The UK offshore drilling market has been characterised by uncertainty following the May 2022 introduction of the Energy Profits Levy (EPL), also known as the windfall tax, and its subsequent modifications by the Conservative Party. The resulting erosion of investor confidence exacerbated by political turmoil has prompted some operators to delay or cancel certain projects, affecting offshore rig demand in the UK sector of the North Sea.

Leading up to the general elections in July 2024, several operators decided to await election results and clarity on future fiscal policy before determining the path forward for certain projects in development.

Now that the results are in and the Labour Party has secured a landslide win and a 174-seat parliamentary majority, the party’s position on oil and gas will determine much of the future of the sector.

Labour’s June 2024 manifesto indicated the party wouldn’t revoke existing oil and licences, but it also wouldn’t issue new ones. The previous UK government launched the 33rd licencing round in October 2022, hoping to boost domestic production amid geopolitical tensions arising from the Russia-Ukraine war. This came after a three-year-long pause in licencing due to a review of the regime, which concluded that the continued licencing for oil and gas is not “inherently incompatible” with the country’s climate objectives. The awards for the 33rd round have been made in three tranches since October 2023, the latest one being in May 2024.

According to the manifesto, Labour plans to extend the EPL’s sunset clause until the end of the next parliament, similar to what the previous government was proposing; increase the EPL rate by 3% to 78%; and, remove the investment allowance, that enables operators to make long-term investments by providing tax relief on capex.

Newly appointed UK Secretary of State for Energy Security and Net Zero, Ed Miliband, has recently outlined priorities for the department, including boosting energy independence through clean power by 2030; establishing Great British Energy (GBE), funded by windfall tax; and creating jobs in the industrial heartlands, including a just transition for the industries based in the North Sea. Further details of the new government’s programme are expected in the King’s Speech on Wednesday 17 July.

High utilisation with fewer rigs

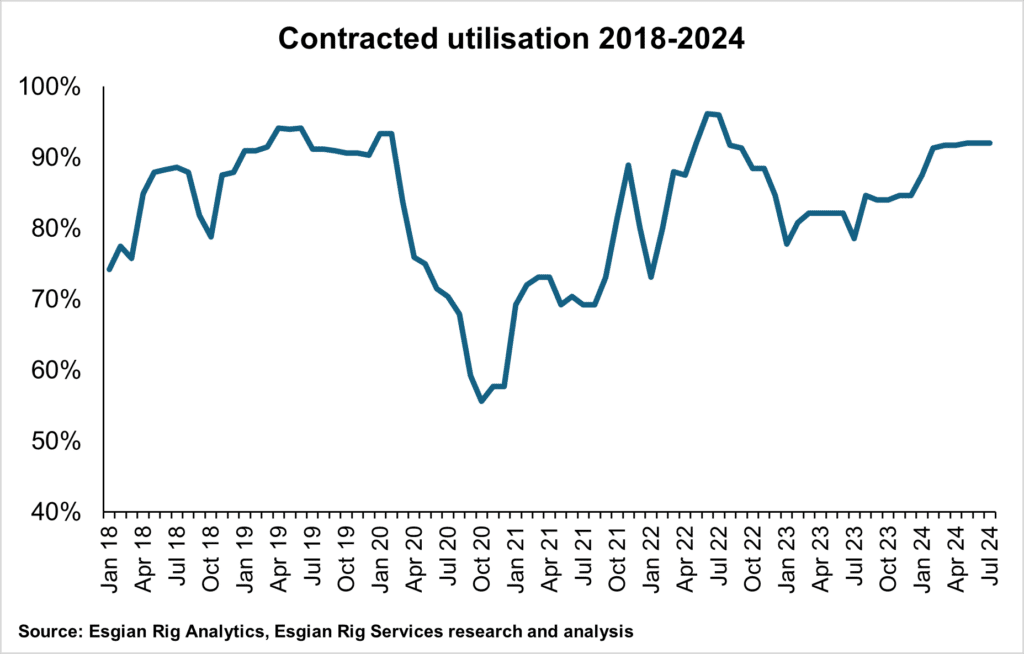

Examining the present circumstances, we see that the competitive contracted utilisation in the UK North Sea has hovered around 92% for much of 2024, marking a clear increase compared to 2023 levels. In most cases, a high utilisation rate indicates strong demand for E&P activities and high levels of investment due to favourable market conditions, but the UK market doesn’t quite fit this description.

