This week marked the beginning of the earnings season in the offshore drilling sector, with Transocean, Noble, and Odfjell Drilling announcing their third quarter 2023 reports along with the latest drilling contract awards.

In case you missed it, you can access our previous Rig Market Roundup here.

Contracts

Offshore drilling contractor Transocean has said in its Q3 2023 earnings call that it expects two of its rigs, a semisubmersible and a drillship, to get new contracts in the coming period. Based upon discussions with customers, Transocean expects that the Transocean Barents will be contracted for new work starting in mid-to-late 2024 until initially late 2026. The semisub has recently completed the Qana well for TotalEnergies offshore Lebanon, and it’s currently under contract with Eni in Cyprus, which is firm into January 2024. After that, TotalEnergies has two one-well options for this rig until mid-2024. In addition, the 12,000-ft drillship Deepwater Skyros will be similarly committed for a new contract into early-to-mid-2025. The drillship is currently under a firm contract with TotalEnergies in Angola until mid-2024, with no further commitments thereafter. Transocean says details of these prospects will be forthcoming, assuming the execution of fully binding customer commitments.

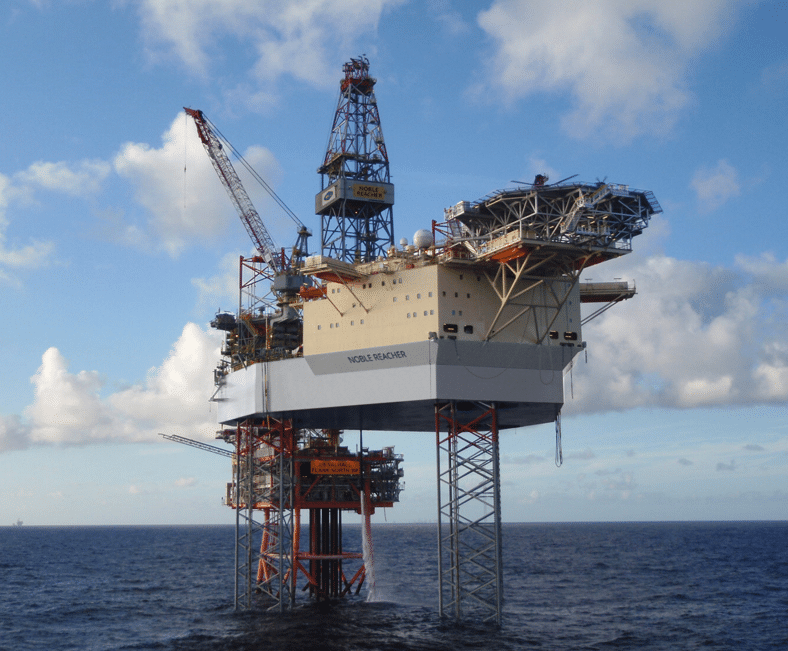

Two Noble jackups have secured further work in the North Sea; a contract extension for the 350-ft Noble Reacher and a new two-well contract for the 350-ft Noble Resilient. TotalEnergies has extended its contract for Noble Reacher for 15 months via previously priced options flat with its current dayrate. This extends the rig’s firm period offshore Denmark to July 2025, with a further year of priced options remaining. The 350-ft Noble Resilient has been awarded a two-well contract with Petrogas in the UK North Sea at a dayrate of $133,000. The contract is expected to commence in Q3 2024 and has a minimum duration of 120 days plus a two-well option available. Noble Resilient is currently in the yard following an incident on 20 October 2023 when a floating production vessel became unmoored and allided with Noble Resilient while the unit was in port in Denmark. Noble stated that an investigation and damage assessment is underway and that it expects damages to be covered by the liable party or its own insurance. Required repairs could impact the rig’s availability for additional work before the Petrogas contract, but are not expected to impact the timing of the contract itself.

