicals, risers, and flowlines to a conductor support frame, which will then connect to a mobile offshore production unit (MOPU) facility equipped with gas processing and compression capabilities.

Australian oil and gas company 3D Energi and ConocoPhillips have negotiated a consolidation of farm-out obligations, allowing the $30 million T/49P well carry obligation to be applied in either the T/49P or VIC/P79 offshore blocks in Australia’s Otway Basin. Under the previously signed farm-out agreements, 3D Energi is carried by ConocoPhillips Australia SH2 Pty Ltd for up to $35 million towards drilling costs of an exploration well in VIC/P79, and by ConocoPhillips Australia SH1 Pty Ltd for up to $30 million towards drilling costs of an exploration well in T/49P. The negotiated changes announced Monday provide ConocoPhillips the option to discharge the well carry obligation across both T/49P and VIC/P79, offering flexibility to the joint venture, while also keeping 3D Energi carried for up to a combined amount of $65 million. This enables optimal exploration and appraisal of the combined acreage position, managing exploration prospects as one large portfolio. The joint venture has previously signed a two-well drilling contract as part of a 2025 exploration drilling programme (Phase 1), pending regulatory approval, with an additional 120 days of optional drilling (Phase 2). The contracted 1,640-ft semisubmersible drilling rig, Transocean Equinox, recently arrived in Australia for a five-well drilling contract and is currently expected to arrive in the Otway region during the first quarter of 2025. Drilling locations for the two wells in Phase 1 of the drilling programme are yet to be determined and will depend on the outcome of 3D seismic interpretation results in both VIC/P79 and T/49P. Separately, 3D Energi said Monday it had entered into a Right of First Refusal Deed regarding the sale of its share of future gas production from VIC/P79 and T/49P with ConocoPhillips Australia. This deed includes a mechanism to achieve market parity pricing while providing ConocoPhillips with first access to the gas.

Source Energy has entered into an agreement to sell its 20% share in licences PL878, PL878 B, and PL 878 C, containing the Atlantis discovery, to ORLEN Group’s PGNiG Upstream Norway. The Atlantis field, located in the North Sea off Norway, was discovered in 2020. Its total recoverable reserves are estimated at 65 million barrels of oil equivalent, with upside potential. This puts Atlantis among the largest discoveries made on the Norwegian Continental Shelf in the last decade. By acquiring the equity in Atlantis, ORLEN Group is looking to maintain long-term stability and high volumes of its gas production in Norway, which will be delivered to Poland via the Baltic Pipe. The divestment of Atlantis is subject to the approval of the Norwegian Ministry of Energy. Once the transaction is completed, PGNiG Upstream Norway will have a 20% stake in the field, with the remainder being held by Equinor, which is the operator. The acquisition of the stake in the Atlantis field will provide PGNiG Upstream Norway with 13 million barrels of oil equivalent, including 1.5 bn cubic meters of natural gas – according to the data published by the Norwegian Ministry of Energy. The licence partners plan to develop Atlantis over the next few years. The partners consider several options to develop Atlantis, including a subsea tieback to the platform at the Kvitebjørn field (in which PGNiG Upstream Norway holds a 6.45% stake and Equinor is the operator) or to the Oseberg field platform (which is also operated by Equinor). The area around Atlantis is currently under active exploration. If further discoveries are made, they might be incorporated into the Atlantis development concept.

TotalEnergies has signed an agreement to acquire a 60% interest and operatorship in Block STP02, offshore Sao Tome and Principe, from the Agência Nacional do Petroléo de S. Tomé e Principé (ANP-STP). The transaction is subject to final approvals from relevant authorities. The remaining interest will be held by the existing licence holders, including Sonangol with 30% and ANP-STP with 10%. Block STP02 cover 4,969 sq km off the coast of Principe and is adjacent to Block STP01, which is operated by TotalEnergies with a 55% interest. Songangol holds 30% and ANP-STP holds 15% interest in STP01. TotalEnergies called STP02” a “promising licence” and said the acquisition follows “encouraging prospectivity interpreted in the 3D seismic data” on the adjacent block.

Petronas, through Malaysia Petroleum Management (MPM), has signed a Small Field Asset (SFA) Production Sharing Contract (PSC) with Vestigo Petroleum for a Discovered Resource Opportunity (DRO) cluster, which was marketed under the Malaysia Bid Round Plus (MBR+). The NBE Cluster is located off the coast of Sabah and consists of Nosong, Bongawan North, and Epidot fields. It is a predominantly gas discovery cluster. A comparable field is Samarang, a mature field located 25 km south of Nosong. Petronas said it would be signing new PSCs with more MBR+ winning bidders in the coming weeks.

TotalEnergies has signed an agreement to sell its entire interest in West of Shetland assets in the United Kingdom to The Prax Group. The transaction is subject to approval from the relevant authorities. As a reminder, Prax acquired Hurricane Energy in 2023, taking over its West of Shetland assets. The agreement with TotalEnergies includes Laggan, Tormore, Glenlivet, Edradour, and Glendronach fields, the onshore Shetland Gas Plant, and nearby exploration licences. These mature assets currently produce about 7,500 barrels of oil equivalent per day in TotalEnergies’ share, made up of around 90% of gas. The transaction involves the transfer of relevant employees from TotalEnergies to Prax in compliance with the applicable legislation. “This transaction is in line with TotalEnergies’ strategy to continuously adapt its portfolio by divesting mature non-core assets,” said Jean-Luc Guiziou, Senior Vice President Europe for Exploration & Production at TotalEnergies. “TotalEnergies remains committed to the UK through both its upstream portfolio in the North Sea (Elgin-Franklin, Culzean and Alwyn fields) and its Integrated Power and Renewables portfolio.”

Image credit: Noble