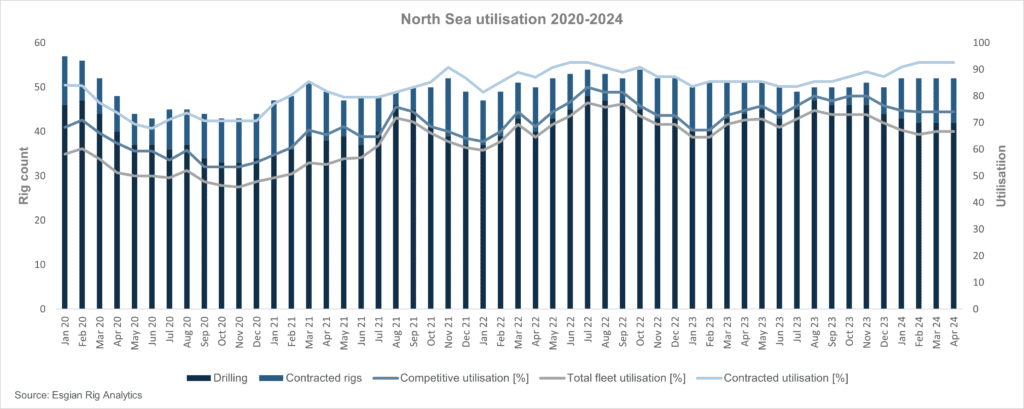

In the wake of the Covid-19 pandemic in 2020, the offshore drilling market faced significant hurdles, with several drilling contractors filing for bankruptcy. The global market has recovered significantly since then, with total utilisation rising from as low as 49% in November 2020 to 70% in March 2024. However, there has been a discernible difference in recovery in the North Sea compared to other regions.

Over the last several years, soft demand in the North Sea has led to reduced supply, impacting both harsh-environment (HE) semisubmersible (SS) and jackup (JU) units in the region. There were 37 SS and 40 JU rigs in the area in January 2020 and now there are 28 SS and 35 JU units.

Most recently, two Transocean Cat D semisubmersibles, the Transocean Endurance and Transocean Equinox, moved to Australia. The latest example of this trend from the jackup segment was the departure of the Shelf Drilling Perseverance, which left the North Sea region in early 2024 for a contract in Vietnam, while Valaris 247 is expected to mobilise from the UK these days ahead of new contracts in Australia.

Out of the remaining active fleet, the majority of units are already booked for 2024 and contractors are in active discussions for opportunities starting in 2025 and beyond.

Sluggish demand & shrinking supply in SS segment

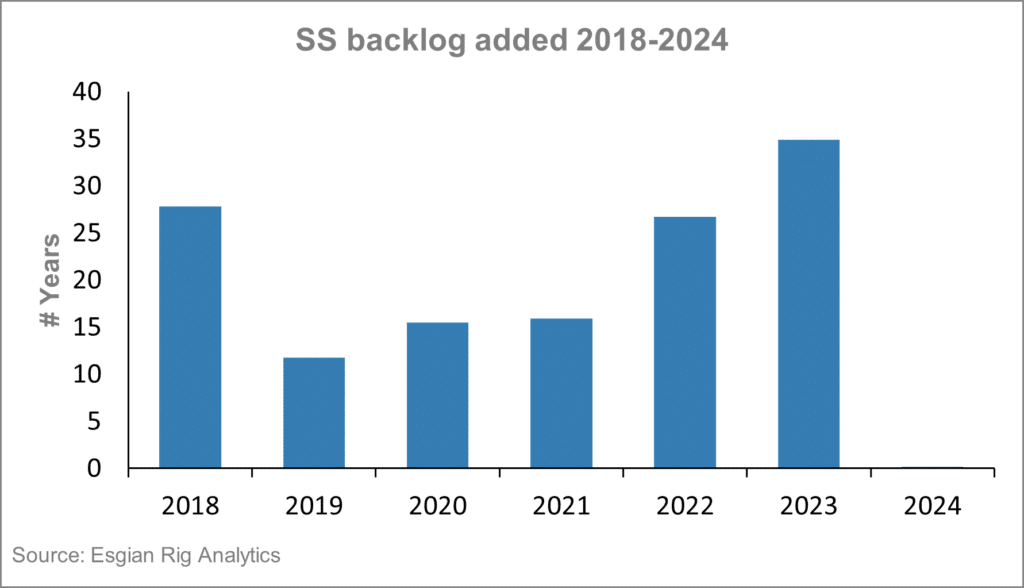

Following stagnation in the 2020-2021 period, contracting activity in the North Sea semisub segment accelerated, adding almost 35 years of backlog in 2023. However, this momentum slowed in Q1 2024, with only one short-term P&A fixture confirmed during the period.