Shell has contracted Noble 10,000-ft drillships Noble Globetrotter I and Noble Globetrotter II for additional work in the US GOM. The combined additional backlog of $56 million and five months keeps both units working into the first quarter of 2024. Noble Globetrotter I secured a one-well extension with Shell at a dayrate of $390,000, keeping the rig under contract into late February 2024. Noble Globetrotter I is currently moving back to the US GOM after completing work for Petronas offshore Mexico. Noble Globetrotter II secured a four-month extension with Shell at a dayrate of $398,500. The rig is now scheduled to remain with Shell until early March 2024. The rig has been with Shell since 2019.

Valaris released its latest quarterly fleet status report, which includes several new floater and jackup contracts and extensions in Latin America, North Sea and West Africa. The total backlog added for the quarter is approximately $480 million and the total contract backlog increased to approximately $3.2 billion. In Brazil, Valaris DS-15 has been awarded a new 250-day extension with TotalEnergies in direct continuation of its current programme. The contract value is $100 million, excluding MPD and additional services, which implies a dayrate of $400,000. The contract also includes two 160-day priced options and one 120-day priced options, which has a contract value of approximately $210 million, excluding MPD and additional services, if exercised. In Mexico, the semisubmersible Valaris DPS-5 has been awarded a two-well contract with Eni commencing March 2024. The duration is for a minimum 110 days and the operating dayrate is $345,000, plus a $3 million mobilization fee. Valaris also announced that Valaris DS-4 had a 6-month priced option exercised by Petrobras for work offshore Brazil. The commencement is in January 2024, in direct continuation of the current programme, and the contract value is $41 million. In Angola, ExxonMobil exercised a 6-month priced option for the drillship Valaris DS-9. The contract will commence in July 2024 in direct continuation of the current programme. Regarding the jackups, Valaris 72 was awarded a 55-well plug & abandonment contract with Eni in the East Irish Sea (UK). The contract duration is almost four years (1,346 days) and the operating dayrate is subject to a market-indexed annual adjustment. Valaris Norway will substitute for the awarded jackup until its current contract with Eni in the UK North Sea finishes in December 2024. Valaris was also awarded a 6-well CCS contract with TAQA in the Dutch North Sea for the jackup Valaris 123, with options for up to 10 wells and an estimated total duration of 300 days. The contract will commence in Q4 2024 and has a minimum duration of 170 days. The operating dayrate is $142,500, increasing to $152,500 effective 1 January 2024 and $162,500 effective 1 January 2026. In Trinidad, Valaris 118 was awarded a 6-well contract extension with BP, commencing in March 2024, in direct continuation of the current contract. The estimated duration is one year and the total contract value is approximately $51 million, which implies a dayrate of just below $140,000. Also in Trinidad, Valaris 249 was awarded a contract with Perenco to drill one appraisal well in the TSP block. The contract is expected to commence in H2 2024, in direct continuation of the current programme with another operator.

ONGC has awarded three contracts for Category I to Jagson Drilling, Dynamic Drilling, and Foresight Offshore. After the commercial opening for Category I in October 2023, ONGC has issued an LOA to the lowest bidder, Jagson Drilling, for the 1982-built BMC Sea Challenger with a dayrate of $91k and to Dynamic Drilling and Foresight after matching the lowest bid in early November for the 1981-built LeTourneau 116-C Divine Driller at $96k and the 1983-built LeTourneau 116-C Foresight Driller IX at $101k. Aban Offshore, which was understood as going to bareboat charter the Enterprise 351 jackup, did not match Jagson’s bid. For Category II, which is for one 300-ft MLT/Slot Type jackup that remains open, Jindal Drilling was the only bidder with the 1975-ft LeTourneau Class 84-S Jindal Supreme with a dayrate of $101k.

