This week, further details have been revealed regarding the second round of jackup suspensions in Saudi Arabia, and one drillship contract has been terminated. On the bright side, a new contract extension for a harsh-environment semisub in Africa will keep it operating there for a while longer.

In case you missed it, you can access our previous Rig Market Roundup here.

Contracts

Arabian Drilling has confirmed that Saudi Aramco has initiated discussions with the drilling contractor over the suspension of an additional leased offshore rig, following an initial round of contract suspensions that began earlier this year. Arabian Drilling has not stated which of its jackups is the target of the current suspension discussions. The company currently has six jackups contracted to Saudi Aramco. Market sources have indicated that Saudi Aramco plans to suspend the contracts of an additional five jackups, following the 22 suspended earlier in the year. The company has already sent notices to ARO Drilling / Valaris over suspending the 350-ft Valaris 147 and Valaris 148. Arabian Drilling 400-ft jackups Arabdrill 50 and Arabdrill 70 had their contracts with Aramco suspended by up to 12 months, beginning in May 2024, while the 250-ft Arabdrill 17’s contract has ended. Arabian Drilling stated that all three rigs are being actively marketed in and out of Saudi Arabia.

ADES does not expect new contract suspensions for its fleet by Saudi Aramco this year. Meanwhile, the company expects to secure new contracts for the remaining two rigs previously suspended by Aramco by the end of 2024. In the first round of contract suspensions which started earlier this year, Aramco suspended a total of 22 jackup units, 5 of those from ADES. ADES has already secured new contracts for three of those rigs and expects to secure new contracts for the remaining two by the end of this year due to a good pipeline of tendering. During the company’s 1H 2024 results conference call, ADES executives noted that 30% of those 22 rigs suspended in the first round have secured new contracts over the last few months, with most of them expected to be coming into operations in 2025. This shows good traction amid increasing demand from GCC countries and promising opportunities in new markets such as Southeast Asia. ADES expects this trend to continue and gain momentum in the coming months. ADES executives further stated that the jackup market tightness will continue to be supported by the scarcity of assets and that higher dayrates will continue generating robust profitability. The Saudi operator has also recently launched the second round of suspensions with market sources indicating that this round could affect five jackups, managed by a total of three drilling contractors. ARO Drilling, a joint venture between Valaris and Saudi Aramco, has already received notices for Valaris 147 and Valaris 148. Furthermore, in an update on Monday 5 August 2024, Arabian Drilling confirmed that Saudi Aramco has initiated discussions with the drilling contractor over the suspension of an additional leased offshore rig. Arabian Drilling has not stated which of its jackups is the target of the current suspension discussions. ADES has confirmed that some of its competitors have been affected by the second round of suspensions. However, ADES stated it does not have any new suspensions coming from Aramco this year. ADES executives noted that anything can happen given the current market dynamics but, as of today, it does not see further suspensions coming to the company.

Arabian Drilling has stated that leasing rigs to be able to return them with minimum financial impact has been part of its strategy, acting as a buffer in case of a softening market. This comes following confirmation by Arabian Drilling in its Q2 2024 report this week in regard to discussions with Saudi Aramco over the suspension of an additional leased offshore rig. During the quarterly conference call on Tuesday, Arabian Drilling confirmed that Aramco’s second round of jackup suspensions will affect a total of five rigs, and of these five, one will be coming its way. Since leasing the rigs was part of the company’s strategy to derisk offshore exposure, this enables it to return the rig to the owner quickly and at minimum cost. Arabian Drilling executives stated that losing offshore contracts is the nature of the beast, adding: “We have planned for this with two leased rigs that can be returned quickly with minimum financial impact.” According to Esgian Rig Analytics’ database, Arabian Drilling currently has a total of six rigs under contract with Saudi Aramco. Out of those six, four are owned by Arabian Drilling and the remaining two are owned by Keppel FELS, but managed by Arabian Drilling. These two units are the 400-ft ArabDrill 120 and ArabDrill 110. The executives noted they are still in discussions with Saudi Aramco and, as of now, it is still unknown when exactly the rig is going to be returned. Currently, both leased rigs have their firm contracts ending in late 2025.

Diamond Offshore received a notice of early termination from an operator on 31 July 2024, related to a previously announced one-well campaign offshore Cote D’Ivoire with 12,000-ft drillship Ocean BlackRhino. The now terminated one-well contract was with Foxtrot and was valued at $18 million. Diamond Offshore stated that it is entitled to retain $8 million in prepaid customer deposits as an early termination fee. Ocean BlackRhino will complete work for Woodside offshore Senegal this month then move to Guinea-Bissau for a contract with Apus Energy that will keep it working into October 2024. Ocean BlackRhino will then undergo around 75 days out of service at a yard in Las Palmas, Canary Islands for its five-year SPS and managed pressure drilling upgrade. Once this is complete, the rig will mobilise to the US GOM in late December 2024 or early January 2025 to commence its next contract with Beacon earlier than anticipated.