Average contract duration in the semisub segment has also increased over the last couple of years, peaking in August 2022 at 1,079 days, and going over 2020 and 2021 levels in mid-2023 with 641 days.

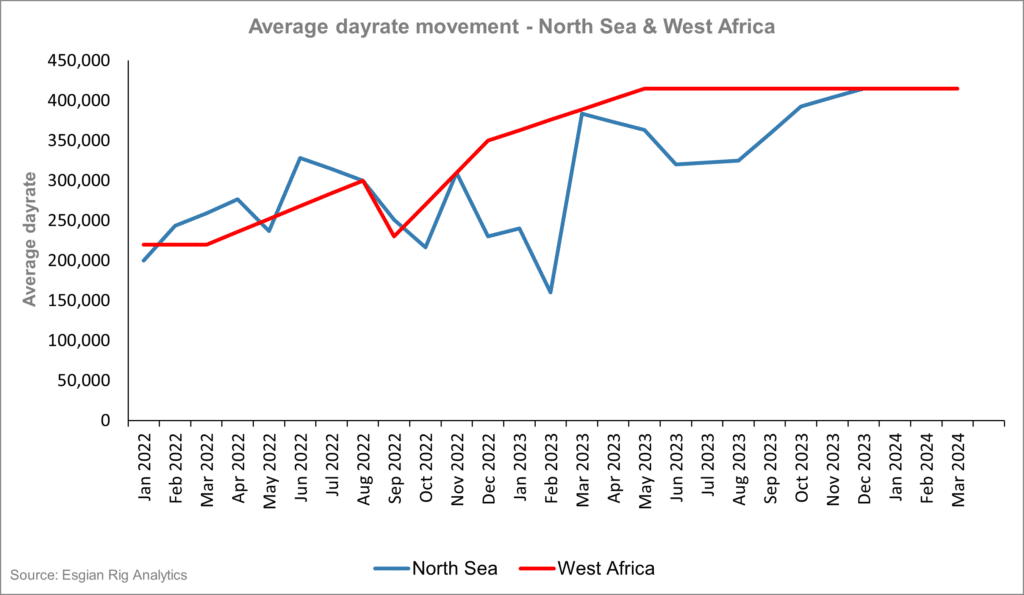

Fluctuating dayrates

Dayrates were slower to recover in the North Sea than other regions due to slow demand but 2023 did bring some recovery in that aspect for the North Sea with average dayrates for semisub units in the region moving to high $300,000s.

HE semisubs have expanded beyond their historical reliance on regions like the North Sea. In recent years, they have worked in West Africa, the Mediterranean/Black Sea, and Oceania.

In West Africa, an average dayrate for HE semisubs landed into the low $400,000s with a Namibia fixture around mid-2023. Average North Sea dayrates experienced a lot more fluctuation with a six-month delay in reaching the West African highest average.

Nonetheless, in late 2023, the North Sea region recorded the highest dayrate worldwide for harsh-environment semisubs during this upcycle after Odfjell Drilling’s Deepsea Nordkapp secured a $490,000 extension in Norway for operations in 2026. The only other semisub unit that came close to this is Transocean Equinox at $485,000 for operations in Australia, with some of its unexercised options going over the $500,000 mark. Norway typically sets the pace for dayrates in the North Sea, with recent examples of fixtures surpassing the $400,000 mark. However, there have been exceptions, with several rates fixed in the low $300,000s during Q3 2023.

So now, with supply and demand in tight balance due to reduced rig count, there is practically no available warm stacked capacity, other than Stena Spey, which is being marketed for sale. One other moored semisub, Dolphin Drilling’s Bideford Dolphin, has recently been sold for scrap to a yard in Türkiye. Meanwhile, if Dolphin decides to reactivate its cold stacked semisub Transocean Leader, to be renamed Dolphin Leader, the unit is unlikely to be available before 2025. Dolphin is currently investigating what it would cost to bring it back.

Diamond Offshore’s Ocean Patriot could be available for some short-term work in the second half of 2024 before starting its three-year contract with TAQA in 2025. On the other hand, Diamond Offshore’s Ocean Endeavor is rolling off contract by December 2024 and is then scheduled for BOP recertification work.