Drilling Activity and Discoveries

While it continues to carry out appraisal drilling in the southeast corner of the Stabroek block offshore Guyana, ExxonMobil is looking at further exploration drilling in the north and west portions of the block according to senior vice president Neil Chapman during the company’s third quarter 2023 earnings call. Chapman said that ExxonMobil is looking for further “anchor prospects” on the block with three exploration targets planned to be drilled over the next 10 to 12 months. However, these plans could change with the results of future exploration and appraisal wells. ExxonMobil currently has six drillships conducting exploration, appraisal, and development drilling offshore Guyana; 12,000-ft Noble rigs Noble Bob Douglas, Noble Don Taylor, Noble Sam Croft, and Noble Tom Madden and 10,000-ft Stena Drilling rigs Stena Carron and Stena DrillMAX. The company has reported several discoveries offshore Guyana in 2023, including the April 2023 Lancetfish discovery, which was followed up by a successful appraisal well Lancetfish-2.

Repsol has stated that an appraisal well at the LLOG Exploration Co-operated Blacktip discovery in the US GOM was positive, proving the existence of a “prolific Wilcox play.” The appraisal well was drilled in September 2023 with Seadrill 12,000-ft drillship West Neptune, which is under contract to LLOG until September 2024. LLOG is the operator of the Blacktip deepwater project with a 50% interest. Repsol holds the remaining 50% after acquiring interests from Shell and Equinor in May 2023. This includes the Blacktip and Blacktip North discoveries.

Petronas Suriname E&P has made an oil discovery at the Roystonea-1 exploration well in Suriname’s offshore Block 52. The well, located about 185 kilometres offshore in a water depth of 904 metres, was drilled to a total depth of 5,315 metres. It encountered several oil-bearing Campanian sandstone reservoir packages. Further evaluation is being undertaken to determine the full extent of this discovery and its potential development synergy with the Sloanea-1 discovery made in 2020 within the same block. The well was drilled with the 10,000-ft semisub Noble Discoverer, which worked for Petronas in Suriname from August through October 2023. The rig is now scheduled to work for Ecopetrol in Colombia. Block 52, which covers an area of 4,749 square kilometres, is located north of the coast of Paramaribo, Suriname’s capital city, within the prospective Suriname-Guyana basin. Petronas Suriname E&P is the operator of Block 52 with a 50% participating interest and ExxonMobil is a partner with the remaining 50% interest. The success of this well is expected to drive further exploration for commercially viable hydrocarbon resources in the surrounding areas.

Demand

Chariot has received approval for its Environmental Impact Assessment (EIA) from the Moroccan Ministry of Energy Transition and Sustainable Development on the Anchois gas development project offshore Morocco. Chariot completed the front-end engineering and design (FEED) on components of its Anchois gas development in March 2023. The project is to have three initial subsea producer wells, including the Anchois-2 well drilled in 2022. The EIA process was conducted over a 12-month period and was informed by onshore and offshore environmental and social baseline surveys; a stakeholder engagement programme held in conjunction with relevant parties; a public enquiry process, which spanned four local provinces. The final report sets out the requisite planning, mitigation, and monitoring measures to follow during construction and production. The EIA integrates recommendations from the National Environmental Committee, is valid for five years, and covers all aspects of the development, including future wells and offshore infrastructure, the onshore Central Process Facility, and link to the GME pipeline. Pierre Raillard, Head of Gas Business and Morocco Country Director at Chariot, commented: “This is a key building block for sanctioning the project’s development, alongside other activities such as our partnering process, which is close to conclusion.”

Murphy Oil’s Board of Directors has sanctioned the Lac Da Vang field development project located in Block 15-1/05 of the Cuu Long Basin, offshore Vietnam. Murphy is the operator of the block, holding 40% working interest, with partners PetroVietnam Exploration Production (35%) and SK Earthon (25%). The project is expected to achieve first oil in 2026, with development phased through 2029. The estimated recovery of the fields is 100 million boe, with peak gross production of 30–40 million boe per day. Murphy also holds a working interest in an adjacent block with nearfield exploration upside.