Northern Ocean has announced an extension of the contract with TotalEnergies for continued work in Africa, using the 10,000-ft semisub Deepsea Mira. The firm term of the contract for the Odfjell Drilling-managed semisub is extended from October 2024 for one well and provides one additional well option. The extension from October provides a firm revenue backlog of approximately $24.3-34.2 million with the option to extend for an additional well, potentially adding a further backlog of approximately $26.9-36.9 million. The rig has been working for TotalEnergies since mid-2023 under a contract for a multi-country drilling programme fixed in December 2022. The firm contract was for 300 days with one 180-day option and one 90-day option. The first option was exercised in December 2023, extending the contract into the fourth quarter of 2024. The initial firm term with TotalEnergies brought the rig to Namibia. After completing the campaign in Namibia’s Orange Basin, the rig moved to the Republic of the Congo in May 2024 where it’s drilling the Niamou Marine01 exploration well towards a planned well depth of 23,106 ft (7,015 m). The rig is currently at the Niamou well location.

Drilling Activity and Discoveries

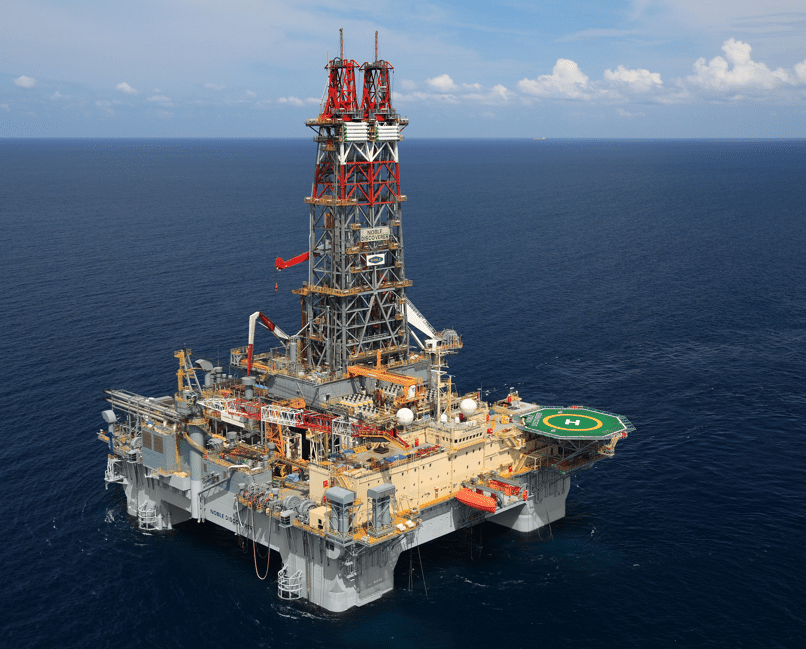

Petrobras reported Monday that it had reached the main target of the Uchuva-2 well offshore Colombia and confirmed the extent of the gas discovery made in 2022 with the drilling of the Uchuva-1 well. The Uchuva-2 well, spudded on 19 June 2024, is in the Tayrona Block, 31 kilometres off the coast of Colombia. It sits in a water depth of 804 metres (2637,8 feet) The well, being drilled by the 10,000-ft semisubmersible Noble Discoverer, is still in progress, with five phases, and the gas-bearing interval was verified at phase 4 through wireline logging, which will be further characterized through laboratory analyses. The Tayrona Block consortium, consisting of Petrobras as operator (44.44%), in partnership with Ecopetrol (55.56%) will continue operations to complete the project to drill the well to the expected depth and characterize the conditions of the reservoirs found. A formation test is expected to be conducted by the end of 2024.

Tullow Oil and its partners plan to conduct a new 4D seismic survey at the Jubilee field offshore Ghana in early 2025. Data from this survey will be used to high grade drilling locations for a planned 2025/2026 drilling campaign. Tullow recently brought a three-year drilling campaign offshore Ghana with Noble 12,000-ft drillship Noble Venturer to a close with the completion of a water injector well in June 2024. Tullow is the operator of the Jubilee and TEN fields offshore Ghana. Kosmos Energy, Ghana National Petroleum Corporation, and Petro SA are all partners in both fields.

Noble 12,000-ft drillship Noble Venturer has completed the first infill well on Block G offshore Equatorial Guinea for Trident Energy. Partner Kosmos Energy said that initial results of the first infill well were positive. A second infill well will be drilled, with both wells expected to be online in the fourth quarter. Noble Venturer will then be used to drill the Akeng Deep ILC prospect on the Kosmos Energy-operated Block S offshore Equatorial Guinea. Results from this exploration well are expected around the end of 2024.