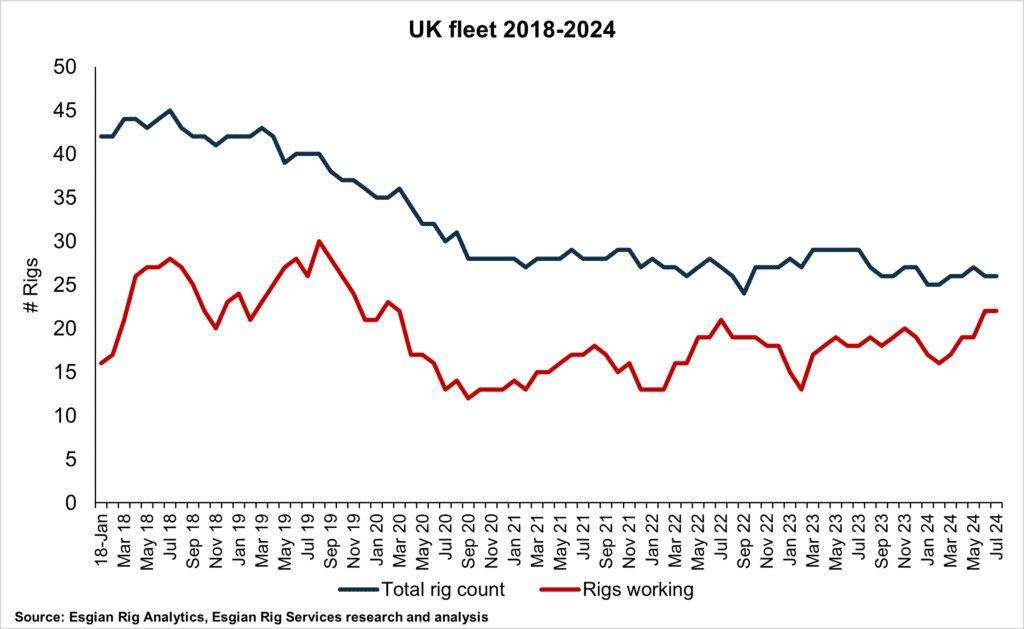

Looking back, the ageing UK North Sea basin experienced a decrease in levels of activity in 2020 due to the Covid-19 pandemic when the number of rigs working dropped to as low as 12 in September 2020, compared to 28 in September 2019, and 25 in September 2018. Over the next several years, activity increased compared to the 2020 levels but total rig count in the region has been decreasing.

The total number of jackups and semisubs in the UK was 45 in July 2018, declining to 24 in September 2022, and averaging at 27 since then. Most of the units that are no longer in the country have moved to other regions, while some have been scrapped. Looking at the 2018-2024 period, the gap between the total number of rigs in the country and the number of rigs working has never been tighter than now.