Other News

As part of the first batch of awards in the 33rd Oil and Gas Licencing Round, the UK’s North Sea Transition Authority (NSTA) has offered 27 new offshore licences in areas prioritised because they have the potential to go into production more quickly than others. The 33rd round was launched on 7 October 2022 with 931 blocks and part-blocks made available for application. In total, the NSTA received 115 applications from 76 companies for 258 blocks/part-blocks when the application window closed on 12 January 2023. This was the highest participation since the introduction of the Innovate Licences in 29th Round in 2016/17. In addition to the 27 licences, six more blocks, which were also ready to be offered, have been merged into five existing licences. All of the 258 Blocks that have been applied for have been through the initial Habitat Regulation Assessment (HRA) and the blocks being awarded now have been identified as not requiring further assessment. A recommendation for the remaining 203 blocks will be made once the Habitat Regulation Assessment Further Appropriate Assessment process has been completed. The winners include Anasuria Hibiscus, Athena Exploration, Bridge Petroleum, DNO North Sea, Eni, Equinor, Finder Energy, Ithaca Energy, NEO Energy, Ping Petroleum, Shell, Tailwind Energy, Tangram Energy, and TotalEnergies.

DNO has been awarded a 50% operated interest in Blocks 9/9f, 9/10c, 9/14c, and 9/15d as part of the first set of awards in the UK’s 33rd Offshore Licencing Round. The 33rd round was launched on 7 October 2022 and the UK’s North Sea Transition Authority (NSTA) announced the first batch of awards on Monday 30 October 2023. Aker BP UK will hold the remaining 50% in the licenced area, which is located adjacent to the Norwegian border and just west of the Aker BP-operated Alvheim hub on the Norwegian Continental Shelf. The area also comprises the Agar discovery from 2018, in which DNO held a 25 percent interest until it was relinquished in 2020. The technical work associated with the area will involve acquiring additional 3D seismic and potentially reprocessing the data to reduce risk and volume uncertainty. The first phase will have a duration of up to two years, after which a decision on committing to a well will be made.

Israel’s Ministry of Energy and Infrastructure has awarded 12 licences in two zones for natural gas exploration in its 4th Offshore Bid Round. Six licences in Zone G offshore Israel were awarded to Eni and its partners Dana Petroleum and Ratio Energies. Another six licences in Zone I were awarded to Azerbaijan state oil company SOCAR and its partners BP and NewMed Energy. These exploration licences are awarded for an initial period of three years. During this period, the licence holders will execute the work programme they committed to in their bid, in order to assess the potential for the discovery of natural gas in the awarded acreage. Following this period, the licence holders may request an extension of the licence for an additional two years, subject to an updated work programme approved by the Petroleum Commissioner and a commitment to drill within at least one of the licences. After complying with these requirements, the licences may be extended by a further two years on the condition that a commitment is submitted to drill in each of the licences not yet drilled by the end of the license period.

Offshore drilling contractor Transocean reported a net loss of $220 million for the third quarter of 2023, compared to $165 million in the second quarter of 2023. The company’s total contract drilling revenues for the quarter were $713 million, compared to $729 million in the second quarter of 2023. Contract drilling revenues decreased by $16 million, which Transocean attributed to idle time on three ultra-deepwater floaters and lower revenue generated by four rigs that were undergoing contract preparation and mobilization activities during the quarter. Transocean’s adjusted EBITDA was $162 million, compared to $237 million in the prior quarter. As of October 2023, the company’s contract backlog was $9.4 billion. Transocean CEO Jeremy Thigpen stated, “Based on our ongoing conversations with customers, we firmly believe that we remain in the early stages of a multi-year upcycle.”

Serica Energy will examine the feasibility of re-developing the abandoned Kyle field in the UK North Sea following the award of a new block in the UK’s latest licencing round. Serica’s subsidiary, Tailwind Energy Chinook Limited, has been awarded a 100% interest in block 29/2a in the UKCS 33rd Offshore Licencing Round. The block contains the decommissioned Kyle oil field, which ceased production in June 2020, and the host FPSO at the time was subsequently removed. During an initial two-year licence period, Serica will carry out studies to determine the feasibility of re-developing the Kyle field with a subsea tie-back to the Triton FPSO vessel via the Bittern field facilities. Serica has a 46.42% interest in the Triton FPSO vessel and a 64.63% interest in the Bittern field, which are operated by Dana Petroleum. Serica’s internal preliminary mid-case estimate of recoverable resources from the redeveloped field is about 9 million barrels of oil. Mitch Flegg, Chief Executive of Serica, said: “The decision whether to proceed with the re-development of Kyle will depend on the results of our studies and the fiscal and regulatory situation at the end of the initial two-year term of the licence.”