China’s CNOOC has informed that the Chinese government authorities have approved the proved gas in-place of the Lingshui 36-1 gas field, which stands at over 100 billion cubic meters. The field has been described by CNOOC as “the first large-size ultra-shallow gas field in ultra-deep water in the world.” The Lingshui 36-1 gas field is located in the southern portion of the Central Sag, Qiongdongnan Basin. The average water depth of the gas field is approximately 1,500 meters (4,921 feet), and the burial depth is 210 meters (689 feet). According to CNOOC, the field has been tested to produce over 10 million cubic meters per day of absolute open flow natural gas. Back in June, CNOOC announced it had made a deepwater gas discovery at the Lingshui 36-1 gas field. COSL’s 6th-gen 5,000-ft HAIYANGSHIYOU 982 semisubmersible rig is understood to have been used for this operation.

Petronas stated on Thursday that one ‘notable’ oil and gas discovery was made in May 2024 at the Bekok Deep-1 well offshore Malaysia. “[The Bekok Deep-1 discovery] stands out due to its promising well testing results, which demonstrate a strong hydrocarbon flow rate. This discovery highlights substantial hydrocarbon potential in this new play, marking a significant milestone in Peninsular Malaysia’s energy sector over the past decade,” Petronas said. The well is understood to have been drilled using the 300-ft PV Drilling I jackup rig.

Talos Energy anticipates receiving Seadrill’s 12,000-ft deepwater drillship West Vela late in the third quarter of 2024 to begin drilling three consecutive high-impact subsalt wells in the US Gulf of Mexico, including the Katmai West #2 appraisal in 2024, followed by the Daenerys and Helms Deep prospects in 2025. As recently reported, Beacon Offshore Energy’s work in the US GOM with the West Vela drillship under the management of Diamond Offshore is expected to end in late September 2024. The rig will then return to the management of owner Seadrill and start its contract with Talos Energy. Talos expects to begin drilling the Katmai West #2 well in the late third quarter of 2024 to further appraise the field, potentially adding significant reserves. Talos projects achieving first production from the Katmai West #2 well in Q2 2025. Modifications to the facility, Tarantula, will increase capacity from 27 MBoe/d to 35 MBoe/d. Talos will hold 50% of W.I. and Ridgewood Energy 50% in Katmai. Talos is the 100% owner and operator of the Tarantula facility. Subsequent to the Katmai West #2 well, Talos expects to use the West Vela drillship to drill the Daenerys exploration well. The Daenerys well is a high-impact subsalt project that will evaluate the regionally prolific Middle and Lower Miocene section and carries an estimated gross resource potential between 100 – 300 MMBoe. The prospect is part of a broader farm-in transaction executed in 2023 with a combined approximately 23,000 gross acres in the Walker Ridge area. The well is expected to spud in the first quarter of 2025 after drilling Katmai West #2. Talos holds a 27% W.I. Partners include Red Willow, Houston Energy, and Cathexis. Furthermore, after completing drilling operations at Daenerys, Talos expects to mobilise the West Vela drillship to Helms Deep. The drillship is set to begin drilling at Helms Deep, an amplitude-supported, near-infrastructure subsalt Pliocene exploitation well, in the third quarter of 2025. The Helms Deep well has a proposed depth of approximately 18,000 feet and an estimated gross resource potential between 17 – 27 MMBoe. Talos is targeting 50% W.I.

Malaysian company Petronas reported on Thursday that it had recently achieved success with the Sloanea-2 appraisal well in Block 52, Suriname. The well was drilled in June using the 12,000-ft Noble Voyager drillship to appraise the original Sloanea-1 discovery made in 2020. The rig previously drilled the Fusaea-1 exploration well in Block 52 before advancing to complete drilling the Sloanea-2 appraisal well and conduct a production test. The first part of Sloanea-2 was drilled in February 2024. Announcing the Sloanea-2 news this week, Petronas said the result had strengthened its prospects in the basin and opened up the possibility of developing a standalone floating liquefied natural gas (FLNG) project in the field in the future. The company said it was evaluating the feasibility of an integrated development strategy for oil and gas extraction within Block 52. Petronas is the operator of Block 52 with a 50% interest. Its partner ExxonMobil holds the remaining 50%. As for the Noble Voyager drillship, following the completion of its contract with Petronas in Surinamese waters, the rig has been moved to Curacao, where it will undergo some SPS work for about two months and then be available for new contracts.

Harbour Energy has reported that preparations are well advanced for the appraisal of the Kan oil discovery located in Block 30 offshore Mexico, with drilling scheduled to begin in the third quarter of 2024. In parallel, Harbour and its partners are undertaking early engineering studies on a potential development. Harbour has a 30% interest in the Kan oil discovery. As a result of the acquisition of the Wintershall Dea portfolio, Harbour will become the operator of Block 30 with a 70% interest. The acquisition is scheduled to be completed in early Q4 2024. The appraisal well Kan-2 will be following up Wintershall Dea’s discovery at the Kan exploration prospect made in April 2023. The appraisal well is understood to be drilled by Borr Drilling’s 400-ft jackup Ran, which is anticipated to start its work with Wintershall Dea following its current job with TotalEnergies offshore Mexico. Ran was also used to drill the original Kan exploration well.