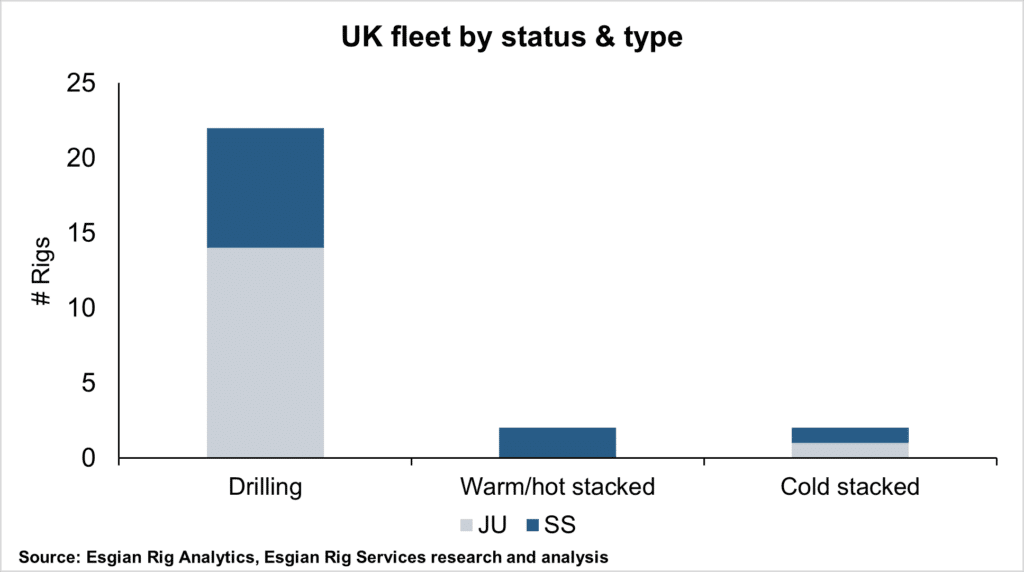

Currently, there are 26 rigs in the UK, 15 of which are jackups and 11 are semisub rigs. Out of this total, 22 rigs are currently working, 2 are warm stacked, and 2 are cold stacked. It should be noted, however, that one of the warm stacked and one of the cold stacked units are up for sale. If these sales materialise, it will result in a further reduction of the total rig count.

The rig count is poised for further changes in 2025 when two semisubmersibles move from the UK to the Norwegian sector and one semisub moves from the Norwegian to the UK sector. Furthermore, one jackup will move from the UK to the Netherlands. Finally, one semisub is currently at a yard outside of the region preparing for a new UK contract in 2025. Once all these have happened, and if no other changes arise, the UK rig count could stand at around 23 units.

The impact: past and future

With the dust still settling on the election results, the Labour government has yet to start implementing its announced plans for the oil and gas sector. Therefore, it is still unclear how much of this will happen and within what timeframe. However, previous experience shows that the UK’s hyper-vigilant market is sensitive to trepidations.

One of the projects that has previously been impacted by political turmoil and changes to the tax regime in the country is Hartshead Resources’ Phase I development, comprising the Somerville and Anning gas fields. The project FID was previously expected in Q3 2023 but uncertainties around the timeline arose following Labour’s proposal for changes in taxation in early 2024. Hartshead warned in March 2024 that this would cause a flight of capital to other jurisdictions.

Furthermore, the first production from NEO Energy’s Buchan Horst has recently been pushed to late 2027. The project’s capital commitments and major contract awards, which include the confirmation of a rig contract, are linked to fiscal clarity from the new government and ensuring the project remains financially attractive.

While Equinor’s high capex Rosebank project has already reached FID, with partners committing to invest about $3.8 billion, and the drilling campaign is planned to start around the second half of 2025, the project’s profitability could be impacted if the investment allowance is removed as proposed by Labour.

Meanwhile, after years of delays and re-evaluations, Ithaca Energy is still holding off on committing to a timeline for its operated Cambo project until it receives some certainty and clarity from the government regarding fiscal policy. Ithaca’s upcoming combination with Eni’s UK business increases the likelihood of developing the project but the operator is still seeking a partner to help fund it.

On the lower end of the project capex-related spectrum, Labour’s possible removal of the investment allowance could also impact the economics of i3 Energy’s one-well development of Serenity, according to the project partner.

Following changes to the cost environment since it was originally assessed, TotalEnergies’ Glendronach is undergoing a recycling of project economics. The operator’s recent agreement to sell its entire interest in West of Shetland assets to Prax Group could further impact the project timeline.

As the Labour Party begins to implement its policies following a decisive election victory, the UK market awaits crucial decisions that will shape its future. Potential increases in regulatory burdens and changes to fiscal incentives are likely to further impact investor confidence and project viability in the UK North Sea.

Image: SS COSLPioneer; Credit: COSL