Noble Corp. reported adjusted EBITDA of $283 million, net income of $158 million and increasing quarterly dividend to $0.40 per share in Q4 2023. Noble is also increasing its 2023 guidance for total revenue to a range of $2.5 to 2.6 billion (previously $2.35 to $2.55 billion) and adjusted EBITDA to a range of $775 to $825 million (previously $725 to $825 million). Contracting drilling services increased from $606 million in Q2 to $671 million in Q3, with the increase driven by higher average dayrates and utilization. Contract drilling services costs decreased by $9 million to $354 million in Q3 due to lower repair and maintenance expenses. The Board of Directors (BoD) approved an increase of quarterly interim dividend to $0.40 per share in Q4 2023, with the dividend payable on December 14th. The company will continue to pay dividends on a quarterly basis, and Q4 2023 represents $1.60 on an annualized basis. Total marketed fleet utilisation was 78% for Q3 (the fleet of sixteen marketed floaters was 92% while the thirteen marketed jackups was 61%). The new contracts for the fleet are valued at approximately $240 million, and Noble’s total backlog as of 31 October 2023 is $4.7 billion.

Ithaca Energy has completed its acquisition of the remaining 40% stake in the Fotla discovery and three exploration licences (P.213 Area C, P.345 Area A, and P.2536). This brings Ithaca’s working interest in the Fotla discovery to 100%. The acquisition agreement with Spirit Energy was announced on 12 July 2023. Now that it’s been completed, it provides Ithaca with full control over the pre-final investment decision work programme and timing of project sanction. The Fotla discovery is located in Block 22/1b of the UK North Sea in 431 ft of water, approximately 10 km southwest of the Ithaca-operated Alba field. The field was discovered in August 2021 by drilling the 22/1b-12 well and subsequently appraised by two sidetracks. Development plans are currently being evaluated, with first production from the discovery targeted for 2026. The conceptual field development plan consists of a subsea tieback to existing infrastructure.

United Oil & Gas has announced the termination of the Asset Purchase Agreement (APA) with Quattro Energy, under which the parties had agreed to the conditional sale to Quattro of the UK Central North Sea Licence P2519 containing the Maria discovery in Block 15/18. United and Quattro entered into the APA in January 2023. On 4 October 2023 United announced that the long stop date for the satisfaction of the APA conditions had been further extended to 27 October 2023. While the regulatory consent for the transfer of the licence had been approved, Quattro had not satisfied the funding conditions under the APA by the extended long stop date and the parties have not agreed to a further extension. Notwithstanding the prospectivity of this licence, against the backdrop of the current regulatory and fiscal challenges impacting the UK North Sea undermining investor confidence in the progression of potential developments in this sector, Quattro has been unable to raise the funds to complete the transaction. Further, the current phase of the licence expires on 30 November 2023 and a firm commitment to drill a well in the next phase of the licence is required to continue the licence beyond this date. While United recognises the potential prospectivity of a development on this licence, having exhausted all other available avenues to progress this opportunity, United has made the decision not to apply to move into the next phase. It is therefore expected that the company’s interest in this licence will cease on 30 November 2023.

Spain’s Repsol is becoming the sole owner of Repsol Sinopec Resources UK Limited, a joint venture (JV) company with China’s Sinopec. Repsol Sinopec Resources UK Limited is headquartered in Aberdeen, Scotland and focused on the North Sea. On 28 April 2023, it was announced that a settlement and share purchase agreement had been reached between Repsol and Sinopec, whereby Repsol would acquire the remaining 49% share of Repsol Sinopec Resources UK Limited. It was agreed that, upon completion of the acquisition, Repsol would become the owner of 100% of Repsol Sinopec Resources UK Limited. The agreement was subject to certain conditions precedent, which were all satisfied by 9 October 2023. The company will be called Repsol Resources UK Limited and will begin a transition into the Repsol organisation.