Occidental Petroleum Corporation (Oxy) has made a discovery at the Ocotillo exploration well in Mississippi Canyon 40 in the US GOM. Murphy Oil, Oxy’s 33.33% partner in Mississippi Canyon 40 where the well is located, shared the news on Thursday in its quarterly report. According to Murphy, the Ocotillo #1 exploration well found 100 feet of net pay across two zones. Murphy said the partner group – consisting of Oxy, Murphy, and Chevron – was evaluating results of the Ocotillo to determine the next steps, plan of development, and was looking forward to advancing the project, which is anticipated to be tied back to a nearby facility operated by Oxy. During the quarter, Oxy also drilled the Orange #1 exploration well in Mississippi Canyon 216. The well encountered non-commercial hydrocarbons and has been plugged and abandoned. Oxy holds a 50 percent working interest in the well, while Murphy holds the remaining 50%. Both wells were drilled using Diamond Offshore’s 12,000-ft drillship Ocean BlackHawk. Oxy subsidiary Anadarko recently extended the rig’s contract by two years. Murphy also provided an update on other US GOM wells it participated in the recent period. The company drilled the operated Mormont #3 (Green Canyon 478) well, and brought online the operated Khaleesi #4 (Green Canyon 389) well and non-operated Lucius #11 (Keathley Canyon 919) well as planned. The company also said it had progressed the operated Neidermeyer #1 (Mississippi Canyon 208) sidetrack well and the non-operated Kodiak #3 (Mississippi Canyon 727) well workover, and both wells were brought online in the third quarter.

US oil firm Murphy Oil is preparing to start its two-well offshore exploration programme in Vietnam in Block 15-2/17 and Block 15-1/05. In Block 15-2/17, Murphy is advancing plans for the Hai Su Vang exploration well, with spudding expected in late Q3 2024. The well is targeting mean to upward volume of 170 to 430 million barrels of oil equivalent, and will test the same type of geology as the Lac Da Vang development project. Following this, the rig will relocate to Block 15-1/05 to drill the Lac Da Hong exploration well near the Lac Da Vang field in Q4. This prospect is targeting 65 to 135 million barrels of oil equivalent. Murphy will be using Japan Drilling’s 425-ft jackup Hakuryu-11 for these operations. The company stated that these wells are two big prospects that have the potential to create a more sizable business in the country. Murphy also shared it planned to begin drilling development wells for the Lac Da Vang field in 2025, with the first oil anticipated in late 2026, and further development expected to continue through 2029.

The Norwegian Offshore Directorate (NOD) has granted Equinor a drilling permit for a wildcat well in the North Sea offshore Norway. The well 35/11-30 S Rhombi is located in production licence 090. The licence is operated by Equinor with Vår Energi and INPEX Idemitsu Norge as partners. The water depth at the site is 355 meters. The well will be drilled with Odfjell Drilling’s 10,000-ft semisubmersible Deepsea Atlantic. The rig is currently at the CCB Base yard in Norway where it’s undergoing its SPS before starting a new contract with Equinor. The operator has already secured consent for the well.

Demand

U.S. oil and gas major Chevron, along with its partners NewMed Energy and Ratio Energies, has approved a $429 million investment to enter the Front-End Engineering Design (FEED) phase to expand the production capacity of the Leviathan gas field offshore Israel. The Leviathan Phase 1B project aims to increase the offshore gas field’s production capacity from the current 12 billion cubic metres (Bcm) per year to 21 Bcm per year. Initially, three production wells are planned to be drilled using a floating drilling rig, with additional wells expected to be drilled throughout the project’s operational years. The final investment decision for the project is expected in the first half of 2025. Production from Leviathan Phase 1B is anticipated to start between mid-2028 and mid-2029.

Speaking during the company’s Q2 2024 call, executives at Transocean commented on the strength of the Norwegian market, with customers contracting harsh environment rigs for Norway up to four years in advance. The company expects semisubmersible dayrates in the region to remain strong and rigs could be called back to Norway. Transocean CEO Jeremy Thigpen stated that the recent exodus of rigs from Norway had tightened up the market and that they expect fixtures in Norway to be in the $400,000s and $500,000s going forward. The company noted that, assuming outstanding options are exercised, the Transocean high specification harsh environment fleet is effectively sold out through 2025 and that he believes Norway will be undersupplied by two rigs in 2026. Transocean currently has four semisubmersibles in Norway; the 1,640-ft Transocean Encourage and Transocean Enabler, and the 10,000-ft Transocean Spitsbergen with Equinor and the 10,000-ft Transocean Norge with Wintershall Dea. In June of this year, Transocean Spitsbergen secured a three-well extension with Equinor at a dayrate of $483,000, keeping the rig working through the first quarter of 2026 while Transocean Norge was awarded a three-well extension with Wintershall Dea at a dayrate of $517,000, keeping the rig firmly under contract into the second quarter of 2028. Transocean recently acquired the outstanding interest in the joint venture that owns Transocean Norge. Transocean moved several rigs out of Norway in recent years. The 1,640-ft Transocean Endurance left Norway for Australia in late 2023. Woodside recently exercised a one-well option for the unit and with remaining options, Transocean expect the rig to remain in Australia until the second quarter of 2026 at least. Sister rig Transocean Equinox also left Norway for Australia in the fourth quarter of 2023 and has firm work continuing into mid-2026 with options available that could keep it in Australia into late 2028. The 10,000-ft Transocean Barents last worked offshore Norway in 2022 and since then has taken a series of jobs in the UK, Lebanon, and Cyprus. The rig is currently preparing for work with OMV Petrom in the Black Sea, with a firm term expected to run from February 2025 to July 2026.