These are all older, lower-specification units. In the higher-spec 6th Gen semisub segment, the first unit scheduled to come off contract this year will be Seadrill’s West Phoenix, following the completion of a Vår Energi job in August. However, the rig is then scheduled for regulatory work after which Seadrill is targeting opportunities in the North Sea and elsewhere, but not before Q2 2025.

With the end of the current year, more potential availability will be coming up in the semisub segment from around mid-2025 and onwards.

Jackup momentum in late 2023 & early 2024

Following the 2020 downturn, contracting activity for jackups in the North Sea recovered during 2021 and 2022 but experienced a lull in the first three quarters of 2023. However, the activity accelerated in the year’s final quarter and the first quarter of 2024. Over six years of backlog were added in 1Q 2024, compared to around 14 years of backlog added for full year 2023.

Upswing in JU dayrates in late 2023

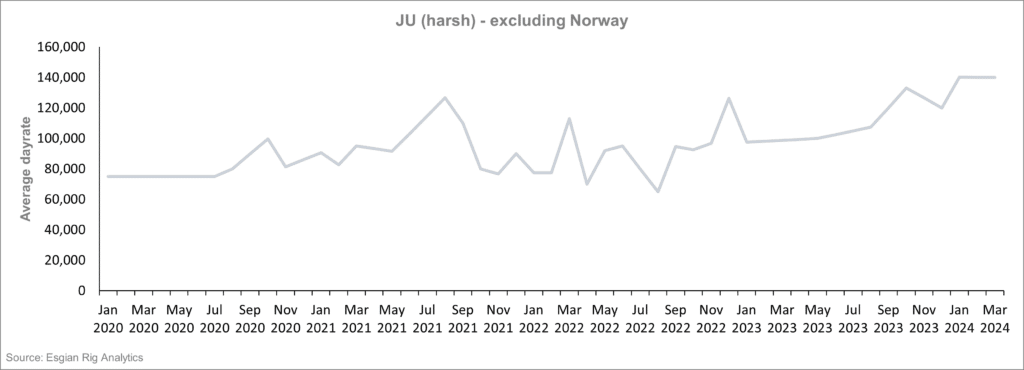

In addition to a recent increase in contracting activity, dayrates under these contracts have been moving comfortably in the $130,000-$145,000 range with one example of a $166,000 dayrate for a three-year contract in the UK starting in 2H 2025. For comparison, the rate for the unit going to Australia has been confirmed at $180,000. Meanwhile, several rates under recent fixtures in Southeast Asia have been in the $150,000-$165,000 range.

In 2023, a couple of examples of North Sea rates going over the $200,000 mark were awarded to CJ70 jackups in Norway, but Norwegian HE rates tend to be higher due to higher regional costs and the more limited pool of rigs certified to work offshore Norway.

A closer look at the average dayrates in the North Sea, excluding Norway, since 2020 reveals noticeable fluctuations. In certain periods since then, average rates have dipped even below 2020 levels. However, they have steadily remained above $100,000 since around mid-2023.

JU supply emulating SS trend

Similar to semisubs, the jackup supply in the North Sea has also been reduced and this, in conjunction with the recent increase in contracting activity, resulted in a tighter jackup market with little remaining available capacity.

The remaining warm capacity includes two Noble harsh-environment jackups, the Noble Highlander and the Noble Interceptor, both stacked in Denmark. However, extensive reactivation and repair costs limit their potential opportunities. Meanwhile, Noble’s CJ50 jackup Noble Resolve is rolling off its current contract by 2H 2024 with no work commitments thereafter currently known.

Demand expected to grow but supply uncertainties remain

While the industry has shown signs of recovery, disparities in the pace and extent persist across different regions. Even though we’ve seen stronger demand and higher dayrates in recent contracting activity in the North Sea, uncertainties remain, especially regarding supply and demand dynamics.

In the near term, the North Sea demand looks flat, though an uptick is anticipated later in 2024 and 2025. Some of the rigs that exited the region are committed to long-term contracts and are unlikely to return in the foreseeable future. For those that would be able to return to fulfil the potential demand, operators would have to bear the associated costs.

The Norwegian market remains stable, but the fiscal instability of the UK market stemming from the introduction of the Energy Profits Levy (EPL) in 2022, along with its subsequent changes, has eroded investor confidence and impacted demand in the country. Still, the UK’s mature basin holds a significant amount of P&A work that will need to be addressed in coming years, alongside emerging opportunities in carbon capture and storage (CCS) operations.

Image: SS Deepsea Nordkapp; credit: Odfjell Drilling