Australia-based Finder Energy has received an offer letter from the UK’s North Sea Transition Authority (NSTA) notifying that it has been successful in winning a licence in the 33rd UK Offshore Licensing Round. The licence comprises blocks 16/8b and 16/13c and is located within the South Viking Graben in the Central North Sea. It has been identified by NSTA as having the potential to go into production quicker than other blocks. The licence contains the large Boaz gas/condensate prospect and is located on the UK/Norway Median line close to host facilities operated by Equinor, including Gina Krog and Sleipner. Finder’s bid was made in partnership with Equinor, with Finder nominated as the Licence Administrator (operator). This partnership opens up development pathways linked to gas markets in Western Europe. The majority of blocks offered in the 33rd Round will be awarded once the regulatory process has been completed, and Finder expects to hear the outcome of its remaining bids early next year. Acceptance of the award and finalisation of joint venture arrangements will occur in the coming weeks.

Triangle Energy’s joint venture with Athena Exploration has been offered 5 blocks in the West of Shetlands gas province as part of the first tranche of awards in the 33rd UK Licencing Round. The JV’s blocks contain the Cragganmore gas field. This is defined by three wells, two of which discovered gas and one which encountered water, outside the area of high amplitudes. The reservoir quality varies between the two gas wells, the determination of which will be addressed by the work programme, which is likely to comprise obtaining 3D seismic and reservoir studies for the firm commitment period. The Cragganmore gas field has been estimated by the operator, Athena, to have a range in discovered recoverable gas (Gross Contingent Resources) from a low estimate (1C) of 273 Bcf to a high estimate (3C) of 1,022 Bcf, with a best estimate (2C) of 527 Bcf (136 Bcf 1C – 263 Bcf 2C – 511 Bcf 3C net to TEG). These blocks are located next to 16 blocks offered to Shell which contain the Tobermory and Bunnehaven gas fields. These gas fields when developed, with the gas field in the JV’s acreage, could form an economic cluster that could be tied back to existing gas pipelines on the Shetland Isles and thereon to the UK mainland. The area is undergoing significant renewed activity, as evidenced by the recent decision of Equinor and Ithaca to take the final investment decision on the nearby 300 million barrel Rosebank oil field. The JV will undertake further discussions with the NSTA to confirm the work programme prior to finalising the award of the permit. It is expected that the work programme will comprise 3D seismic and studies for the first stage of the licence.

Odfjell Drilling believes that demand for offshore drilling rigs will remain solid in the long-term and that dayrates will continue to rise. Meanwhile, the trend of units leaving Norway for contracts elsewhere is expected to continue. In its Q3 2023 report released this week, Odfjell Drilling noted that, for the first time in its 50-year history, the company had eight units drilling at the same time. Combined, the company’s own fleet averaged a financial utilisation of 98.4%, the highest financial utilisation achieved since Q4 2020. Kjetil Gjersdal, Chief Executive Officer of Odfjell Drilling, commented: “Our wider industry continues to perform well with significant demand, while supply remains tight. Encouragingly, we believe that demand will remain solid for the long term, allowing dayrates to continue to retain the positive momentum seen in recent months.” The company expects to see the trend of more units leaving Norway for international contracts continuing, and the likelihood of newbuilds, extremely unlikely. The company noted the results of tenders in Norway that its own fleet was not available for, which were below the market rate. The company considers these awards as not being indicative of the value that its own high-spec, 6th generation semisubmersibles would achieve. Internationally, Odfjell sees strong demand in locations such as Namibia, Australia, and Brazil. The company’s net profit from continuing operations in Q3 2023 was $184 million, compared to $12 million in Q3 2022. The company’s revenue in the quarter totalled $186 million, a 12.7% increase on Q3 2022.

Image credit: Noble