Harbour Energy has informed that the partnership in the Zama project offshore Mexico will look to tender the major contracts to secure refreshed cost and schedule estimates ahead of a final investment decision (FID) once the front-end engineering design (FEED) phase has been completed. In its 1H 2024 report this week, Harbour stated that the FEED for the Zama development started in June, marking an important milestone. Zama has the potential to add reserves equivalent to over a year’s worth of Harbour’s current production. Harbour’s current c.12% interest in Zama will increase to c.32% following the completion of the Wintershall Dea portfolio acquisition, which is expected in early Q4 2024. Mexican state oil company PEMEX is the operator of Zama with a 50.43% interest. Former operator Talos Energy has a 17.35% interest and recently divested a 49.9% equity interest in its subsidiary Talos Energy Mexico 7, S. de R.L. de C.V to Zamajal, S.A. de C.V, a wholly owned subsidiary of Grupo Carso. The Zama field is located in the shallow waters of Block 7 in the Sureste Basin. Under a development plan submitted in 2023, two offshore platforms will be installed at Zama and 46 wells drilled, with production transported to shore via two pipelines and processed at dedicated facilities.

Indian national oil company ONGC has cancelled a tender for four jackups and returned the bid bonds to participating companies. The tender was for four jackups for a period of three years each, starting in the fourth quarter of 2024. ONGC opened commercial bids in the now-cancelled tender in March 2024. Participating drilling contractors included Shelf Drilling, Dynamic Drilling, and Greatship, all offering jackups already working for ONGC. ONGC previously cancelled a tender to contract three HPHT jackups for a period of three years.

Murphy Oil stated that it has identified multiple exploration opportunities in Côte d’Ivoire, and was expecting to receive final data from a seismic reprocessing programme for its blocks by the end of 2024. The company said it would continue its evaluation, and as additional data becomes available, it will likely begin preparations for an exploration programme in 2025 or 2026. Murphy’s blocks—CI-102, CI-502, CI-531, CI-709, and CI-103 – are adjacent to Eni’s Baleine and Murene discoveries. Block CI-103 contains the undeveloped Paon discovery, for which Murphy is currently reviewing its commercial viability and field development concepts. The company stated it was on track to submit a development plan by the end of 2025.

Australia’s Finder Energy has agreed to acquire an interest in an offshore licence in Timor-Leste that contains four discovered but undeveloped oil fields. Finder has entered into conditional sale agreements with Eni and Inpex to acquire a 76% interest in, and operatorship of, PSC TL-SO-T 19-11 (PSC 19-11) offshore Timor-Leste. The remaining 24% is held by TIMOR GAP, the national oil company of Timor-Leste. According to Finder, the PSC includes four discovered but undeveloped oil fields, including the fully appraised Kuda Tasi and Jahal fields, which together hold a 2C oil resource of 22 MMbbl. This, according to the company, allows for rapid progress to production, with additional upside from low-risk appraisal and exploration opportunities. Completion of the acquisition is subject to regulatory approvals of the transaction and change of operatorship, along with ANP’s corresponding three-year extension of the PSC to 29 August 2027. Finder provided an indicative project timeline, highlighting its priority of developing the Kuda Tasi and Jahal fields. If the execution of seismic data reprocessing, subsurface evaluation, concept selection, FEED, FDP, and other processes proceed as planned, a final investment decision (FID) is expected in late 2026, with development drilling, facility installation, and first oil targeted for 2027. One of Finder’s slides depicts an FPSO development option with three development wells tied to a floating production unit. Finder intends to seek a partner through a partial stake divestment process before it enters the Prepare/Define Phase, which concludes with approval of a Field Development Plan and FID. Finder’s other objective is to unlock the potential of the low-risk appraisal and near-field exploration opportunities, which hold a combined mean gross prospective resource of 116 MMbbl. A drill decision is tentatively expected in 2026, contingent on the completion of previous studies and the technical work program, with potential drilling in 2027.

Mobilisation/Rig Moves

The 12,000-ft drillship Abdulhamid Han, a 7th generation drillship owned by Turkish national oil company Türkiye Petrolleri Anonim Ortaklığı (TPAO) is moving to the Black Sea for a drilling campaign to boost production from the Sakarya natural gas field. The rig had its drilling tower dismantled at a yard in Aliağa, Türkiye in order to move under bridges through the Bosphorous Strait and will have its tower reassembled at the port in Filyos before moving on to its drilling location in the Black Sea. TPAO had previously been using the rig on a drilling campaign in the Mediterranean Sea. In the Black Sea, the rig will be used for development drilling at Sakarya as well as exploration wells at other fields in the region. Türkiye’s Minister of Energy and Natural Resources Alparsan Bayraktar stated, “We need to increase the production of the Sakarya gas field very quickly. Our goal in the first quarter of 2025 is to increase this 5.5 million cubic meters to 10 million cubic meters, which will meet the natural gas needs of almost 5 million households.” Bayraktar added that Türkiye would also remain active in the Mediterranean and is making plans for projects there in 2026.

Seadrill expects drillships West Auriga and West Polaris to begin long-term contracts with Petrobras in December 2024. Both rigs are finishing up contract preparations and maintenance; West Auriga in the US GOM and West Polaris in Singapore, and will soon relocate to Brazil. The two units secured 1,064-day contracts with Petrobras for work at the Buzios field offshore Brazil in late 2024. The total contract value for West Auriga, including mobilisation and additional services, is $577 million while the total contract value for West Polaris is $518 million. The rigs are beginning work later than previously expected by Seadrill, which the company attributed to vendor and weather delays disrupting shipyard schedules and “unexpected scope related to previous owners’ and managers’ differing approaches to rig repair and maintenance.” However, the company said the rigs would soon set sail for Brazil where they will undergo acceptance testing.

Beacon Offshore Energy’s work in the US GOM with the 12,000-ft drillship West Vela under the management of Diamond Offshore is expected to end in late September 2024. The rig will then return to the management of owner Seadrill. Seadrill has work lined up for the rig with Talos Energy in the US GOM that will begin soon after the Beacon contract and keep the rig working into June 2025.

Rig Sales

Diamond Offshore has classified its cold stacked semisubmersible Ocean Valiant as held for sale. The 1988-built unit has been stacked in the United Kingdom since mid-2020 and was no longer being marketed for work. Ocean Valiant is a 3rd generation semisubmersible of the ODECO Odyssey design and has a design water depth of 6,000 ft. Diamond Offshore indicated earlier this year the limited outlook for the rig as it was not included among the combined fleet projected for Noble Corporation and Diamond Offshore following the completion of a planned acquisition. Diamond Offshore recently sold the 50-year-old 10,000-ft semisubmersible Ocean Monarch for recycling.

Other News

The Namibian Ministry of Mines and Energy has agreed to an extension of the initial exploration period of offshore licence PEL 96 for Tower Resources, extending it to 31 October 2024 and inviting the company to apply to enter the first renewal period of PEL 96 for a period two to three further years. The Ministry has also agreed to defer Tower Resources’ commitment to acquire 1,000 sq km of new 3D seismic data to the first renewal period. Tower Resources stated that its remaining work commitment for the initial exploration period is already substantially complete. The company is continuing to work on the evaluation of leads and prospects and will reprocess previously acquired 2D seismic data in order to support the selection of an area for further 3D data acquisition.

Seadrill has reported a second-quarter 2024 operating profit of $288 million and adjusted EBITDA of $133 million on $375 million of total operating revenues. This is compared to an operating profit of $80 million and adjusted EBITDA of $124 million on $367 million total operating revenues in the prior quarter. Second quarter 2024 operating revenues totalled $375 million, a sequential increase of $8 million. Contract revenues were $267 million, a decrease of $8 million, primarily due to fewer operating days on the 12,000-ft West Auriga and the 10,000-ft West Polaris drillships, which have been undergoing preparations for their upcoming contracts in Brazil, and lower utilisation, partially offset by increased days on the 12,000-ft Sevan Louisiana semisubmersible unit. During the quarter, Seadrill recorded a gain on sale of $203 million associated with its sale of three jackup rigs and associated interest in its Gulfdrill joint venture, which closed on 25 June 2024, for cash proceeds of $338 million. As of 5 August 2024, Seadrill’s order backlog was approximately $2.5 billion. In Q2, the Sevan Louisiana secured a one-well contract with an independent operator in the U.S. Gulf of Mexico that began in direct continuation of its previous contract and secured the rig into August. The average contract dayrate earned for the quarter was $289,000 compared to $276,000 for the second quarter of 2023. The increase is driven by higher dayrates for the 12,000-ft drillship West Neptune with LLOG and the 10,000-ft West Capella drillship operating in Indonesia, along with lower contractual rates during Q2 2023 for the West Polaris and the 6,000-ft tender barge T-15, which did not recur during Q2 2024. These improvements were partially offset by the Sevan Louisiana operating at a below average dayrate during Q2 2024 for a well intervention contract with Walter Oil & Gas, and the West Auriga earning an above average contractual rate during the three months ended Q3 2023, which ended February 2024, Seadrill explained. As of 30 June 2024, Seadrill owned a total of 16 drilling rigs, of which 11 were operating (including one leased to the Sonadrill joint venture), two were undergoing contract preparations for upcoming contracts expected to start at the end of 2024, and three were cold stacked. Seadrill expects full-year 2024 revenues between $1,355 million and $1,405 million; adjusted EBITDA of $315 million and $365 million; and capital expenditures and long-term maintenance between $400 million and $450 million. “Though a combination of supply chain, weather, and scope have shifted West Auriga and West Polaris start dates, both rigs will soon set sail for Brazil and should begin their contracts by year-end, contributing meaningfully to Seadrill earnings and cash flow in 2025,” said Seadrill CEO Simon Johnson. “Any additional work the Sevan Louisiana secures this year would represent upside opportunities to the mid-point of our guidance.” Seadrill will delist from the Oslo Stock Exchange on 10 September 2024 and maintain a single listing on the New York Stock Exchange.

UAE-based ADNOC Drilling’s jackup rig business unit saw its revenue for the second quarter increase by 48% year-on-year, reaching $284 million from $192 million. The company attributed this growth to the contribution of new jackup rigs. On a sequential basis, the jackup rig unit’s revenue rose by 2%, from $278 million to $283 million, driven by the addition of a new jackup rig. Overall, ADNOC Drilling, whose primary revenue drivers are land rigs, achieved a ‘record’ second-quarter revenue of $935 million, an increase of 29% year-on-year, spurred by fleet expansion and Oilfield Services. Second-quarter EBITDA increased by 37% year-on-year and 8% sequentially, totalling $472 million, which resulted in an EBITDA margin of 50%. ADNOC Drilling’s offshore fleet consists of 35 jackup rigs.

Diamond Offshore posted a lower net income for the second quarter of 2024 compared to the previous quarter of the year, as its revenues decreased due to the West Auriga drillship returning to Seadrill after the expiration of its charter. Revenue for the second quarter of 2024 totalled $253 million compared to $275 million in the prior quarter. The decrease in revenue quarter-over-quarter was primarily driven by the absence of revenues for the West Auriga, which was returned to the rig owner in the first quarter upon termination of the charter for the rig, and the 10,000-ft semisub Ocean GreatWhite being off rate for repairs in the quarter. The decrease in revenue was partially offset by the impact of $8.7 million in performance bonuses earned in Senegal during the second quarter. Diamond’s net income in Q2 2024 was $9.3 million, compared to $11.6 million in Q1 2024. Related to the Ocean GreatWhite incident in early 2024, the company continues to anticipate that the repairs and equipment replacement cost associated with the incident will be covered under the hull & machinery insurance policy. The company currently estimates that all incremental costs, less a $10 million deductible, will be reimbursable under the policy. The company has so far received insurance proceeds of $20 million. In addition, the company carries loss-of-hire insurance on the Ocean GreatWhite. After a 60-day waiting period, the loss-of-hire insurance provides $150,000 per day, for up to 180 days, for each day of lost revenue as a result of a covered property loss claim. The company currently estimates that it will be entitled to approximately 90 days of loss-of-hire insurance recovery. The semisub returned to the West of Shetland area in early June and resumed operations with bp in early July. The contractor secured $350 million in contract awards in Q2 and $89 million in post-Q2 period. Diamond’s merger with Noble Corporation is pending with completion expected to close by the first quarter of 2025. The waiting period under the Hart-Scott Rodino Antitrust Improvements Act of 1976 for the pending merger expired in late July.

Advent Energy’s subsidiary, Asset Energy, the operator of the PEP-11 exploration permit in the Sydney Basin, NSW, Australia, is seeking judicial intervention to expedite the decision-making process for the joint venture’s applications related to the permit, which is prospective for natural gas. Asset Energy is seeking a declaration that the Commonwealth-New South Wales Offshore Petroleum Joint Authority breached an implied duty by not making a decision on two pending applications related to the variation and suspension of work programme conditions and related extension of PEP-11. Additionally, it has called for an order for the Joint Authority to decide on the applications within 45 days. According to a statement by the PEP-11 partners on 6 August, it has been 1,656 days since the first application and 1,278 days since the second application was accepted by NOPTA, which then made a recommendation to the Joint Authority with respect to both applications. “To date, neither the First Application nor Second Application has been determined by the Joint Authority according to law,” the PEP-11 partners said in a statement. Back in July, the PEP-11 partners stated that while the applications were under review, Asset was investigating the availability of a mobile offshore drilling unit to drill the proposed Seablue-1 well on the Baleen prospect at PEP-11 Block, which would take approximately thirty-five days to complete. The Seablue-1 well site is located approximately 30 km south-east of Newcastle in Commonwealth waters, in a water depth of 125 metres (410 feet). Asset has been in talks with drilling contractors and other operators who have recently contracted rigs for work in the Australian offshore. It is worth noting that the Joint Authority’s decision is a routine administrative decision, and any future authorisation related to drilling will require environmental approvals. The PEP-11 partners have said that Asset has decided to start work necessary for environmental approvals in advance of the PEP-11 licence application approval, in order to be prepared to drill the Seablue-1 well as soon as possible. Advent Energy, through Asset Energy Pty Ltd, holds 85% of PEP 11. Joint Venture partner Bounty Oil & Gas holds the remaining 15%.

Perth-based companies deepC Store and Azuli International have been awarded offshore Greenhouse Gas Assessment Permits in the Bonaparte and Browse Basins offshore Australia. The awarded blocks are GHG23-1 and GHG23-2. The GHG23-1 is located in the Bonaparte Basin, in a water depth ranging between 70 metres and 120 metres (230 feet to 394 feet), while the GHG23-2 block, in the Browse Basin, sits in a water depth ranging between 50 metres and 270 metres (164 feet to 886 feet). The two companies have simultaneously entered into a Joint Study Agreement for a strategic partnership with Japan-based J-POWER, which plans to become a joint venture participant in the awarded licences, which are said to have the potential to permanently store up to 1 giga (billion) tonne of CO2. The partners have said they intend to develop a full value chain project from liquified CO2 (LCO2) receipt at locations in Japan and Australia as well as surrounding region, with the LCO2 transported by ship to floating storage and injection (FSI) facilities in Australian waters. In related news, Japan’s Inpex last month started drilling the West Peron 1 well in its greenhouse gas storage assessment permit G-7-AP in the Bonaparte Basin, offshore Australia. Inpex is using the 400-ft Valaris 247 jackup rig for the operation.

Diamond Offshore is actively marketing its 3,000-ft semisub Ocean Patriot for opportunities in the North Sea in 2024 to fill the gap before its new, three-year contract in early 2025. The Ocean Patriot completed its previous job in mid-May 2024 and demobilised to Cromarty Firth, where it has been idle ever since in anticipation of its three-year contract with TAQA for P&A on 35 wells. Secured in late 2023, this contract is scheduled to start in early 2025. It also includes up to 17 additional P&A wells under priced options that would add a fourth year of work. Several potential 2024 opportunities for the rig were deferred amid political and fiscal uncertainty in the UK sector, brought about by the introduction of the Energy Profits Levy (EPL) in 2022. In the years that followed, operators have been delaying or reducing their activities in the region, leading to drilling contractors having to secure new jobs elsewhere, which has resulted in a reduced rig count in the North Sea region. Ocean Patriot is one of two semisubs currently available in the UK North Sea, in addition to Stena Drilling’s 5,000-ft Stena Spey, which is held for sale. This semisub has been idle since late 2023 and its last contract was with Ithaca Energy on K2 well. Diamond’s other UK semisub, the 6,000-ft Ocean Valiant, has been cold stacked since 2020 and is now being held for sale. This follows the sale of two other semisubs earlier this year: the sale of the 5,500-ft Dolphin Leader and the sale of the 1,500-ft Bideford Dolphin. So now, in addition to these two warm stacked units – one currently idle but with a future contract and the other up for sale – and one cold stacked unit held for sale, Esgian’s Rig Analytics data shows that the UK sector currently has eight semisubs working. One of these, COSL’s 2,460-ft semisub COSLPioneer, is expected to move to Norwegian waters in early 2025. Meanwhile, Dolphin’s 1,500-ft Borgland Dolphin is expected to return from Las Palmas to the UK waters by Q2 2025. A bit later in the year, Odfjell Drilling’s 10,000-ft Deepsea Atlantic is expected to arrive in the UK from Norway.

The Norwegian Ocean Industry Authority (Havtil) has carried out further audits on COSL’s 4,921-ft semisub COSLProspector. These audits are in addition to the one reported on in late July, all of which are part of the regulator’s processing of COSL’s application for an Acknowledgment of Compliance (AoC) for the COSLProspector, ahead of a new contract with Vår Energi in Norway. On 16 February 2024, Havtil carried out an audit of COSL Drilling Europe and its management of maritime systems on the COSLProspector. The objective of the audit was to verify through spot checks whether the technical condition, organisation, preparations for operation and relevant documents were in compliance with the maritime systems requirements in the petroleum regulations. Seven non-conformities were identified, concerning: indication of valve position in solenoid cabinet; mechanical closure of weather-tight sliding doors; recovery after damage; maintenance; procedures; operation of anchor winches; and, communication in operating house. In addition, three improvement points were identified, concerning: training and competence; local labelling of ballast valves; and winterisation. In an audit of structural safety and waves in deck, conducted on 18 and 19 June, one non-conformity was identified concerning the use of procedures. In addition, two improvement points were identified, concerning training and risk analyses. The regulator has asked COSL to report by 2 September 2024 on how the non-conformities identified during both of these audits will be addressed and for COSL’s assessment of the improvement points observed. In addition, Havtil carried out an audit from 2 to 8 May 2024 related to ICT, electrical facilities, safety instrumented systems, and technical safety. The audit identified 17 regulatory non-conformities. Some of the observations are exempt from public disclosure and are accordingly not shown under non-conformities in the audit report. COSL has been asked to report on how these non-conformities will be addressed with a deadline for this set at 15 August 2024.

Image credit: Noble